Thames Water, one of England’s many regional water monopolies, infamously privatised by Margaret Thatcher in…

Market Fever and its Aftermath C. P. Chandrasekhar and Jayati Ghosh

Globally, equity and bond markets are turning bearish. Analysts seem to be unanimous in their explanation: the era of cheap and abundant money, that was leveraged for investments in capital markets, is over. Governments and central banks are tiring of the long spell over which, having abandoned the initial post-crisis fiscal stimulus, they have resorted to interest rate cuts and infusion of liquidity (through ‘quantitative easing) to drive a depressed economy to recovery. One consequence of the resulting environment of cheap and abundant liquidity was that versions of the carry trade flourished. Investors borrowed money cheap and invested in asset markets in the developed countries and emerging market economies, leading to a globally spread, self-fueling asset price boom. In time it was clear that valuations were completely out of tune with fundamentals, warranting assessments that the speculative spiral must unwind. But so long as nobody knew exactly when, and the music played on, the dance continued.

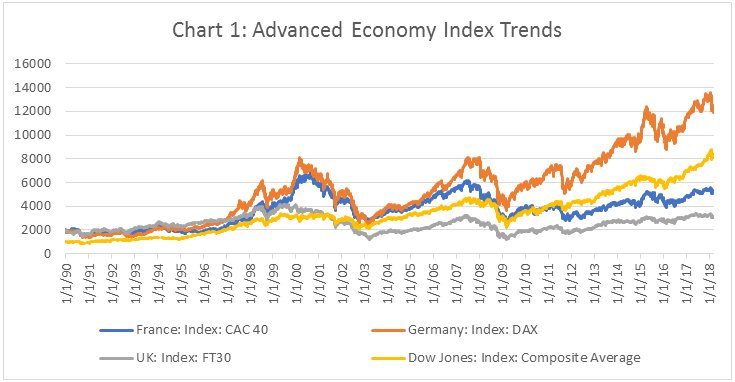

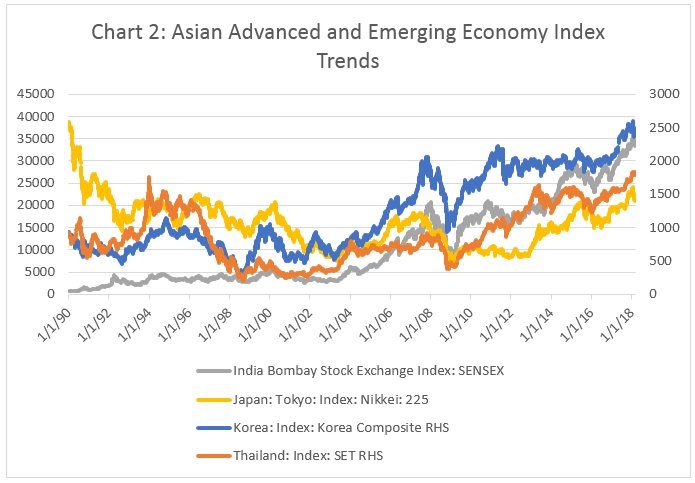

While it is still early days, many suspect that the bull run has now ended. The Sensex, for example, has fallen by more than 2000 points or more than 7 per cent since the beginning of February. Charts 1 and 2 present long-term trends in markets in the developed countries and a set of emerging markets. What is striking is the synchronized movements in equity market indices in recent years, resulting from the global diffusion of speculative financial investments. This has been true not only when markets have been buoyant, but also during the 2008-09 downturn. Earlier, while the dotcom bust of 2001, for example, affected equity markets in the western developed countries like the US, UK, France and Germany (Chart 1) and Japan and South Korea in Asia (Chart 2), emerging markets like India and Thailand did not feel the tremors as much. That divergence ended subsequently as financial investors increasingly diversified after 2003 to emerging markets such as India and Thailand. In this phase, the similarity is clear. The global flow of liquidity primed both advanced economies and emerging markets in the run up to the 2009 crisis. And once the ‘easy money’ monetary response to the financial crisis was put in place, markets across the world, which collapsed during the 2008-09 crisis, have been buoyant.

Those were the years when the global economy was steeped in recession. Now, when there is talk of a synchronized global recovery, investors seem to be turning bearish. This divergence between asset price trends and real-world fundamentals can be traced to the failure of the policy response to the financial crisis and Great Recession. The aversion for fiscal measures, and excessive reliance on monetary ones, did not prove very effective in triggering a real economy recovery, leaving the world mired in recession for a decade. But the decision of leading central banks to fatten their balance sheets and infuse liquidity into the system, contributed to asset price inflation that has crossed all reasonable limits.

Not surprisingly, central bankers have been looking for an opportunity to start unwinding their unconventional monetary measures. That opportunity came with recent signs of consistent employment gains in the US and low but positive rates of GDP growth in many developed countries. But the moment central banks made clear their intention to allow rates to rise and drawback the monetary lever, markets turned unstable, and headed south. The real issues now are whether there would be a hard landing in asset markets and the implications that would have for the rest of the economy.

The landing is likely to be hard, and the external effects more damaging, the more intense the speculative spiral. This is of relevance because of significant differences in the volatility of different markets during the boom, even when they were synchronized in the direction of movement. Within the developed world, surprisingly, Germany seems to be home to a more volatile market as reflected in movements in the DAX. South Korea is also characterized by significant volatility. But emerging markets like India and Thailand show signs of unusually high volatility in the years after 2003, and India seems to be particularly vulnerable to violent swings.

One other index of volatility in the period since the 2008 crisis is the proportionate rise in the relevant index between March 2009 and March 2018 (Chart 3). By this measure, the countries that have seen the most intense bull run are Germany (230 per cent), the US (163 per cent), India (300 per cent) and Thailand (329 per cent). If these numbers reflect the relative role of speculation in these markets during the bull run spurred by cheap and abundant global liquidity, then they do not bode well, especially for emerging markets like India and Thailand. These countries were the targets of the carry trade, as speculative investors moved in backed with cheap capital and benefited from both equity price inflation and domestic currency appreciation because of large foreign capital inflows.

Since net inflows were large and positive in most of these years, these countries are locations with large accumulation of legacy foreign financial capital investments in both equity and bond markets. If for any reason, such as the end of the era of cheap and abundant money in the West, these investors choose to book profits or cut losses and exit, a phase of capital flight would ensue. That could trigger steep currency depreciation and balance of payments difficulties, and also damage the balance sheets of domestic players who had exposed themselves to unhedged foreign debt during the years of easy money. The external effects of all these would be extremely adverse. Needless to say, countries that have seen the largest spikes in asset values like India can be particularly affected as the spiral unwinds.

In India’s case, the problem has been compounded by the 2003 decision to abolish long term capital gains tax. Since then, till this year’s budget, capital gains made from more than a year’s investment in India’s financial markets have been exempt from domestic taxation, making the Indian market a tax haven. This decision to throw fiscal sense to the winds, because of greed for foreign capital inflows, obviously made India the flavour of the easy money season, explaining the so-called “incredible” bull run in Indian markets. To exploit that run, and encouraged by low deposit rates, upper middle class savers have also put their money in mutual funds with capital market exposure. As a result, even when foreign investor sentiment has been depressed, the market remained buoyant because of the rush of domestic financial institutions into the market. This worked even when the bonanza from capital gains tax exemption was withdrawn.

The result is that the market is inflated beyond all reasonable limits. A downturn is inevitable. The only point of dispute is how hard the landing will be.

(This article was originally posted in the Business Line on 12 March 2018.)