Thames Water, one of England’s many regional water monopolies, infamously privatised by Margaret Thatcher in…

Institutional Investors and Indian Markets C. P. Chandrasekhar and Jayati Ghosh

These are uncertain times for emerging market economies (EMEs) like India. They have been important destinations for investments financed by the cheap liquidity that was pushed into the financial system by developed country central banks attempting to address the financial crisis of 2008 and after. The result has been the accumulation of large sums of portfolio investments in their equity and debt markets. This has generated fears that, as central banks in the US, EU and elsewhere unwind their easy money policies and raise interest rates from their historic lows, this capital will exit the emerging markets. Once access to the cheap finance that supported speculative investments is turned off, it is argued, capital flight, market volatility and a currency collapse would ensue. The ‘taper tantrum’ in 2013, when the Fed merely announced its intention to reverse its easy money policies, seemed to warrant those fears.

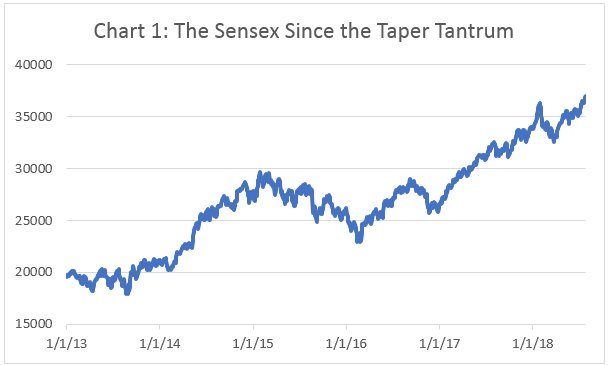

However, according to others, these fears are exaggerated – as proven by stock market performance in some countries, including India. The BSE Sensex, for example, has performed relatively well, rising over the last two and a half years, despite fluctuations (Chart 1). This is surprising given the important position of FIIs in India’s stock market, with the value of their holding amounting to a significant proportion of the market value of all “free float” shares (those not owned by promoters or the state). The absence of major stock market tremors is also a surprise because of other evidence that the EMEs are vulnerable. Some like Argentina, South Africa and Turkey are doing poorly and experiencing capital flight. Most have been experiencing a depreciation of their currencies vis-à-vis the dollar. And, fears are being expressed that firms that had incurred large debts in foreign exchange during the easy money era are finding it difficult to bear the increased debt-servicing burden created by currency depreciation, and that corporate bankruptcies are on the rise.

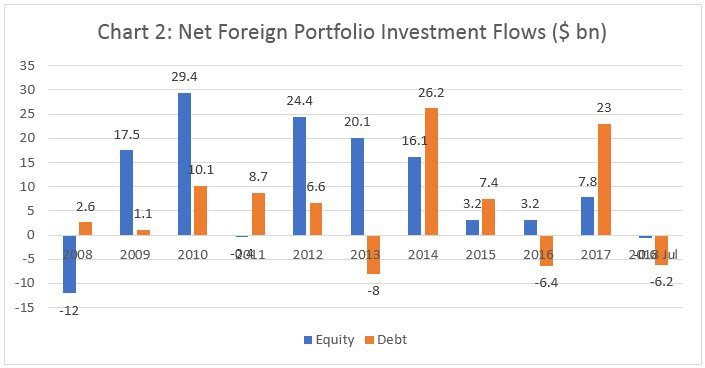

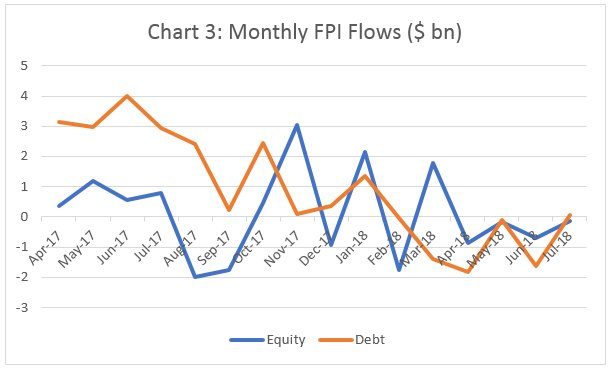

Multiple factors could explain why these effects of the liquidity surge and its reversal are not reflected in many stock markets, including those in India. To start with, during the years of liquidity expansion, foreign investors did restructure their fund allocations away from equity and towards debt. Debt instruments that accounted for 10.4 per cent of outstanding foreign portfolio investment at the end of 2008, constituted 30 per cent of the total by the end of 2017. Moreover, as Charts 2 and 3 show, portfolio investments in debt have been far more volatile than those in equity instruments, and the decline in annual net purchases and their descent into negative territory have been far more true of debt than equity investments.

One likely reason for the shift in interest at the margin towards debt and away from equity is the fact that FII investment decisions make much more of a difference to equity prices. FII investments are large relative to the size of the market in terms of turnover. FII holdings of around $250 billion were more than 16 per cent of market capitalisation at the end of 2016 and more than 10 per cent at the end of 2017. Much of these investments was in a few leading shares. If, therefore, foreign institutional investors are forced to withdraw their investments in equity (because of a rise in US interest rates, for example), prices can move down sharply, delivering substantial losses. This would not be as true of investments in debt instruments, with a substantial proportion invested in government securities, where prices and interest rates are more sticky. So the shift to debt is partly a strategy adopted in a context where the possibility of a quick and substantial withdrawal from emerging markets like India is on the rise.

Having adopted that strategy, the FIIs seems to be exploiting the resulting room for manoeuvre. In recent times, sell offs in debt markets and of debt instruments have been far larger than in equity, resulting in the greater volatility of net purchases of the former. And when exit occurs, it is significantly more from debt markets than equity markets.

The relative stickiness of FII investments in equity has as its corollary the absence of a much expected collapse of a market where asset prices are clearly inflated beyond what any set of ‘fundamentals’ warrant. If FIIs stay with equity more than debt, equity values and indices are likely to be more stable. But what we have is not stability but continued appreciation, even as uncertainty intensifies globally. One reason is the substantial increase in assets under the management of mutual funds and other non-bank financial institutions, a significant share of which is flowing into equity markets as well. Domestic institutional investors in the form of mutual funds, pension funds and insurance companies have become important and active players in the equity market, especially the secondary market.

When the market turns bullish on average for this reason, the thirst for short term speculative profits also increases. When bearish sentiments dominate and prices come down, there is a higher propensity to pick up equity at a lower price with the expectation that it would rise. In addition, there is evidence that when stock indices fall sharply, there is pressure applied on public financial institutions to support the market with liquidity and investments. This moderates and reverses the downward trend. In the event, expectations of buoyancy are often realised.

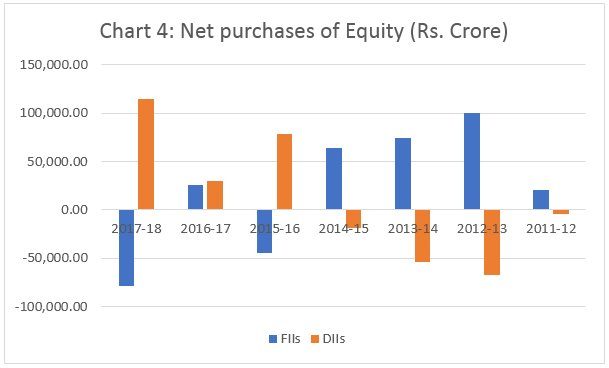

This tendency is strengthened by the contrary behaviour of the FIIs and the domestic institutional investors (DIIs) that together overwhelmingly dominate the market for equity. Both work with strategies and influences of their own, thereby generating an interesting pattern. When there are signs that the FIIs are selling and exiting, the DIIs emerge as big buyers. And when FIIs want to buy up equity, the DIIs appear more than willing to sell for a profit. As Chart 4 shows, in most years net purchases/sales of FIIs and DIIs are almost mirror images of each other. This contrary behaviour of the two major forces not only aborts any sharp decline in stock indices, but also contributes to inexplicably sustaining a boom in uncertain times.

The danger here is that the market does not correct itself early enough, setting off an unsustainable spiral unwarranted by the actual potential of the firms concerned. The longer that spiral lasts, the steeper must be the fall when the unavoidable adjustment begins. The Indian market seems poised for such a turn. But when that would occur is anybody’s guess.

(This article was originally published in the Business Line on July 30, 2018.)