When multiple crises confront global leaders, some receive less attention than they should. One such is an(other) external debt crisis in developing countries, which is likely to be prolonged with long-term spill overs. However, while most observers admit that a debt crisis is unfolding, a commitment to find a lasting solution is absent. The elements of such a package are known. It must include official debt write-offs, large private creditor haircuts and the channelling of cheap liquidity to less developed countries through mechanisms like enhanced SDR issues. While failure to deliver on these fronts is preventing resolution, the resort to austerity in the midst of a crisis is imposing huge burdens on the majority in debt stressed countries.

The posts in this section monitor and analyse the evolving crisis, and offer viable and progressive alternatives.

Developing Countries’ Government Debt Crises Loom Larger Ndongo Samba Sylla and Jomo Kwame Sundaram

Developing countries are being blamed for having borrowed and spent irresponsibly. But they have only…

African Debt Crisis and lessons for Lanka Ahilan Kadirgamar

In the last two decades since Arrighi wrote his seminal article, Sri Lanka and many…

Paying with Austerity: The Debt Crisis and Restructuring in Sri Lanka C. P. Chandrasekhar, Jayati Ghosh and Debamanyu Das

Abstract On April 12, 2022, Sri Lanka defaulted on external debt service commitments. Announcing the…

Domestic Debt Restructuring Robs Working People’s Savings Ahilan Kadirgamar

The Government of Sri Lanka's domestic debt restructuring program targets working people’s savings to satisfy…

Frequently Asked Questions on Domestic Debt Restructuring Ahilan Kadirgamar, Madhulika Gunawardena, Shafiya Rafaithu, and Sinthuja Sritharan

What is meant by debt restructuring? Sovereign Debt Restructuring: When a country is no longer…

Chronicles of Debt Crises Foretold Anis Chowdhury and Jomo Kwame Sundaram

The debt crises looming in developing countries are being exacerbated by changing debt composition. Declining…

The IMF Bias: Signals from Pakistan C. P. Chandrasekhar

On July 14 this year, the shaky government of a debt-stressed Pakistan, won itself a…

The Recurring Crisis: Debt in the LICs C. P. Chandrasekhar and Jayati Ghosh

Severe external debt stress in several low- and medium-income countries (LMICs) has raised two questions.…

The Terrible Human Costs of Debt Service C. P. Chandrasekhar and Jayati Ghosh

The IMF’s estimates of debt stress suggest that as of May 2023, 11 countries were…

Third World External Debt in the Light of Simple Economics Prabhat Patnaik

India and other third world countries can morally justify their being a part of G-20…

‘Shock Therapy’ Sri Lankan-style C. P. Chandrasekhar

On July 1, Sri Lanka’s parliament approved through a majority 122-versus-62 vote, a plan to…

Sri Lankan Central Bank Moots Recast of Pension Funds, haircut on Sovereign Bonds Meera Srinivasan

Sri Lanka’s Central Bank has proposed restructuring the beleaguered nation’s debt by recasting the outgo…

On Sovereign Debt, China, Inflation, Capital Markets and Left Activism Jayati Ghosh

Jayati Ghosh taught economics at Jawaharlal Nehru University, New Delhi for nearly 35 years, and…

Schizophrenia at the IMF Jayati Ghosh

At long last, the International Monetary Fund has begun to recognize that the best way…

The Changing Structure of Global Imbalances C. P. Chandrasekhar and Jayati Ghosh

The global distribution of surpluses and deficits in the balance of payments, or the excesses…

Improving the Solutions for Sri Lanka’s Debt Crisis Ishac Diwan, Jayati Ghosh, Ravi Kanbur, Sharmini Coorey and Shanta Deverajan

For Sri Lanka to emerge from the present crisis, is it enough to follow the…

Lessons from Sri Lanka’s Sovereign Debt Crisis Jayati Ghsoh

The Research Intelligence Unit (RIUNIT) hosted a webinar 'Lessons from Sri Lanka's Sovereign Debt Crisis'…

Pakistan’s Debt Crisis: No resolution in sight C. P. Chandrasekhar and Jayati Ghosh

While Pakistan is beset by multiple crises on the political, social and economic fronts, media…

Will there be another Debt Crisis? Current economic challenges facing the Global South An interview with Jomo Kwame Sundaram

What are the economic challenges facing the Global South post-pandemic? What role have global financial…

Resolving the Debt Crisis: Grim lessons from Africa C. P. Chandrasekhar

As the number of developing countries likely to default on external debt service commitments increases,…

How not to Deal with a Debt Crisis Jayati Ghosh

In the 1920s and early 30s, John Maynard Keynes was embroiled in a controversy with…

The Unfolding Global Crisis C.P. Chandrasekhar

The IMF’s most recent World Economic Outlook, released in time for the annual meetings of…

1980s’ Redux? New Context, Old Threats Anis Chowdhury and Jomo Kwame Sundaram

As rich countries raise interest rates in double-edged efforts to address inflation, developing countries are…

Bonds of Debt C. P. Chandrasekhar and Jayati Ghosh

Debt-strapped Sri Lanka has reached a staff-level agreement with the IMF, that promises access to…

A Long Road Ahead for Sri Lanka Ahilan Kadirgamar and Devaka Gunawardena

On Wednesday, the Sri Lankan Parliament elected Ranil Wickremesinghe as the republic’s interim president. Mr Wickremesinghe, who…

Lending and Profiteering – Lessons from Argentina’s Recent Debt Problems Kunibert Raffer

Over 30 years ago, Kunibert Raffer (University of Vienna) was first to propose a fair…

Roots of the Sri Lankan Debt Trap C. P. Chandrasekhar and Jayati Ghosh

The contours of the economic, political and humanitarian crises that Sri Lanka currently faces are…

Reflections on the Sri Lankan Economic Crisis Prabhat Patnaik

So much has been written on the Sri Lankan economic crisis that the facts are…

A World Economy in Disarray C. P. Chandrasekhar

When the world’s financial leaders met mid-April at Washington for the annual spring meetings of…

Crisis in an Island Economy C. P. Chandrasekhar

Sri Lanka’s economy is sliding into chaos afflicted with multiple crises, triggered by a steep…

Unwarranted Confidence C. P. Chandrasekhar and Jayati Ghosh

Global inflation, the launch of a monetary tightening cycle in the US with increased interest…

The Impasse in External Debt Relief C. P. Chandrasekhar and Jayati Ghosh

When the pandemic first swept across the globe and destroyed economies in its wake, there…

Prioritise Pandemic Relief, Recovery: No time for debt buybacks Anis Chowdhury and Jomo Kwame Sundaram

Developing country governments are being wrongly advised to use their modest fiscal resources to pay…

The Challenge of LDC Debt C. P. Chandrasekhar

As governments begin to vaccinate their populations against COVID-19 to win herd immunity, attention would…

Haemorrhaging Zambia: Prequel to the Current Debt Crisis Andrew M. Fischer

Following a stand-off with commercial creditors and protracted but unresolved negotiations with the IMF, Zambia defaulted on…

Covid Debt and the Tax Paradigm C. P. Chandrasekhar and Jayati Ghosh

The Covid-19 pandemic has forced governments across the world to increase reliance on debt. The…

Debt Hawks Detract from Urgently Needed Fiscal Recovery Efforts Anis Chowdhury and Jomo Kwame Sundaram

Developing country debt has continued to grow rapidly since the 2008-2009 global financial crisis (GFC). Warnings against debt have…

Covid-19 Compounds Developing Country Debt Burdens Anis Chowdhury and Jomo Kwame Sundaram

Covid-19 is expected to take a heavy human and economic toll on developing countries, not…

Developing Asia’s External Debt Concerns C. P. Chandrasekhar and Jayati Ghosh

There has been much discussion about how external debt concerns are likely to weigh heavily…

As the Covid-19 pandemic spread across countries, governments across the world have imposed lockdowns and taken other drastic measures to control the contagion. This has led to unprecedent shocks to the global economy, as economic activity has come close to collapse in many regions of the world, affecting both demand and supply.

The articles in this section analyse the economic processes in this still-unfolding story, analysing the effects on the economy and different segments, the policy responses and other proposals for coming out of this crisis.

Covid-19 in India – profits before people Jayati Ghosh

The unfolding pandemic horror in India has many causes. These include the complacency, inaction and…

End Vaccine Apartheid before Millions more Die Anis Chowdhury and Jomo Kwame Sundaram

At least 85 poor countries will not have significant access to coronavirus vaccines before 2023. Unfortunately,…

Urgently Needed Deficit Financing No Excuse for More Fiscal Abuse Jomo Kwame Sundaram and Anis Chowdhury

Fiscal and monetary measures needed to fight the economic downturn, largely due to COVID-19 policy…

The Environment and The Covid 19 Pandemic Priscila D. Martínez Galeazzi

The speed and effects of climate change generate a crisis even more serious than the…

Vaccine Apartheid Jayati Ghosh

Because a pandemic can be overcome only when it is overcome everywhere, embracing an every-country-for-itself…

Covid Debt and the Tax Paradigm C. P. Chandrasekhar and Jayati Ghosh

The Covid-19 pandemic has forced governments across the world to increase reliance on debt. The…

The Impact of Covid on Remittances in Mesoamerica Jorge Zavaleta

On April 22, 2020, the World Bank reported that 2020 would have the worst decline…

Reclaiming Economics after Covid-19 Carolina Alves and Ingrid Harvold Kvangraven

The Covid-19 pandemic is a crisis like no other. Unlike the 2007-08 financial crisis, there…

A Guide to Flattening the Curve of Economic Chaos Jayati Ghosh

Now it is official: India has managed to become the global leader in the number…

The Covid-19 Shock in Palestine: Global public health crisis, local impacts and responses, national socio-economic recovery Raja Khalidi

The white man will never understand the ancient words here in spirits roaming free between…

WTO is Using COVID for its Expansionist Free Trade Agenda Murali Kallummal and Smitha Francis

As the world is reeling under the deaths and exponential spread of the COVID pandemic,…

Covid-19: Why is India doing worse than other South Asian countries? C. P. Chandraskhar and Jayati Ghosh

Now that India has already overtaken Brazil among countries with the most number of Covid-19…

Asia’s Covid-19 Response and the Road to a Green Recovery C. P. Chandrasekhar

Across the world, one consequence of the coronacrisis has been a shift away from fiscal…

The Pandemic Requires a Different Macroeconomic Policy Response Jan Kregel

Let me start by noting that I have been on shelter in place in New…

Modi’s Covid-19 Policies make clear that in India some lives matter more than others Jayati Ghosh

In February, 12-year-old Jamlo Makdam left her home in the Indian state of Chhattisgarh to…

Fight Pandemic, not Windmills of the Mind Anis Chowdhury and Jomo Kwame Sundaram

With uneven progress in containing contagion, worsened by the breakdown in multilateral cooperation due to…

Covid-19 Compounds Developing Country Debt Burdens Anis Chowdhury and Jomo Kwame Sundaram

Covid-19 is expected to take a heavy human and economic toll on developing countries, not…

How we can Change the World after the Pandemic An interview with Walden Bello by Francesca Lancini

Walden Bello: a life lived in the name of human rights. From fighting dictatorship in the Philippines to…

Covid-19 cannot be defeated by a Divided World Anis Chowdhury and Jomo Kwame Sundaram

Announcing an independent evaluation of the global Covid-19 response on 9th July, World Health Organization…

A Critique of the Indian Government’s Response to the COVID-19 Pandemic Jayati Ghosh

The most destructive effects of Covid-19 in India have not been the result of the…

Covid-19 In the World Economy: Momentum and retreat Oscar Ugarteche and Alfredo Ocampo

This note aims to contrast what the COVID-19 pandemic has meant in economic and social…

Financialization: Tackling the other virus Jomo Kwame Sundaram and Michael Lim Mah Hui

The 1971 Bretton Woods (BW) system collapse opened the way for financial globalization and transnational…

India’s Abysmal Healthcare System Prabhat Patnaik

DD Kosambi uses a telling example to illustrate the crisis of Indian feudalism: at the…

Rethink Food Security and Nutrition Following Covid-19 Pandemic Jomo Kwame Sundaram and Wan Manan Muda

The Covid-19 crisis has had several unexpected effects, including renewed attention to food security concerns.…

A Stock Market Boom amidst a Real Economy Crisis Prabhat Patnaik

Something very odd is happening in the United States. The coronavirus toll keeps rising with…

Reviving the Economy, Creating the ‘New Normal’ Jomo Kwame Sundaram and Anis Chowdhury

The Covid-19 pandemic has significantly impacted most economies in the world. Its full impacts will…

Food Security and Loss of Income Oscar Ugarteche and Arturo Martínez Paredes

This note will review the current food picture that is complicated for much of the…

COVID-19 and Patriarchy in the International Year of the Nurse and Midwife Salimah Valiani

In an effort to shed light on the vital but undervalued labour of predominantly female…

India’s Response to Covid-19 has been Sadistic Jayati Ghosh

One of the most vocal critics of neoliberalism in general and the socioeconomic policies of…

Using COVID-19 to open the Door to Youth and Job Creation Salimah Valiani

Just before lockdown in South Africa, a young person close to me landed her first…

Pandemic and the Reverse Migration of Labour in India Sunanda Sen

The current predicaments faced by of India’s migrant labour - losing livelihood and shelter in…

Covid-19 Recessions: This time it’s really different Vladimir Popov and Jomo Kwame Sundaram

The world economic contraction so far this year is largely due to measures, especially at…

COVID-19 Lockdown: Impact on agriculture and rural economy Vikas Rawal, Manish Kumar, Ankur Verma and Jesim Pais

Lack of planning and preparation by the Central government for tackling the COVID-19 pandemic has…

The Worrisome Return of Capital C. P. Chandraekha and Jayati Ghosh

In a trend which sees equity markets in the “emerging economies” imitate stock markets in…

The Effects of Covid-19 on Price Indices Armando Negrete

The world is approaching a food consumption crisis. There are growing problems in the production…

Politics, Profits Undermine Public Interest in Covid-19 Vaccine Race Anis Chowdhury and Jomo Kwame Sundaram

With well over five million Covid-19 infections worldwide, and deaths exceeding 340,000, the race for…

A Fragile Federation under Strain C. P. Chandrasekhar

Among the many damages wrought by the inapposite Central government policy response to the Covid…

Some Thoughts Regarding the Forthcoming Review of the 2030 Agenda Gabriele Koehler

Here are some thoughts as I worry whether the many post-Covid-19 recovery programmes in the…

COVID-19 Lockdown: The crisis of rural employment Vikas Rawal and Manish Kumar

Lack of preparation by the Central government for dealing with the COVID-19 pandemic has dealt…

COVID-19 Lockdown: Impact on agriculture Vikas Rawal and Manish Kumar

Lack of preparation by the Central government for dealing with the COVID-19 pandemic has dealt…

Callousness in a Time of Crisis C. P. Chandrasekhar

On May 12, Prime Minister Modi declared that the government, in response to the Covid-19…

Covid-19 Straw Breaks Free Trade Camel’s Back Jomo Kwame Sundaram

Economic growth is supposed to be the tide that lifts all boats. According to the…

New Fronts in the US-China Trade War C. P. Chandrasekhar and Jayati Ghosh

While everyone was busy looking at the Covid-19 numbers across the world, other “stuff was…

INET Webinar: COVID-19 and the developing world Webinar with Dr. Jayati Ghosh

Developing countries, many of which appear not to have felt the health effects of…

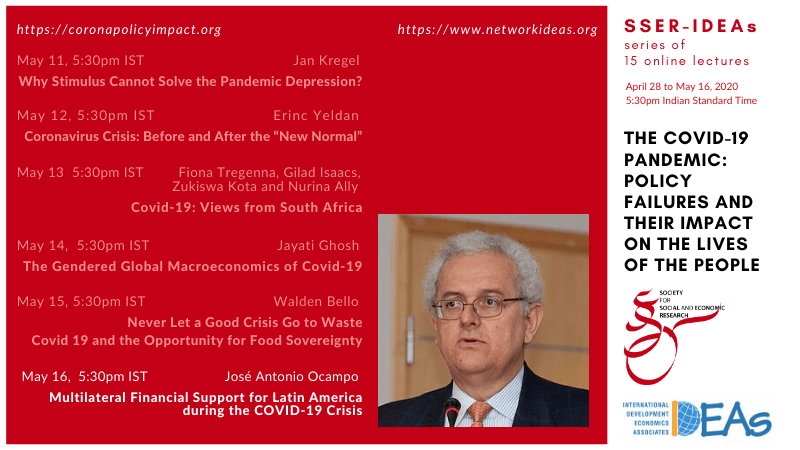

Multilateral Financial Support for Latin America during the Covid-19 Crisis José Antonio Ocampo

The presentation used in the lecture can be seen here. A paper by the speaker…

Outsourcing the Stimulus C. P. Chandrasekhar

On May 8, 45 days into the post-Covid lockdown, the central government, through a Finance…

Never Let a Good Crisis Go to Waste: COVID19 and the opportunity for food sovereignty Walden Bello

"Covid-19 Provides an Opportunity for Breaking with the Global Food Supply Chain” By Walden…

Choking the Lifeline of the Rural Economy: MGNREGS during the COVID-19 lockdown Manish Kumar

This paper shows that the lack of planning and preparation before implementation of the lockdown…

‘Passing the Buck’ Becomes Reckless ‘Conspiracy Blame Game’ Anis Chowdhury and Jomo Kwame Sundaram

Although Wuhan local authorities undoubtedly ostracized local medical whistle-blowers, notably Dr Li Wenliang, who suspected a…

We Need a Radically Different Model to Tackle the COVID-19 Crisis James K. Galbraith

The Current Situation in the United States: May 2020 Two weeks ago week the US…

How to Build the Global Green New Deal Jayati Ghosh

The demands for a "Global Green New Deal" were never about some Utopian vision or…

A Dangerous Course Prabhat Patnaik

Despite repeated demands by the states the Centre still has not released what is their…

The End of Globalization Prabhat Patnaik

In an editorial on April 3, The Financial Times of London wrote: “Radical reforms in…

Covid-19 Unmasks Dangers of Commodified Healthcare Salimah Valiani

Covid-19 has been linked to a number of truth claims long made by activists in…

Argentina Responds Boldly to Coronavirus Crisis Anis Chowdhury and Jomo Kwame Sundaram

Like much of the West, Argentina did not take many early precautionary actions after the…

Contours of the Covid-crisis C. P. Chandrasekhar and Jayati Ghosh

Early evidence of the crisis in the developed world induced by the Covid-19 pandemic is…

It Takes Two to Tango: Can monetary stimulus compensate for an inadequate fiscal stimulus in India? Parthapratim Pal and Partha Ray

Monetary policy can only make credit cheaper, it cannot bring money into the hands of…

The Profitability of the Oil Industry Oscar Ugarteche and Arturo Martinez Paredes

The crisis over COVID-19 has hit the world economy as a whole. This note will…

COVID-19 and Children, in the North and in the South Giovanni Andrea Cornia, Richard Jolly and Frances Stewart

This paper aims to document the likely direct and indirect impact of COVID-19 in both…

New FDI Norms in Time of COVID – Good Economics or Geopolitics? Sunanda Sen

The move for capital account liberalisation, which took off in India within a few years…

Never Let a Good Crisis Go to Waste : The covid-19 pandemic and the opportunity for food fovereignty Walden Bello

The Covid-19 pandemic has provoked widespread discussion of what kind of future the world should…

Pandemic Crisis: Dangers and opportunities Lim Mah Hui and Michael Heng

It is widely known that the Chinese word for crisis consists of two characters -…

What Changed with the Epidemic? Oscar Ugarteche

The world has gone from having predictions of declining growth/recession to being faced with the…

All-of-Government, Whole-of-Society Involvement Needed to Fight Virus Anis Chowdhury and Jomo Kwame Sundaram

The Covid-19 pandemic is now widely considered more threatening than any other recent viral epidemic.…

Covid-19 Crisis calls for Universal Delivery of Food and Cash Transfers by the State Jayati Ghosh, Prabhat Patnaik and Harsh Mander

The immediate need for universal food and cash delivery is by now obvious and urgent.…

What Must India do Now to Address the Coronavirus Crisis Dipa Sinha, Prasenjit Bose and Rohit

While the Covid-19-induced lockdown has yielded mixed and spatially diverse results so far in terms…

Citizen Action is Central to the Global Response to COVID-19 Isabel Ortiz and Walden Bello

The coronavirus (COVID-19) pandemic has created an unprecedented human and economic crisis. Governments are taking…

Agricultural Supply Chains during the COVID-19 Lockdown: A study of market arrivals of seven key food commodities in India Vikas Rawal and Ankur Verma

The sudden announcement of a national lockdown to contain the spread of COVID19 has resulted…

Covid-19: Brazil’s Bolsonaro trumps Trump Anis Chowdhury and Jomo Kwame Sundaram

Brazil’s President Jair Bolsonaro appointed medical entrepreneur Nelson Teich his new health minister on 17…

A Crisis Like no Other: Social reproduction and the regeneration of capitalist life during the COVID-19 pandemic Alessandra Mezzadri

Back to work! As the COVID-19 health crisis deepens, it looks increasingly clear that the short-term collapse…

The Might of the US Fed C. P. Chandrasekhar

The Reserve Bank of India is reportedly in discussion with the US Federal Reserve to…

The Pandemic and the Global Economy Jayati Ghosh

There are still many uncertainties about the COVID-19 pandemic: about the extent of its spread,…

When the US and India Together Failed the Developing World C. P. Chandrasekhar and Jayati Ghosh

At the recent G20 and IMF-WB Spring meetings held virtually in the third week of…

The “Sink” for Indian Capitalism Prabhat Patnaik

The distress to which lakhs of migrant workers were suddenly exposed by the Narendra Modi…

Why India Should Support an SDR Issue by the International Monetary Fund Jayati Ghosh

The global economy is in the grip of an unprecedented crisis, once never experienced before…

Vietnam Winning New War Against Invisible Enemy Anis Chowdhury and Jomo Kwame Sundaram

Vietnam, just south of coastal China, is the 15th most populous country in the world…

Covid-19: The Beginning of the Domino Effect Oscar Ugarteche and Alfredo Ocampo

The effects of COVID-19 on the real economy are beginning to materialize around the world.…

Are Distress Deaths Necessary Collateral Damage of Covid-19 Response? Vikas Rawal, Kathik A Manickem and Vivek Rawal

The Experience of First Three Weeks of the Lockdown in India India implemented a national…

Finance versus the People in the Era of the Pandemic Prabhat Patnaik

The current pandemic has brought to the fore, and with exceptional clarity, the fundamental contradiction…

Kerala Covid-19 Response Model for Emulation Anis Chowdhury and Jomo Kwame Sundaram

Within weeks, the Covid-19 epidemic was classified by the World Health Organization (WHO) as an…

The Coming Global Recession: Building an internationalist response Video recording of the Webinar

A video recording of a webinar held on 8 April with Professor Jayati Ghosh, Quinn…

Lessons from the Coronavirus: The socialization of care work is not ‘just’ a women’s issue Smriti Rao

The defining images of the coronavirus crisis in India are the images of migrants, children…

The Corona Virus and Developing Countries Translated and edited by BRAVE NEW EUROPE

The global pandemic is sparing almost no one. Rapid and rigorous aid must urgently be…

In a surprise move, on November 8, 2016, the Indian government announced that the currency notes of Rs 500 and Rs 1000 denomination cease to be legal tender from the midnight of that very date. The arguments advanced in support of the move was that this would root out black money and take care of counterfeiting of currencies; however, withdrawing more than 85 per cent of the currency notes in circulation has been a major hit on India’s poor and lower middle classes. This section presents articles and videos explaining the major impacts of this move on the people and the economy.

Buckling under Pressure Jayati Ghosh

Is there no one left in our important institutions who is still capable of speaking…

The Demonetization Fiasco Prabhat Patnaik

The demonetization of 86 percent of the currency of the country, a virtually unprecedented measure…

Barbara Harriss-White on Demonetisation An interview with Madras Courier

Part 1 Barbara Harriss-White is an Emeritus Professor at the University of Oxford, with decades…

The Pursuit of Unreason Prabhat Patnaik

A distinguished Ugandan social scientist of Indian origin, whom I happened to meet earlier this…

The Utter Failure of Demonetization: The RBI says so even as it says not Surajit Mazumdar

From the figure of the value of fresh banknotes issued by banks by 19 December,…

Banks as victims C. P. Chandrasekhar

In the outcry against the disastrous demonetisation experiment of the Modi government one aspect that…

Supreme Court should Frame an Eleventh Question on Demonetisation Prasenjit Bose and Zico Dasgupta

Whether the demonetisation scheme declared through the November 8 notification qualifies as a fiscal or…

Money and the Social Contract in India Jayati Ghosh

The social contract between a state and its citizens is a complex thing. Philosophers of…

Demonetisation and Banks’ Lending Rates Prabhat Patnaik

Spokesmen of the ruling party are busy these days spreading another falsehood, namely that, because…

Demonetisation and India Inc C. P. Chandrasekhar

In Finance Minister Arun Jaitley’s pre-Budget meeting with members of India’s Chambers of Commerce and…

Demonetization as the Basis for a Fiscal Stimulus Prabhat Patnaik

A bizarre argument is doing the rounds these days. It states that the cash which…

Demonetization as a Means of Fighting “Black Money” Prabhat Patnaik

So many lies are being spread by the government which is currently busy wrecking the…

Demonetisation: All pain for the majority C. P. Chandrasekhar

At the time of writing, chaos continues to prevail at bank branches and ATMs across…

Demonetization and its Discontents Arjun Jayadev

You know it is trouble when the metaphor that is said to get describe your…

Demonetisation was Primarily a Political Act Jayati Ghosh

Two weeks into the surprise announcement of by Prime Minister Modi of the demonetisation of…

Interview with TM Thomas Isaac on Demonetisation

In an interview to Scroll.in, economics professor turned Finance Minister of Kerala, TM Thomas Isaac said…

Demonetization: Illusory Gains, Enduring Damages Arindam Banerjee

The demonetization of Old High-value Denominations (OHD) announced on the 8th of November, with effect…

The Chimera of a ‘Cashless’ Economy Prabhat Patnaik

A secondary justification for the demonetization of 500 and 1000 rupee notes, apart from its…

Modi’s Demonetisation Move May Have Permanently Damaged India’s Informal Sector Pronab Sen

At the stroke of the midnight hour on November 9, 2016, India lost 86% of…

Artificially Created Distress Utsa Patnaik

Without adequate preparation or thought, the monetary authorities and the government have taken a drastic…

Why the Corrupt Rich will Welcome Modi’s ‘Surgical Strike on Corruption’ Jayati Ghosh

Narendra Modi came to power in India on a promise to end corruption. Halfway into…

C.P. Chandrasekhar on India’s Currency Chaos

C.P. Chandrasekhar, Professor, Centre for Economic Studies and Planning, JNU talks to World Business Report…

Abhijit Sen Speaks on the Impact of Demonetisation

Abhijit Sen, retired Professor, Centre for Economic Studies and Planning, JNU speaks on the impact…

Prabhat Patnaik speaks on Demonetisation

Prabhat Patnaik, Professor Emeritus at the Centre for Economic Studies and Planning, JNU, speaks on…

The Political Economy of Demonetising High Value Notes Jayati Ghosh

The Modi government is extremely adept at optics, at policy measures presented in a blaze…

Demonetization of Currency Notes Prabhat Patnaik

Narendra Modi went on national television at 8 p.m. on November 8 to announce that…

On the occasion of the beginning of the Centenary year of the October Revolution Professor Prabhat Patnaik delivers a series of four lectures where he attempts to theoretically construct the historical journey from 1917 to the present in order to explain the kind of conjuncture in which we are placed today.

The Spontaneity of Capitalism Prabhat Patnaik

The post-war restructuring of capitalism involving decolonization, the introduction of Keynesian demand management, and…

Marxist Theory and the October Revolution Prabhat Patnaik

Marx’s theory when it was first presented had a far more profound impact on intellectual…

The Leninist Conjuncture Prabhat Patnaik

The basic theoretical presumption underlying the October Revolution was that because inter-imperialist rivalry had unleashed…

Britain’s vote to leave the European Union adds to the uncertainty in the world economy and the unfolding crisis in the region will inevitably affect developing countries as well. This section presents analyses of the vote on Brexit and its implications for Britain, for the European Union and for the global economy.

Brexit, the City, and the Crisis of Conservatism Alan Freeman & Radhika Desai

In this report, the authors argue that, underneath the surface of liberal dismay and right…

Why the European Union should be Even More Worried about Brexit C.P. Chandrasekhar and Jayati Ghosh

The economic pressures that may have driven the Brexit vote are also evident in other…

The Brexit is Not Gender Neutral Gabriele Kohler

This article highlights the gendered implications of the Brexit vote- what it means for women…

What Next for the EU? Jayati Ghosh

Even before the results of the UK referendum, the European Union was facing a crisis…

After Brexit C.P. Chandrasekhar

Britain has voted to leave the European Union (EU). And the managers of global capitalism…

Brexit Earthquake has Many Ruptures Radhika Desai

The Brexit vote was a momentous political earthquake and the seismic shifts that caused it…

Brexit: A revolt against the hegemony of globalized finance Prabhat Patnaik

Almost all commentators on the British electorate’s vote to leave the European Union, whether from…

The announcement of a BRICS development bank in the context of the ongoing global economic turmoil assumes a special significance. Some perceive it as an alternative to the already discredited World Bank with its North Centric leadership resulting in a dogmatic imposition of neo-liberal conditionalities on the indebted South; many assume this as a watershed, signaling the shift in global economic governance from the traditional powerhouses of the North to the newly emerging powerhouses of the South; while others perceive it as a tool to be used by the member countries to increase their influence in their respective Southern pockets.

This section includes articles analysing the emergence of BRICS Development Bank and its possible implications for global economic governance, regional impact of the BRICS nations, and other repercussions.

Why does Brazil’s Banking Sector Need Public Banks? What should the BNDES do? Felipe Rezende

The author examines the role played by the BNDES in financing long term development, how to finance it, and the…

Development Finance in BRICS Countries Published by the Heinrich Boll Foundation

The volume aims to provide background information for an informed debate about development financing from the perspective of emerging economies,…

Banking with a Difference C.P. Chandrasekhar

Democratic forces in BRICS and other countries have to ensure that the BRICS bank acts differently from existing development banks…

The BRICS Bank Prabhat Patnaik

The optimism that the newly formed BRICS bank can provide an alternative to the neo-liberal World Bank maybe misplaced given…

The BRICS Bank: Part of a new financial architecture (II) Oscar Ugarteche

Given that the BRICS countries all have first tier development banks implies that they also have development bankers who can…

The BRICS Bank: Part of a new financial architecture (I) Oscar Ugarteche

The BRICS Bank would be less vulnerable if it used non dollar denominated bonds similar to those established by the…

BRICS Gains Currency in Brazil Biswajit Dhar

BRICS is poised to make a mark in the global economic governance, if the NDB and the CRA turn into…

Using the Potential of BRICS Financial Co-operation Jayati Ghosh

The emergence of BRICS as a global economic entity offers a scope for democratizing the entire process of South-South Co-operation…

To commemorate 10 years of International Development Economics Associates (IDEAs), we are organizing a Conference titled ”Global Economy in a Time of Uncertainty: Capitalist trajectories and progressive alternatives” in Muttukadu, Chennai, during 24-26 January 2012, and a Seminar titled ”Whither Global Capitalism” in the Convention Center, Jawaharlal Nehru University (JNU), Delhi, during 28-29 January 2012. This section contains the contributions by the participants in the two events.

International Seminar on “Whither Global Capitalism?” Jawaharlal Nehru University, New Delhi, 28-29 January 2012

An international seminar on ''Whither Global Capitalism?'' will be held on 28-29 January 2012 at the Convention Centre, Jawaharlal Nehru…

International conference on ”The Global Economy in a Time of Uncertainty: Capitalist trajectories and progressive alternatives” Muttukadu, Chennai, India, 24-26 January, 2012.

Click for the Conference Report International Development Economics Associates will mark a decade of existence in 2011. This has been…

Notes on Land, Long Run Food Security and the Agrarian Crisis in India Sheila Bhalla

These Notes are organised in three main parts. Part I looks at examples of three approaches to land use and…

A Proposal for a Growth and Fiscal Compact Mario Tonveronachi

The author investigates the present crisis in Europe that is threatening to undo the economic integration process started under the…

Resolving the Food Crisis: Assesing global policy reforms since 2007 Timothy A. Wise and Sophia Murphy

Download the full report. The spikes in global food prices in 2007-8 served as a wake-up call to the global…

Notes on Land, Long Run Food Security and the Agrarian Crisis in India Sheila Bhalla

These Notes are organised in three main parts. Part I looks at examples of three approaches to land use and…

A Proposal for a Growth and Fiscal Compact Mario Tonveronachi

The author investigates the present crisis in Europe that is threatening to undo the economic integration process started under the…

Resolving the Food Crisis: Assessing Global Policy Reforms Since 2007 Timothy A. Wise and Sophia Murphy

Download the full report. The spikes in global food prices in 2007-8 served as a wake-up call to the global…

Following the financial crisis, much has been done for preventing systemic failure in the financial sector, stalling economic downturn and ensuring a recovery. However, the adequacy and appropriateness of the measures adopted remain questionable. As far as reforming the financial sector is concerned, despite a spate of proposals, agreement on the appropriate mix of policies and the progress with implementation have been limited. This section presents papers and articles that analyse the adequacy of various proposals and measures, the challenges that could arise at the time of implementation and advocate additional or alternative measures. Some of these papers also take a renewed look at the veracity of the arguments given for explaining the genesis of the crisis.

Why Capitalist Governments worry more about Inflation than Unemployment? Prabhat Patnaik

Capitalist governments invariably seek to control inflation by enlarging unemployment. This has nothing to do with any belief in a…

Further Reflections from a Reforming Indian Central Banker Andrew Cornford

The author reviews the latest book by Y.V. Reddy, titled 'Economic Policies and India's Reform Agenda New Thinking', on governance…

Capital Account Regulations and the Trading System: A compatibility review Edited by: Kevin P. Gallagher

This report published by Boston University's Pardee Center is the outcome of a workshop co-sponsored last June in Buenos Aires,…

Capital Account Regulations and the Trading System: A compatibility review Kevin P. Gallagher

The report validates the concerns that many nations may not have adequate flexibility to regulate capital flows because of the…

Insolvency Protection and Fairness for Greece: Implementing the Raffer Proposal Kunibert Raffer

The financial crisis in Greece and the 'austerity measures' being imposed on the country has lead to disastrous results for…

Insolvency Protection and Fairness for Greece: Implementing the Raffer Proposal Kunibert Raffer

The financial crisis in Greece and the ‘austerity measures’ being imposed on the country has lead to disastrous results for…

Society, Economic Policies, and the Financial Sector Y.V. Reddy

This is the Per Jacobsson Foundation Lecture 2012 delivered by the author at Basel, Switzerland. It is argued that the…

Using Minsky to Simplify Financial Regulation

The basic error in the current regulatory approach embodied in Dodd-Frank is that it does very little to limit the…

Monetary Policy and Central Banking after the Crisis: The implications of rethinking macroeconomic theory Thomas I. Palley

In this paper, the author presents an outsider reform program that focuses on central bank governance and independence; reshaping the…

New Issue Newsletter on EU Financial Reform

The financial costs of resolving the financial crisis that erupted in September 2008 are now taking a heavy toll on…

The Great Austerity War: What caused the deficit crisis and who should pay for it? James Crotty

The author argues that the recent deficit crisis in USA is the result of a shift from the New-Deal-based economic…

Transatlantic Cooperation for Post-Crisis Financial Reform- To What End? Aldo Caldiari

During the 2008-09 financial crisis, the G20 began to meet at the “Heads of State” level to formulate and implement…

Drawing Lessons from US Financial Reform Efforts: A Civil Society Perspective Aldo Caliari, Center of Concern

The author analyses the Dodd-Frank Act of reforming the US financial sector from the perspective of the civil society. He…

Structural Reform Of Systemically Important Financial Institutions: The FSB’s Response To Too Big To Fail Andrew Conford

Earlier this year, the focus was mainly on the Dodd-Frank Wall Street Reform and Consumer Protection Act of the USA.…

The Failure of Cross-border Financial Firms: New Thinking in the Aftermath of the Financial Crisis Andrew Cornford

The development of rules for handling insolvencies of financial and non-financial firms with operations in a number of countries (cross-border…

The Global Crisis and the Governance of Power in Finance Gary A. Dymski

This paper argues that resolving the global crisis of financial systems depends on recognizing and responding to the considerable, multi-dimensional…

The WTO as Barrier to Financial Regulation Jayati Ghosh

In most parts of the world today (except perhaps in India, where optimism about the benefits of unregulated financial markets…

The Peril of Paradigm Maintenance in the Face of the Crisis Andrew Fischer

This paper addresses how Keynesian narratives are being used to reconstitute an orthodox policy paradigm in the face of the…

Controlling Dangerous Financial Products through a Financial Precautionary Principle Gerald Epstein and James Crotty

High risk, opaque, and complex financial products have been among the key causes of the current economic crisis. Not only…

New Pathways to Oligarchy: Towards a theory of oligarchic democracy Amiya Kumar Bagchi

In this paper the author argues that as recorded history has shown, any republican government could end up as an…

Restructuring the Financial System: A synthetic presentation of an alternative approach to financial regulation Mario Tonveronachi and Elisabetta Montanaro

Rejecting the current approach to financial regulation based on a laissez faire regime on risk production and allocation, the authors…

Global Liquidity and Financial Flows to Developing Countries: New trends in emerging markets and their implications C.P. Chandrasekhar

This paper argues that supply-side factors rather than the financing requirements of developing countries, explain the recent revival and surge…

Financial and Economic Crisis in Eastern Europe Rainer Kattel

The paper argues that the foreign savings-led strategy followed by Eastern European economies created in 2000s almost a decade long…

Financial Regulation and the Lobbying Activities of the Financial Sector Carlo Panico and Antonio Pinto

The breakdown of the Bretton Woods’ agreements and the oil shocks of the Seventies, the paper argues, changed the management…

Financial Innovation and System Design Mario Tonveronachi

The most relevant financial innovations have been the result of active policies pursued by public authorities, which have intrinsic to…

The Theory of the Global “Savings Glut” Prabhat Patnaik

For some time now, Mr. Ben Bernanke, Chairman of the Federal Reserve Board, has been arguing that the substantial increase…

No Going Back: Why we cannot restore glass-steagall’s segregation of banking and finance Jan Kregel

Recently, a number of authoritative voices have called for a return to the New Deal Glass-Steagall legislation as the most…

It is now more than two years since the sub-prime lending crisis in the US mortgage sector came to light. The unprecedented financial crisis in the developed world brought with it the end of the illusion of the market being ”efficient”. This section presents papers and articles that seek to explain the causes and consequences of the U.S. sub-prime mortgage crisis. Through a critique of the underlying structure and dynamics of deregulated finance, they analyse how this crisis led to a generalized credit crunch in other financial sectors and ultimately affected the world economy at large. There are also theoretical papers that explore the related issues, all of which provoke a fundamental rethink on financial liberalisation in order to reduce the systemic and global instability associated with it.

The Climate Finance Conundrum Anis Chowdhury and Jomo Kwame Sundaram

According to the UN Framework Convention on Climate Change, climate finance refers to local, national, or transnational financing that supports…

Climate Inaction, Injustice Worsened by Finance Fiasco Jomo Kwame Sundaram

Many factors frustrate the international cooperation needed to address the looming global warming catastrophe. As most rich nations have largely…

“Ten years of procrastination” Andrew Cornford

"Ten years of procrastination", Talk at the session, Ten years after the crisis, where are we ?, of the second…

From Marx to Morgan Stanley: Inequality and financial crisis Michael Lim Mah-Hui and Khor Hoe Ee

Despite robust growth, rising inequalities and financial instability have affected many countries. This is a result of skewed distribution of…

The Myth of the ”Sub-prime” Crisis Prabhat Patnaik

Capitalism, like the proverbial horse, kicks even when in decline. Even as the current crisis hit it, it gave an…

Should Greece Follow Estonia’s Example? Rainer Kattel

One of the suggestions regarding Greece’s current woes is that it should cut its public spending, just like Estonia. But,…

Should Greece Follow Estonia’s Example? Rainer Kattel

One of the suggestions regarding Greece’s current woes is that it should cut its public spending, just like Estonia. But,…

Productive Incoherence in an Uncertain World: Financial governance, policy space and development after the global crisis Ilene Grabel

The current global financial crisis raises important questions for scholars of international political economy. Among the most important of these…

Financial and Monetary Issues as the Crisis Unfolds James Galbraith

On June 15 and 16, 2009, the working group on financial and monetary issues of Economists for Peace and Security…

The Revenge of the Market on the Rentiers: Why Neo-Liberal Reports of the End of History turned out to be Premature Jose Gabriel Palma

Starting from the perspective of heterodox Keynesian-Minskyian-Kindlebergian financial economics, this paper begins by highlighting a number of mechanisms that contributed…

The Relevance of Ragnar Nurkse and Classical Development Economics Rainer kattel, Jan Kregel, Erik S, Reinert

The Authors aim to show how the classical development economics of Ragnar Nurkse’s (1907-1957) generation epitomized the best development practices…

What is Minsky All About, Anyway? Korkut Ertürk and Gökcer Özgür

The current financial crisis has been interpreted as the fulfillment of Hyman P. Minsky’s predictions by many, while others have…

A Comparison of Two Cycles in the World Economy: 1989-2007 Korkut Boratav

The paper compares and analyses some of the quantitative indicators of the world economy during the 1989-2007 years. The global…

G20: How not to Rule the World Jayati Ghosh

Not much could have been expected from this G20 Summit. Despite the urgency of a global economy going rapidly over…

Recommendations of UN Expert Commission on Finance

This is the preliminary recommendations of the UN Expert Commission on Finance, constituted by the President of the UN General…

Why more of the same will not work Jayati Ghosh

A visit to Western Europe in early March provided some slightly different – if unsettling – insights into global economic…

Fiscal Stimulus Plans: The Need for a Global New Deal Isabel Ortiz

This article reviews the fiscal stimulus packages announced in 43 countries. In March 2009, the total amount announced for these…

Whatever’s happened to Global Banking? C.P. Chandrasekhar & Jayati Ghosh

The call for nationalization of banks in developed countries, even if for a temporary period, marks a potential ideological shift.…

The Asian Face of the Global Recession C.P. Chandrasekhar & Jayati Ghosh

As news of the intensity of the global downturn worsens, so do assessments of the extent of its global spread.…

The Wisdom of Storytellers Jayati Ghosh

The Italian playwright, author of the brilliant satirical play “Accidental Death of an Anarchist”, won the Nobel Prize for Literature…

Tools for a New Economy Robert Pollin

In this article, the author outlines the reasons for the current financial crisis, juxtaposing them to earlier such crises. He…

Just Say “No” to the Credit Rating Agencies Gerald Epstein

The credit rating agencies have got us, coming and going. First they help cause the biggest economic calamity since the…

Coping with Financial Market Crisis UNCTAD Policy Briefs

Recent UNCTAD policy briefs discuss the reasons behind the crisis and options before policymakers. They make a case for stronger…

Will We never Learn? UNCTAD Policy Briefs

As financial crisis becomes increasingly global, world economy seems headed for a deep and synchronised downturn. Latest UNCTAD policy brief…

Redistribution and Stability: Beyond the Keynesian / neo-liberal impasse Harry Shutt

As the financial crisis that erupted in 2007 unfolds in an economic cataclysm which, it is now clear, is unprecedented…

The Coming Capitalist Consensus Walden Bello

Not surprisingly, the swift unraveling of the global economy combined with the ascent to the U.S. presidency of an African-American…

Will the Paulson Bailout Produce the Basis for Another Minsky Moment? Jan Kregel

The reorganisation of the financial system that appears to be taking place in the US does not seem to respect…

The Time has come: Let’s shut down the financial casino ATTAC's Statement on the Financial Crisis and Democratic Alternatives

ATTAC was launched in 1998 as an organization to counter the onslaught of the profit driven financial markets that was…

We Need a Paradigm Shift Jayati Ghosh

Everyone now recognises the need to reform the international economic regime. But the idea should not simply be to fix…

Structural Causes of the Global Financial Crisis: A critical assessment of the ‘new financial architecture’ James Crotty

The author argues that the ultimate cause of the current global financial crisis is to be found in the deeply…

Policy and Security Implications of the Financial Crisis: A Plan for America James K. Galbraith

In mid-June 2008, an international group of economists met in Paris to discuss the gravity of the current economic crisis…

Proposals for Effectively Regulating the U.S. Financial System to Avoid Yet Another Meltdown James Crotty and Gerald Epstein

The authors argue that the current financial crisis is a result of the radical financial deregulation process that began in…

Making Financial Markets Work for Development Peter Wahl

This paper analyses the financial sector crisis from the development perspective. The author attempts look a little closer at the…