The ongoing political crisis in Thailand

has been capturing headlines for some time now, and now even appears to

be heading towards some kind of climax. This political instability reflects

more than the resistance of the existing establishment to the increasingly

vociferous demands of those who have been marginalised from most of the

benefits. It also reinforces the significance of (and the need for) democratic

legitimacy in a developing country such as Thailand, despite all the known

problems with its electoral process.

But the purely political is not all that underlies this current crisis.

Indeed, it could be argued that the economic underpinnings of this political

crisis are the more significant forces propelling the actions of the anti-government

protestors. This reflects the socio-political results of more than a decade

in which the neo-liberal economic model, which still drives the policy

making of the elite, has been fundamentally exposed among the people.

The conflict between the current Thai government (as well as those elements

of the establishment that directly and indirectly enabled this particular

political grouping to rule) and the wide spectrum of anti-government protestors

is not simply about certain political processes or about individuals like

Thaksin Shinawatra, the exiled former Prime Minister. Rather, it is substantially

about economic policy. As Pausk Phongpaichit and Chris Baker have shown

in their excellent book on Thaksin, he was (and remains) a larger-than-life

figure with only too lifelike faults, which have ranged from blatant nepotism

to megalomaniac attempts at stifling democracy. So the support for his

return is not only (or even necessarily) because of the craving for a

strong leader, but much more due to the perception that the economic strategies

followed by his government brought at least some relief to the people.

The continued popularity of Thaksin among the peasants and otherwise unorganised

workers is largely because of what the Thai elite sniffs away as “populist

policies”. This term is a favourite among chattering classes across the

developing world, used to denigrate any economic policies with minimally

redistributive impact from the rich and middle classes to the poor. In

Thaksin’s case, these included providing peasants and small businesses

with access to institutional finance, increasing the share of rural Thailand

in public expenditure, providing fiscal transfers down to the village

level in the form of untied funds to be used according to the preferences

of local communities, and such like. While these did not contradict or

even challenge the basic neo-liberal framework within which corporate

industry continued to be favoured, they share some of the spoils of economic

growth with those who had hitherto been excluded. They were certainly

popular policies, and they played a role in giving to Thaksin and his

various political formations a degree of legitimacy among ordinary people

that is still unmatched in Thailand.

While many of Thaksin’s actions in power (and his own undemocratic tendencies)

certainly sowed the seeds of his decline and fall from grace, the coup

and various other actions of the Thai establishment could also be seen

as the empire striking back. The subsequent inability of the government

to capture the political imagination of the masses, or even to achieve

basic legitimacy despite trying to continue with some of Thaksin’s economic

policies, may be due to the growing evidence that even such “populism”

is no longer economically sustainable in Thailand.

To understand this, and also to begin to comprehend the extent of general

dissatisfaction with the economic regime, it is useful to examine the

relationship between economic growth and employment (which determines

the material conditions of the bulk of the Thai population, even the peasantry).

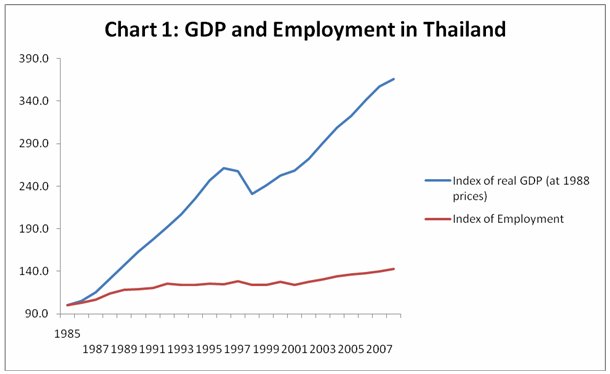

Chart 1 shows how real GDP and total employment have moved over the past

twenty five years in Thailand. Remember that Thailand, in common with

many developing countries, is generally a labour surplus economy engaged

in an uneven and unbalanced process of industrialisation. Yet it is evident

that aggregate GDP growth rates have run far ahead of aggregate employment

growth, even when the measure of employment includes (as it does here)

all form of self-employment, casual work and even part-time work.

The period of the Asian crisis occasioned a drop in GDP as well as in

aggregate employment, but the subsequent sharp recovery in GDP did not

translate in more rapid employment growth, which has tended to stagnate.

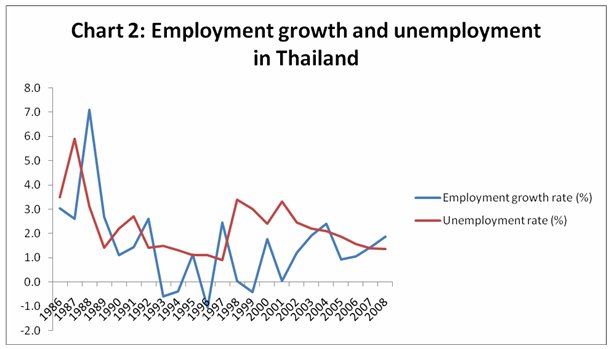

This pattern is confirmed by Chart 2, which shows annual rates of growth

of aggregate employment as well as the unemployment rate. Employment growth

has been volatile within a narrow range, and indicates a trend decline

compared to the 1980s. It was negative at several points in the 1990s,

not only in the crisis years, and zero in 1999 and again in 2001, reflecting

the effects of the global recession. Subsequently, despite more respectable

aggregate GDP growth, the peak rates of employment expansion have been

less than 2.5 per cent. Unemployment rates fell somewhat during the 1980s

boom but rose again after the crisis and since then have displayed volatility

around a higher trend. While these rates may appear low, they are part

of an institutional structure that offers no social protection to the

unemployed, where the inability to find paid work is therefore reflected

in more disguised unemployment in agriculture and petty services.

The pattern is a recognisable one. Many developing countries, including those perceived to be the most successful in terms of output growth rates, exhibit this form of jobless growth. This reflects two general tendencies: a shift in production structure across and within sectors, whereby income expansion is associated for demand for goods and services produced in more capital-intensive conditions without generating demand for labour-intensive goods and services; and the associated technological and organisational changes that improve labour productivity.

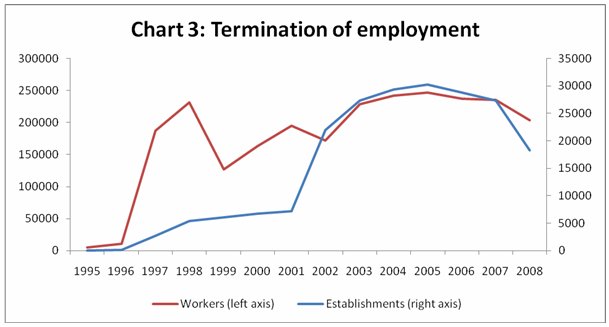

This pattern is seen once again in the incidence of jobless growth in the formal sector, described in Chart 3. Both in terms of number of establishments and number of workers, termination of work contracts was relatively low in the economic boom that preceded the crisis. However, layoffs zoomed up during the Asian crisis of 1997-98, and have stayed high in the entire subsequent period even though the economy supposedly started booming. In fact, the number of establishments adversely affected has grown faster during the 2000s boom, rather than the previous crisis.

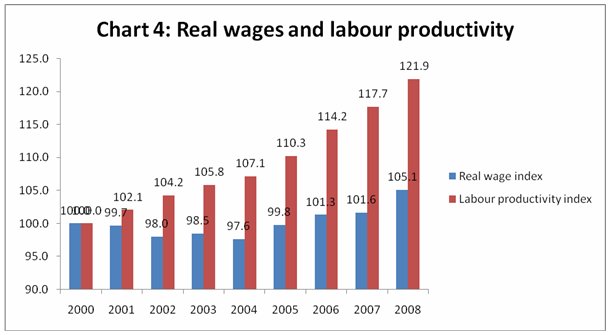

Overall, this means a labour market in which workers are clearly worse

off, since both external competitiveness issues and internal dynamics

have dictated that demand for labour does not keep up with supply. This

reduced bargaining power is indicated by the fact that real wages – which

were drastically affected during the crisis of 1997-98 – continued to

fall even during the recovery, and then have recovered only slightly.

In 2008, real wages were only 5 per cent higher than their level of 2000,

while labour productivity had increased by 22 per cent.

Of course these are aggregate figures, and the sectoral pattern is likely

to be more complex. But they indicate an economy in which the distribution

of national income is clearly shifting away from workers to those who

receive profit, rent and interest. The reduced bargaining power of workers

is inevitably part of the reduced bargaining power of the peasantry, from

whom the ranks of new workers are generally drawn.

This broader context of worsening income distribution is essential to

understand the current political tensions in Thailand. The anger of the

anti-government protestors is fundamentally related to this process, and

Thaksin is appreciated by this group only because he showed that it is

still possible at the margins to improve the lot of the poor using fiscal

and monetary policies.