The World Trade Organization (WTO) has

recently published its latest annual report. It shows that even seven

years after the implementation of the Uruguay Round Agreements, distortions

and imbalances in world trade are still pervasive. The report highlights

that imbalances and distortions are particularly high in sectors where

developing countries have export interest.

In developed countries, agriculture is still receiving huge amount of

subsidies despite its small and declining share in domestic GDP. In 2002,

total support to agriculture in OECD countries was around US$ 311 billion,

which was equivalent to about 1.3 percent of total GDP of the OECD area.

The amount of agricultural subsidies is more than six times higher than

the annual development assistance budget of OECD countries, which is about

US $50 billion. In countries like Japan, Republic of Korea, Norway, and

Switzerland total support to agriculture is close to or exceeds the sector's

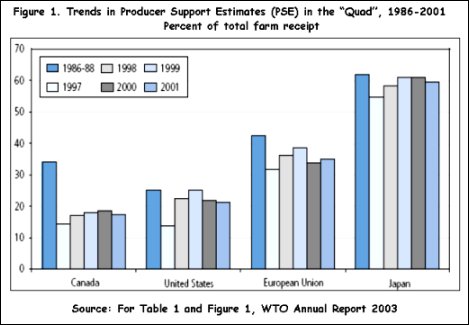

contribution to GDP (Table 1). From Figure 1 it can also be observed that

in all the Quad countries (EU, Canada, Japan and US), support given to

agriculture, when measured as a percentage of total farm receipts, is

higher in 2001 than in 1997.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Annual Report also reveals that, contrary to popular belief, subsidies

in most developed countries are not targeted towards the poor farmers.

In fact, in most OECD countries, a very high proportion of subsidies goes

to the top 25 percent of farmers. Quoting an OECD study, the report highlights

that in EU, USA, Canada and Japan top 25 percent of farmers receive 70

percent, 89 percent, 75 percent and 68 percent of total agricultural subsidies

respectively. Data published in the Annual Report also contradict the

claim that OECD countries have mostly moved away from market distorting

subsidies like price support to relatively less market distorting subsidies

like Blue and Green box subsidies. Data show that market price support

is still prevalent in these countries as prices received by the OECD farmers

continues to be much higher than international prices. The producer Nominal

Protection Coefficient (NPC) of OECD countries shows that the prices received

by the OECD farmers were 31 percent higher than international prices in

2001. Estimates show that in 2001, highly trade distorting subsidies like

market price support (MPS) and output payments (OP), together accounted

for 69 percent of total support to producers in OECD countries. On this,

the WTO Annual Report 2003 comments:

"… the continued dominance of the most distortive forms of

support means that farmers in many OECD countries remain largely insulated

from world market signals. They also constrain agricultural growth and

development opportunities in non-OECD countries". Pp. 22.

Recent domestic policies undertaken in most OECD countries suggest that

high subsidization of agriculture is going to continue. The proposed reform

of Common Agricultural Policy (CAP) of EU has already run into problems

in countries like France and it is not yet certain whether and when the

CAP reforms will be eventually implemented. But even if the CAP reforms

are implemented, the WTO Annual Report suggests that the total EU farm

budget will be around €40 billon. However, the report also mentions

that this figure does not include subsidies given to farmers via price

support and tax concessions. As has been already mentioned, farmers in

all the OECD countries, including the EU countries, continue to receive

generous price support from their respective governments. Once these subsidies

are added to the figure of €40 billon, it is not clear how much actual

reduction in subsidies is going to take place even after the CAP reforms

are implemented.

Secondly, USA, through its Farm Security and Rural Investment Act of 2002,

has proposed to increase its agricultural subsidies significantly. Under

this law, federal spending on US agriculture is slated to increase by

US$ 82.6 billion over the next ten years. This will be in addition to

US$ 100 billion which the US Government was already set to give farmers.

The WTO Annual Report indicates that this huge increase in subsidies primarily

will be in production enhancing subsidies. It says: "several of the

subsidies contained in the bill would provide incentives to boost production.

This is particularly true of "counter-cyclical payments", under

which growers of wheat, corn, rice, soyabeans, and cotton will be guaranteed

a certain price irrespective of market conditions, thereby distorting

both production and trade; in the event that prices fall further, such

subsidies will rise accordingly, although a "circuit breaker"

built into the legislation is designed to keep spending within the WTO

ceiling". Pp. 22.

This large increase in production enhancing subsidies in the US is likely

to exacerbate the distortions present in global agricultural trade by

artificially inducing overproduction of agricultural commodities and thereby

further depressing international agricultural prices. After the Uruguay

Round, most developed countries increased their farm subsidies but they

did so by shifting some of their more production distorting subsidies

(or the Amber Box subsidies) to Blue and Green box subsidies, which are

supposedly less trade distorting. But, as USA is now planning to increase

their production enhancing subsidies by a huge amount, it is almost certain

that distortions and imbalances of the international agricultural trade

are going to go up in near future.

The new US farm bill also marks a crucial shift in the negotiating position

of USA in the current round of agricultural negotiations. During the earlier

stages of negotiations, USA was arguing for sharp reduction in domestic

subsidies while the EU was arguing for a more conservative approach. But,

given the new US farm bill, it is almost certain that USA will no longer

push for a large reduction in domestic subsidies in the current round

of negotiations. This has changed the balance of negotiations completely

and there is currently an apprehension among developing countries that

reluctance of these two major players to reduce domestic subsidies will

practically preempt any move by other WTO Member countries to achieve

higher reduction in domestic subsidies in the next agreement on agriculture.

A recent joint draft proposal submitted by USA and EU about the ongoing

agricultural negotiations strengthens this apprehension[1].

The WTO Annual Report also points out that apart from high subsidies,

existence of tariff peaks[2] and high specific duties

in developed countries continue to restrict market access of agricultural

exports from developing countries. According to the WTO Annual Report,

incidences of tariff peaks are particularly high in the agriculture sector

of these countries. Estimates suggest that roughly 60 percent of the imports

of the QUAD countries, which face tariff peaks, come from developing countries.

Most developed countries also use specific duties for agricultural imports

(see Box 1 for an explanation of specific duty). Specific duties are inherently

more problematic than ad valorem rates because they are more opaque than

Ad Valorem tariffs and often conceal a very high level of Ad Valorem Equivalent

(AVE)[3]. The WTO Annual Report reveals that "between

94 and 98 of the top 100 tariffs (in AVE terms) in Canada, the EU and

Japan involve specific duties; they range from 61% to nearly 210% in the

EU, from 47% to roughly 1,739% in Japan, and from 56% to 314% in Canada.

In the United States, 84 of the top 100 tariffs involved specific duties

whose AVEs ranged from 34 to nearly 253%". Pp 17.

|

As far as market access for non agricultural goods are concerned, the

WTO Annual report shows that among manufactured products, tariff peaks

are concentrated in textiles, clothing and footwear sectors. For both

developed and developing countries, bound rates are highest in textiles

and clothing, leather, rubber, footwear and leather products. Tariff rates

are higher than average in fish and fish products and transport equipments

also. It is not a coincidence that sectors where the developing countries

have export interest are attracting much higher tariff rates.

Widespread existence of tariff escalations also hinders exports from developing

countries. In most developed countries for both agricultural and industrial

goods, tariffs tend to increase with the level of processing. This is

called 'tariff escalation'. Tariff escalation discourages exports of value

added commodities and locks developing countries in the cycle of producing

and exporting primary products and restricts them from diversifying towards

more value added exports. It also acts as a major obstacle to local processing

of domestic primary products (stage 1) as well as of semi-finished goods

(stage 2). The WTO Annual report shows that, among industrial products,

incidence of tariff escalation is particularly high in textiles and clothing,

leather and footwear products. The WTO Annual Report also points out that

in the textiles and clothing sector there is evidence of escalation in

non-tariff protection (greater protection given to higher value-added

products through non-tariff barriers). Quoting the report of WTO Textile

Monitoring Body, the report shows that in the textiles sector, most developed

countries have removed quota restrictions mainly on products which belong

to the lower value-added range. As the Annual Report comments, such protection

impedes developing countries in their efforts to move their production

into higher value-added products.

To further restrict market access in their countries, developed countries

are increasingly using trade defense mechanisms as Non Tariff Measures.

The Annual Report shows that protectionist measures taken by WTO Member

countries have gone up in the recent years. The steady increase in trade

defense mechanisms like anti-dumping duties, countervailing measures and

safeguards leads to the suspicion that these measures are increasingly

used as Non-Tariff Measures (NTMs) by the member countries. For example,

the number of cases of initiation of Anti-dumping measures increased steadily

from 157 in 1995 to 347 in 2001. More than half of the anti-dumping measures

imposed by WTO member countries are directed towards two categories of

products, namely 'base metals and articles thereof' and 'chemicals and

articles'. Secondly, the use of SPS (Sanitary and Phytosanitary Measures)

and TBT (Technical Barriers to Trade) have also increased steadily over

the years. There is a growing concern among developing countries that

these measures are used by developed countries to restrict market access.

The report also points out that instances of WTO members resorting to

other trade defense mechanisms like safeguards and countervailing measures

are also on the rise in the recent years.

These findings are particularly disconcerting for developing countries

because implementation experiences show that the Uruguay Round did not

bring any fundamental changes in the global trading system. As the WTO

Annual Report points out, continued presence of high level of subsidies

in agriculture, backloading of quotas in textiles and lack of meaningful

liberalization in the services sector have ensured that the benefits accruing

to the developing countries are much less than anticipated. Given this

backdrop, this new trend of increased use of trade defense mechanisms

is going to be a serious cause for concern for developing countries. Continued

deadlocks in the current round of negotiations are not helping the matter

either.

Given these problems, it is not surprising that the optimism about the

multilateral trading system is gradually fading in most developing countries.

As an alternative, most countries are trying to improve their trade relations

on bilateral or regional basis. Consequently, there has been a proliferation

of Regional Trading Agreements (RTAs) among developing countries in the

recent years. According to the WTO Annual Report, currently more than

240 RTAs are operational and as the last years' Annual Report pointed

out, more than 50 percent of global trade now takes place through the

regional trading groups. It is to be noted here that trading within RTAs

does not come under the purview of WTO and, therefore, these regional

alternatives are posing a significant challenge to the multilateral trading

system. The WTO Annual Report 2003 expresses deep concern about this latest

development and comments: "RTAs can complement the multilateral trading

system, help to build and strengthen it. But by their very nature RTAs

are discriminatory; they are a departure from the MFN principle, a cornerstone

of the multilateral trading system. Their effects on global trade liberalization

and economic growth are not clear given that the regional economic impact

of RTAs is ex ante inherently ambiguous".

However, unless the Cancun Ministerial manages to address the concerns

of the developing countries, it is unlikely that the growth and proliferation

of RTAs are going to subside. In fact, failure of the Cancun ministerial

may even drive countries more towards alternative forms of international

trading systems.

The Complete Report can be Downloaded/Viewed at:

http://www.wto.org/english/res_e/booksp_e/anrep_e/anrep03_e.pdf