It took a while to get formalised, and

even now there are several hurdles to be crossed before it becomes operational.

Nevertheless, the signing of the agreement on December 9, 2007 in Buenos

Aires, to create the Banco del Sur is a very welcome sign that the complacent

world of development finance run by the Bretton Woods lending institutions

is about to get some much-needed shocks.

The Banco del Sur is a pet project of the President of Venezuela, Hugo

Chavez, who has seen it as an important means of reducing the influence

of the IMF and World Bank in imposing neo-liberal economic policies with

adverse consequences upon developing countries. While it has global aspirations,

the current focus is on Latin America, where it is also seen as part of

the moves towards greater regional integration and reduced dependence

upon the United States.

The seven countries that signed the agreement in early December were Venezuela,

Bolivia, Argentina, Ecuador, Brazil, Paraguay and Uruguay. (The surprise

new entrant, Colombia, whose leader is a close ally of the US, asked to

join but later pulled out, presumably under US pressure.) While these

countries have divergent interests and aspirations with respect to the

Bank, the move reflects a general disillusionment with the role of the

IFIs in the region. These include not only the IMF and the World Bank,

but also the Inter-American Development Bank (IDB), which has some participation

from Latin American countries but is dominated by the US. It has generally

adopted the same approach and policies as its larger counterparts.

It is general knowledge that the IFIs’ record in the region is less than

admirable. In the 1980s, when the external debt crisis forced several

large debtor countries in Latin America to turn to the IMF, it imposed

severe and misplaced monetarist adjustment policies that led to the dramatic

fall of incomes and growth potential, such that the period became known

as a “lost decade” for the region. In the 1990s, the IFIs encouraged very

rigid macroeconomic policies as well as policies of privatization with

inadequate regulation that worsened already very unequal income distribution

and damaged possibilities of increasing aggregate productivity.

The crisis management record is also abysmal. Mexico in 1995 and Argentina

in 2001, for example, both suffered more as a result of the wrong policies

imposed upon them by the IFIs. And the World Bank has routinely pushed

market-based and private solutions in areas such as education and health,

even when the consequent problems are all too well-known.

The extraordinary thing is that the IFIs appear to have learned very little

from their past mistakes. Nor do they seem to recognise that they deserve

to have very little say in determining policies, given how little they

have actually contributed to development finance in recent years, not

only in Latin America but in the developing world as a whole.

Indeed, in the Latin American region the changing nature of international

capital markets has meant that the IFIs - and official finance generally

– have been not just minor but actually negative net contributors to resources

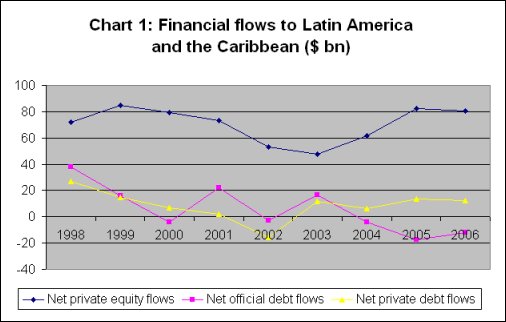

for development. Chart 1 shows how net financial flows to the Latin American

and Caribbean region have been dominated by private equity flows (and

within that, incidentally, by FDI rather than portfolio flows).

|

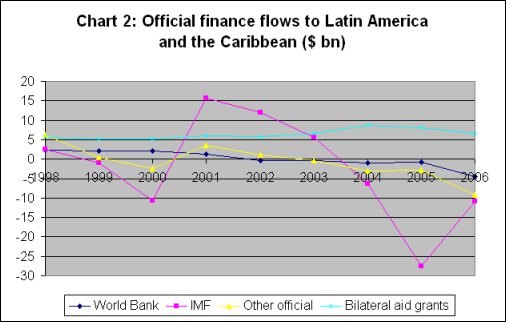

| It is also evident from Chart 1 that net official debt flows have been quite volatile, negative in many years (and clearly so from 2004 onwards) and therefore hardly contributed to development finance. Until 2004 they also appeared to follow the debt cycle established by private creditors, which is surely the opposite of what was required or could be expected. Within official finance flows, the role of the IFIs has been even less positive. Chart 2 shows that net finance flows from the IMF to the region as a whole have fluctuated wildly but generally been negative. In fact, the only three years when it was positive reflected the impact of the large bailouts provided to Argentina during its major financial crisis and IFI-guided economic implosion. For most of the recent period, the IMF has been a large recipient of repayment flows from countries in the region, receiving net inflows to the tune of tens of billions of dollars every year. |

|

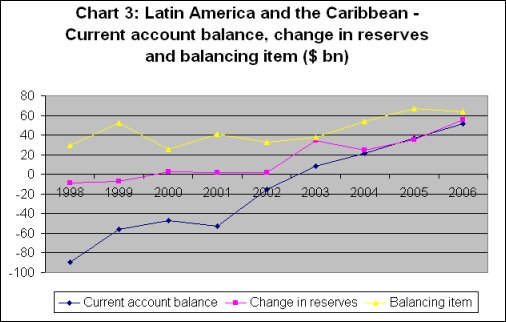

| Of course, it could be argued that the IMF’s mandate is to lend to countries in distress, and therefore it may even be a good sign that it is not engaged in net lending to the region. The same argument does not hold for the World Bank, which is supposed to be the basic source of development finance. The net amounts provided by the World Bank to the region since the late 1990s have been paltry, and since 2002 they have been negative as well. Even the IDB - the other large multilateral creditor – has been receiving net inflows from the region The only consistently positive – albeit relatively small – source of net finance has come from bilateral aid – and in recent years this has been dominated by intra-regional assistance, as oil-rich countries like Venezuela have provided finance for smaller countries. It provided around $2.5 billion to help Argentina repay its IMF loan early, and is currently offering $500 million to reduce the debt crunch in Ecuador and $1.5 billion to stabilise the economic situation in Bolivia. The Banco del Sur would institutionalise such ad hoc arrangements and lending. The plan is to raise $7 billion in paid-in capital from member countries. So far, Venezuela has offered to put in $1.4 billion and Argentina $350 million (or 10 per cent of its reserves). However, government financing alone will not be sufficient. To become a real alternative to the IFIs, the Banco del Sur would have to leverage this capital to raise funds from the market and lend out to borrower countries. That in turn will require the ability to access capital markets as a preferred borrower so as to keep interest rates low for its own borrowers. Despite the sceptics, there is no question that this is a very favourable time for such an initiative, given the resources within the region that could be tapped. Chart 3 provides some idea of this. Since 2003, the aggregate current account balance of the region has moved from deficit to surplus. Official foreign exchange reserves have also been growing rapidly, and currently more than $200 billion of such reserves are invested outside the region. More significantly, the “balancing item” of the balance of payments data, which includes not only errors and omissions (a proxy for private capital flight) but also net acquisition of foreign assets including outward FDI, has been increasing by substantial amounts every year. |

|

| Of course, much remains to be sorted out before the Banco del Sur can become operational, including questions like the governance structure, lending framework, membership criteria, the type of loan guarantees expected, the appointment of senior managers, and safeguard policies. The member countries are reported to have different objectives as well. Venezuela and Bolivia see it as an alternative to the IMF, which would also provide balance of payments financing. Brazil envisages a more limited role for the Bank, of servicing the infrastructure investment needs of an expanded Mercosur. Several of the smaller countries probably just want an alternative source of development finance that will be less bureaucratic and more sensitive to local needs than the Washington-based IFIs. Ultimately, the creation of the Banco del Sur is part of a broader trend within Latin America of governments increasingly distancing themselves from the IFIs that are widely perceived as too biased in favour of US interests and too insistent on providing rigid and undesirable policy advice. Such a distancing is of course further bad news for the IFIs, since they are now themselves facing financial problems because of a cutback in their lending operations! But it is also bad news for the US, whose sphere of influence will be considerably undermined by such moves. In addition, if Latin American governments also start to move their reserves out of US dollar holdings, which will add to the pressure on the dollar and to US interest rates, perhaps intensifying the credit crunch that is already under way. Therefore, we should expect a backlash and counter-moves to this initiative quite soon, both from the US administration and from international financial circles. But if this plan succeeds even partially, it is an important source of hope for the rest of the developing world. And meanwhile it will also be interesting to see if this competition in development finance forces the Bretton Woods institutions out of their complacency, to try to reinvent themselves so that they can actually contribute usefully to the development of the South. |