Media reports and assessments by public

and private financial institutions make clear that India invites and enjoys

global attention as one of the high growth, emerging markets n the world

economy. Along with China, Brazil and Russia, it is one of the countries

captured in the BRIC acronym coined by international financial firms keen

on talking up these economies so that they attract investors and deliver

large commissions and fees to firms that broker or mediate such investments.

In the resulting transition from fact, to hype and fable, India is being

presented as an economy that not merely grows much faster than other global

contenders, but is populated by firms that are aggressively buying into

global assets and workers who are eating into global jobs by underwriting

cheap exports or through real or digital migration. In the new Asian century,

while the erstwhile tigers of East Asia have lost momentum, India and

China are presented as contenders for supremacy.

This perception of India as an uncaged tiger in the global system derives

whatever strength it has from developments during the last four years

when India, like other emerging markets, has been the target of a surge

in capital flows from the centres of international finance. And India

has emerged as a leader among these markets over the last one year or

so, when India’s integration with the global economy has intensified considerably.

The recent intensification has implied a qualitative change in India’s

relationship with the world system. Till the late 1990s, India relied

on capital flows to cover a deficit in foreign exchange needed to finance

its current transactions, because foreign exchange earned through exports

or received as remittances fell short of payments for imports, interest

and dividends. More recently, however, capital inflows are forcing India

to export capital, not just because accumulated foreign exchange reserves

need to be invested, but because it is seeking alternative ways of absorbing

the excess capital that flows into the country. New evidence released

by the Reserve Bank of India on different aspects of India’s external

payments point to such a transition.

The most-touted and much-discussed aspect of India’s external payments

is the sharp increase in the rate of accretion of foreign exchange reserves.

During the first six months (April to September) of financial year 2007-08,

the net addition to India’s stock of foreign exchange reserves amounted

to $40.4 billion (ignoring the effects of changes in the relative values

of currencies). The comparable figure for the corresponding period of

the previous year was just $8.6 billion.

This surge in the pace of reserve accumulation had by September 28, 2007

taken India’s foreign exchange reserves to $248 billion. Being adequate

to finance more than 15 months of imports, these reserves were clearly

excessive when assessed relative to India’s import requirements. More

so because net receipts from exports of software and other business services

and remittances from Indian’s working abroad had contributed between $28-29

billion each during 2006-07, financing much of India merchandise import

surplus. Viewed in terms of the need to finance current transactions,

which had in the past influenced policies regarding foreign exchange use

and allocation, India was now forex rich and could afford to relax controls

on the use of foreign exchange. In fact, the difficulties involved in

managing the excess inflow of foreign exchange required either restrictions

on new inflows or measures to increase foreign exchange use by residents.

The government has clearly opted for the latter.

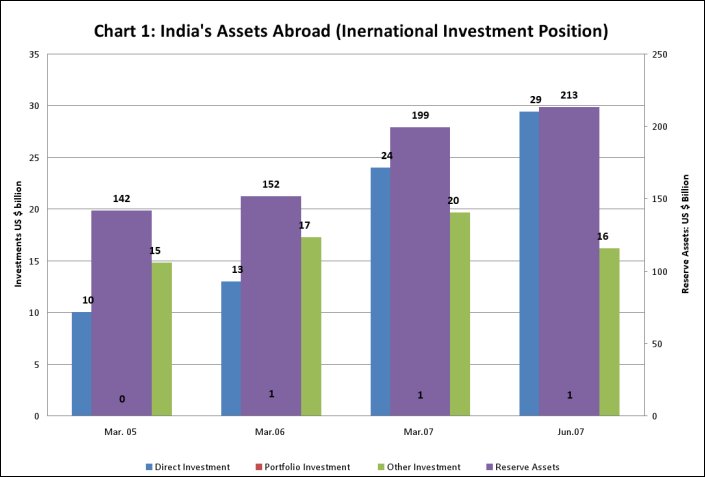

Not surprisingly, the pace of reserve accumulation has been accompanied

by evidence that Indian firms willing to exploit the opportunity offered

by liberalized rules regarding capital outflows from the country are resorting

to cross-border investments using the “invasion currency” that India’s

reserves provide. Even though evidence is available only till the end

of June 2007, this trend (that has intensified since) is already clear.

Figures on India’s international investment position as of end-June 2007

indicate that direct investment abroad by firms resident in India, which

stood at $10.03 billion at the end of March 2005 and $12.96 billion at

the end of March 2006, had risen sharply to $23.97 billion by the end

of March 2007 and $29.39 billion at the end of March 2007 (Chart 1). The

acceleration in capital outflows in the form of direct investments from

India to foreign countries had begun, as suggested by the anecdotal evidence

on the acquisition spree embarked upon by Indian firms in areas as diverse

as information technology, steel and aluminum.

|

| Does this suggest that using the invasion currency that India has accumulated, the country (or at least its elite firms) is heading towards sharing in the spoils of global dominance? The difficulty with this argument is that it fails to take account of the kind of liabilities that India is accumulating in order to finance its still incipient global expansion. As has been noted in these columns, unlike China which earns a significant share of its reserves by exporting more than it imports, India either borrows or depends on foreign portfolio and direct investors to accumulate reserves. China currently records trade and current account surpluses of around $250 billion in a year. On the other hand, India incurs a trade deficit of around $65 billion and a current account deficit of close to $10 billion. Its surplus foreign exchange is not earned, but reflects a liability. To take the most recent period for which data is available, India had recorded a current account deficit of $10.7 billion on its balance of payments during April-September 2007. Despite earning $15.4 billion from net exports of software and business services and receiving net remittances of $18.4 billion during those six months, India had an overall deficit in its current account because of a large negative merchandise trade balance. This deficit had to be financed with capital imports. But this is where the change in India’s external engagement is occurring. The $10.7 billion current account deficit recorded during April-September 2007, was not very much higher than the $10.3 billion deficit relating to the corresponding months of 2006. However, while during April-September 2006 India received capital flows amounting to just $18.9 billion to finance the deficit and leave a small capital surplus, it received a massive $51.1 billion during April-September 2007 resulting in the acceleration of reserve accumulation. |

|

| The implication is that excess capital flows account for all of the accretion of foreign exchange reserves (excluding valuation changes) in India. The composition of such accretion needs examining (Chart 2). Of the $51.1 billion net inflow of capital during April-September 2007, net inward foreign investment ($22.2 billion) and external commercial borrowing ($10.6 billion) account for an overwhelming share. What is more, within foreign investment, it is not direct investment but portfolio investment that dominates. According to the Reserve Bank of India’s Balance of Payments statistics, during the first six months of financial year 2007-08 (April-September), net direct investment by foreigners in India amounted to $9.86 billion. However, this was the period when Indian firms were increasing their investments abroad. As a result, net direct investment from India to foreign countries amounted to $5.97 billion. This, implies that the net inflow into the country on account of direct investment amounted to just $3.89 billion. The bulk of the inflow on the investment side was on account of portfolio flows. Net inflows of portfolio investments by foreigners amounted to $18.3 billion, whereas net outflows on account of Indian investments abroad were a meagre 35 million. In addition, aiming to benefit from the much lower interest rates abroad, the Indian corporate sector has increased its borrowing from abroad. Once we take account of the resulting large inflows of external debt being incurred by private players in India, much of India’s foreign exchange reserve accumulation is explained. Thus, the acceleration in the pace of reserve accumulation in India is not due to India’s prowess but to investor and lender confidence in the country. But the more that confidence results in capital flows in excess of India’s current account financing needs, the greater is the possibility that such confidence can erode. This could happen for two reasons. First, the build up of debt and short-term portfolio inflows that imply interest, dividend and capital outflow commitments, also implies that the volume of such commitments rises relative to India’s ability to earn foreign exchange from exports of goods and services and access foreign exchange through remittances from migrant workers. As the cost of debt and investment servicing rises relative to current foreign exchange earnings, concerns about India’s “real” ability to sustain this trajectory are bound to arise. Further, there are signs that India’s capacity to earn foreign exchange from exports may be diminishing because of the appreciation in the value of the rupee that capital inflows result in. During April-September 2006, merchandise exports (on a balance of payments basis) rose by 22.9 per cent relative to the corresponding months of the previous year and exports of software and business services by 38.3 per cent. On the other hand, the corresponding figures for April-September 2007 were 19.9 and 4.6 per cent respectively. In the case of services, this is a sharp slowdown indeed. If this continues, India may have to use capital inflows to meet commitments related to past inflows. A second reason why investor confidence may wane is that much of the inflows into India are in the form of portfolio flows. This implies that, unlike in the case of China, the contribution of foreign capital inflows to India’s export earnings is small. It also means that these flows are more easily repatriated and the probability of a quick exit is significant. Therefore, a rising capital liability of this kind could erode foreign investor confidence, and the reserves and investments that give India its current “strength” can shrink. The difficulty is that the misplaced domestic confidence that rising reserves create and the difficulties and costs associated with managing those reserves, is encouraging the government to favour profligate foreign exchange use by both firms and individuals. The obsession with acquisitions abroad, the full benefits of which for the country are yet to be assessed, is one element of this new attitude. The decision to allow resident individuals to transfer sums up to $200,000 a year for use in any form, is another. That is, capital import rather than export success is leading to a resurgence of foreign exchange profligacy in a form very different from that witnessed during the second half of the 1980s, when borrowed foreign exchange was used to finance non-essential imports. The 1980s episode led to the foreign exchange crisis of 1991. What this episode would deliver is yet to be seen. |