Portents for the global economy are gloomy at best.

And recent events have already shown that the Indian economy will be

also be affected by adverse developments in the rest of the world, whether

through the impact of mobile capital flows, or through exports being

dragged down by the recession in Europe and the economic uncertainty

in the US.

How resilient is the Indian economy at present, in the face of these

negative global forces? In terms of domestic demand, it is certainly

possible for the government to think of ways of rejuvenating the economy,

ideally through more broad-based employment-led growth. But externally,

the recent pattern of growth has been crucially related to India's greater

global integration, and therefore it has created patterns of dependence

on international markets and international capital. This makes the economy

significantly more vulnerable, especially because the growth has been

reliant on capital inflows to generate domestic credit-driven bubbles,

rather than trade surpluses.

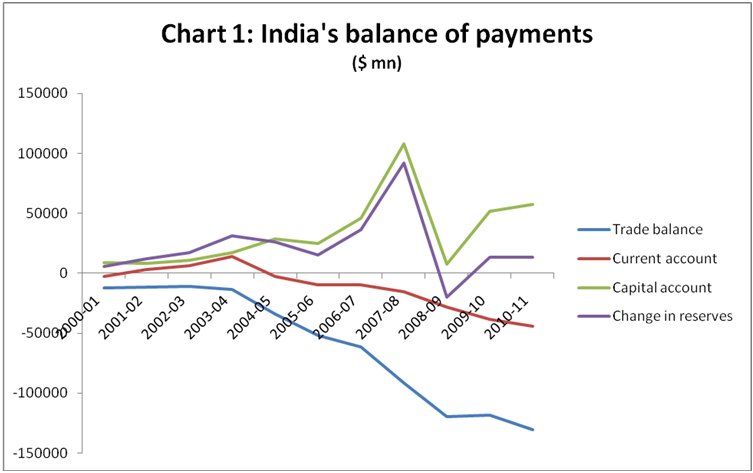

Chart 1 describes the main elements of India's balance of payments.

(All data in this and the following charts are from the Reserve Bank

of India's online statistical database, accessed on 6 January 2012.)

Several features of importance emerge from this chart. First, the trade

balance has been negative and progressively worsened over the course

of the decade. Second, in the early years of the decade, this impact

could be kept in check because remittance inflows and software exports

ensured that the current account was either in surplus or ran small

deficits. But in the second half of this period, even large remittance

inflows could not prevent a substantial deterioration of the current

account. Third, despite this, external reserves have kept growing, except

for the crisis year 2008-09. Fourth, this was entirely because of capital

inflows, which increased over the decade except in the crisis year,

and the capital account peaked in 2007-08 with more than $100 billion

net inflow.

What this suggests is that India's external reserves

were effectively borrowed rather than earned, as they were largely growing

because of capital inflows that were dominated by portfolio inflows

and external commercial borrowing. This is confirmed by Chart 2, which

shows that – especially in the second half of the decade – foreign investment

and external commercial borrowing were dominantly responsible for the

inflows on capital account.

In this context, another recent feature of foreign investment is worth

noting. In the past, it made a lot of sense to separate portfolio inflows

from direct foreign investment, on the grounds that the former are typically

more short-term in orientation and more likely to be volatile and therefore

exit the country in periods of downswing. However, the emergence of

private equity, especially after 2000, has changed this considerably,

since this is typically included in FDI. Private equity is also essentially

short term in orientation, since it seeks to make relatively rapid capital

gains on the acquisition of domestic assets. A significant proportion

of inward FDI into India in the recent past has been in the form of

private equity. As a result, a significant proportion of inward FDI

is also effectively short term, and cannot be assumed to be in for the

long haul, any more than explicitly portfolio inflows.

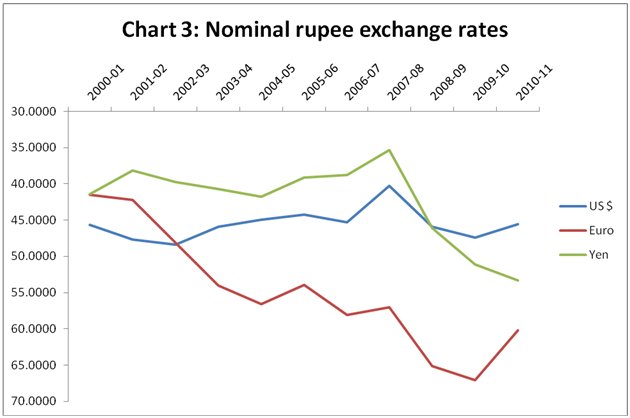

There is a widespread perception that the rupee has

depreciated significantly in recent times. Certainly, in nominal terms

vis-à-vis the major currencies, there is evidence of substantial

decline in value. Chart 3 shows the rupee relative to the US dollar,

Euro and Japanese Yen. Nominal depreciation has been particularly evident

over much of 2011, which has not been captured in this chart.

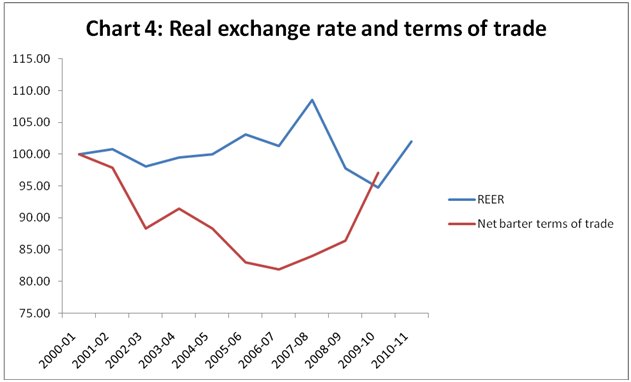

However, it should be noted that this was also a period in which inflation

in India was significantly higher than in many if not most of its trading

partners. As a result, the real effective exchange rate, shown in Chart

4, barely changed very much over the entire course of the decade. The

net barter terms of trade declined until 2007, especially because of

high world oil prices, but then improved, so that even in terms of this

variable there was not much change by the end of the decade.

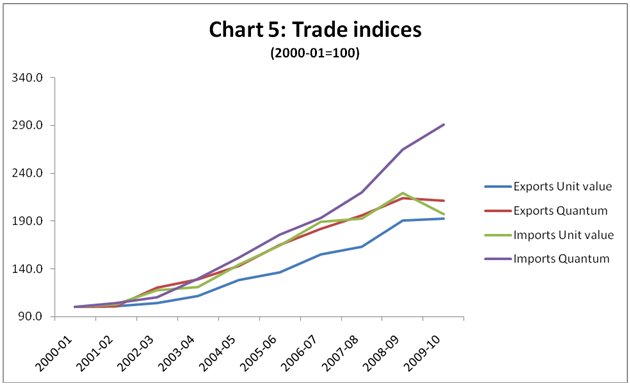

Chart 5 describes the indices of trade in terms of

quantum and unit value, separately for exports and imports. This is

an extremely significant chart, because it highlights that the quantum

index for imports moved up much more rapidly than all the other indices.

Further, it does not seem to have been at all affected by the global

crisis. So it would be unwise to blame high oil prices alone for the

high and growing total import bill – clearly import liberalisation has

resulted in a significantly increased propensity to import within the

economy.

This also has another implication: the domestic impact is greater than

would be evident from just the total value of imports, since significantly

greater quantities of imports are entering the country. This has direct

effects on import-competing activities, on employment and livelihood

particularly of small producers. The slow growth of non-agricultural

employment despite rapid aggregate GDP growth may be at least partly

related to the impact of substantially increased import volumes of a

wide range of manufactured commodities.

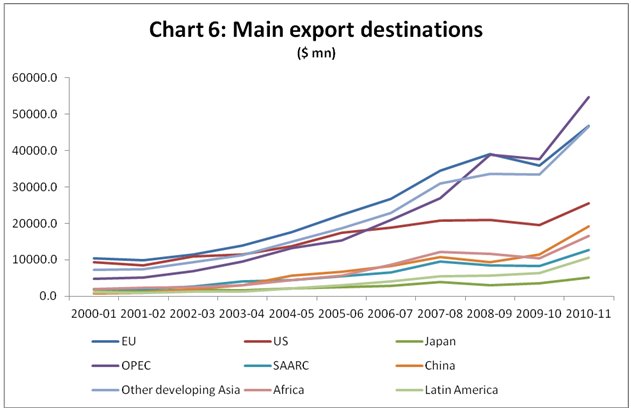

In terms of direction of trade, it is evident from

Chart 6 that the European Union remains an extremely important destination

for exports. This is bad news, given the likely recession in Europe

which is also bound to affect their imports. OPEC as a group recently

overtook the EU in becoming the grouping to receive the largest amount

of India's exports (in value terms) but it is worth noting that China

and other developing countries in Asia have become increasingly significant

as export markets for India.

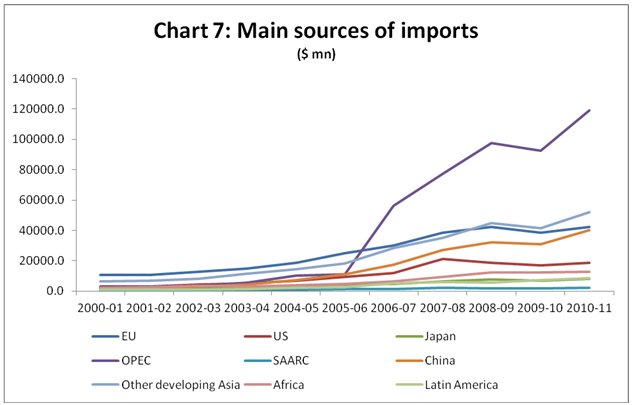

Chart 7 shows that in terms of imports, the global increases in oil

prices propelled OPEC countries dramatically to the top of the groupings

in terms of sources of imports in the second half of the decade. But

once again, it is important to note that China and other developing

Asia have become major sources of imports, exhibiting the fastest rate

of growth for non-oil imports.

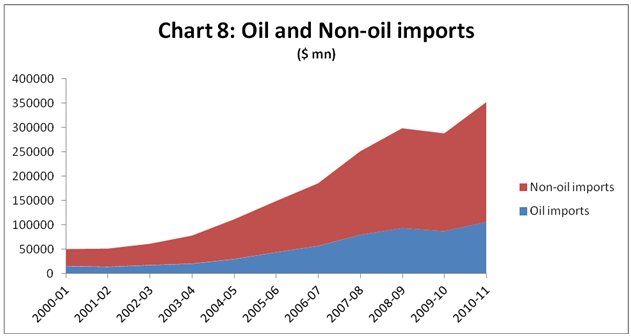

These non-oil imports have in fact been growing very sharply. Chart 8 makes it clear that the recent increases in the total import bill cannot be ascribed to oil prices alone, because non-oil imports have been growing much faster in value terms.

So recent trends in the external sector were already

cause for concern, even before the latest impact of the ongoing global

economic crisis can be felt. It is not just high energy dependence which

is a strategic problem for India. The rapid expansion of non-oil imports

suggests an economy that (despite two decades of liberalising ''reforms'')

is becoming less externally competitive and generating trade patterns

that are likely to continue to have adverse employment effects. Most

of all, a trajectory of growth based on capital inflows that generate

domestic finance-driven consumption, including significantly high imports

and worsening trade balances, is obviously not sustainable. We do not

need a global crisis to recognise these danger signals.