The nature of financial integration

of developing countries with their developed counterparts has been radically

transformed over the last four years. Evidence collated by the World Bank’s

annual report for 2007 on Global Development Finance, reveal a number

of features of the new scenario that have far-reaching implications.

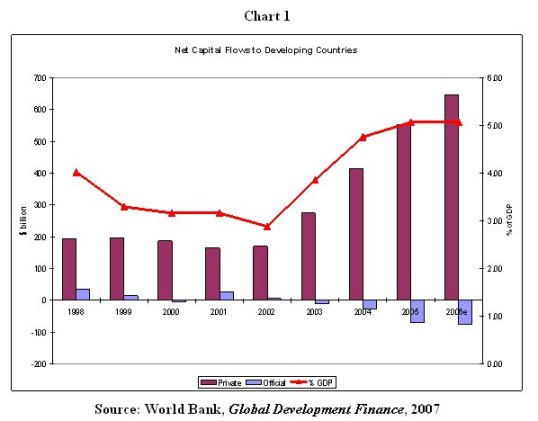

The first of these is an acceleration of financial flows to developing

countries (Chart 1) precisely during the years when as a group they have

been characterised by rising surpluses on their current account. Total

flows touched a record estimated 600 billion in 2006, having risen by

19 per cent on top of an average growth of 40 per cent during the three

previous years. Relative to the GDP of these countries, total flows, at

5.1 per cent, are at levels they touched at the time of the East Asian

financial crisis in 1997.

| |

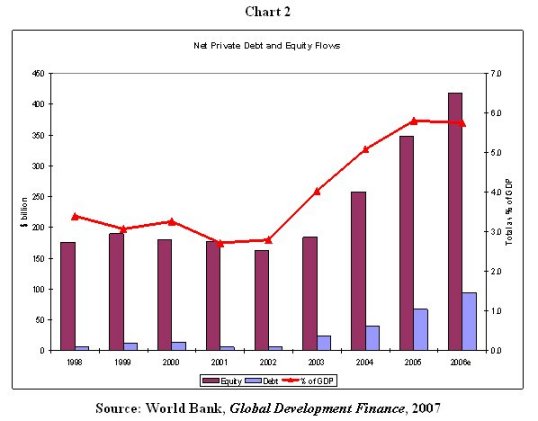

A second feature is the acceleration of the long term tendency for private flows to dominate over official (bilateral and multilateral) flows. Private debt and equity inflows, which had risen by 50 per cent a year over the three years ending 2005, increased a further 17 per cent in 2006 to touch a record $647 billion (Chart 2). On the other hand net official lending has in fact declined over the last two years. One factor accounting for this is the failure of the G-7 to match promises of a substantial hike in aid disbursements beyond what the retirement of the debt of few heavily indebted poor countries ensures. The other is that the more developed among the developing countries have chose to make advance repayments of debt owed to official creditors, especially the IMF and the World Bank. Overall, principal repayments to official creditors exceeded disbursements by $70 billion in 2005 and $75 billion in 2006. In the event there has been a reverse flow of capital to the World Bank and the IMF, which is threatening the viability and influence of these institutions, especially the latter. However, the increase in private flows has more than matched the reverse flows to official creditors.

| |

The third feature is that the dominance of private flows has meant that

both equity and debt flows to developing countries have risen rapidly,

with the surge being greater in the case of the former. Net private debt

and equity flows to developing countries have risen from a little less

that $170 billion in 2002 to close to $647 billion in 2006, an almost

four-fold increase over a four-year period. While net private equity flows,

that rose from $163 billion to $419 billion dominated the surge, net private

debt flows too increased rapidly. Bond issues rose from $10.4 billion

to $49.3 billion and borrowing from international banks from $2.3 billion

to a huge $112.2 billion. What is more, net short-term debt, outflows

of which tend to trigger financial crises, has risen from around half

a billion in 2002 to $72 billion in 2006.

The fourth feature, which is a corollary of these developments, is that

there is a high degree of concentration of flows to developing countries,

implying excess exposure in a few countries. Ten countries (out of 135)

accounted for 60 per cent of all borrowing during 2002-04, and that proportion

has risen subsequently to touch three-fourths in 2006. In the portfolio

equity market, flows to developing countries were directed at acquiring

a share in equity either through the secondary market or by buying into

initial public offers (IPOs). IPOs dominated in 2006, accounting for $53

billion of the $96 billion inflow. But here too there were signs of concentration.

Four of the 10 largest IPOs were by Chinese companies, accounting for

two-thirds of total IPO value. Another 3 of those 10 were by Russian companies,

accounting for an additional 22 per cent of IPO value.

A fifth feature is that despite this rapid rise in developing country

exposure, with that exposure being excessively concentrated in a few countries,

the market is still overtly optimistic. Ratings upgrades dominate downgrades

in the bond market. And bond market spreads are at unusual lows. This

optimism indicates that risk assessments are pro-cyclical, underestimating

risk when investments are booming, and overestimating risks when markets

turn downwards. But two consequences are the herding of investors in developing

country markets and their willingness to invest in a larger volume of

money in risky, unrated instruments.

Finally, the rapid rise in capital flows to developing countries at a

time when many of them are recording large current account surpluses has

substantially increased their foreign exchange reserves and triggered

a flow of capital out of developing countries. This outflow takes three

forms: (i) investment of reserves in safe and low-return instruments such

as US Treasury Bills; (ii) financing of asset acquisition to support the

growing presence of leading developing country firms in global commodity

markets; and (iii) financial investments in and lending to other developing

countries, resulting in the South-South flow of capital. These trends

together suggest that developing countries are still largely restricted

to the low return or high risk segments of global capital flow. This is

the cost they bear to meet the requirements of ensuring balance in the

global balance of payments.

These features of the current global financial scenario can be interpreted

in two ways. One is in the direction taken by the World Bank. It admits,

on the one hand, that "the probability of a turn in the credit cycle"

has risen and that a "key challenge facing developing countries is

to manage the transition by taking pre-emptive measures aimed at lessening

the risk of a sharp, unexpected reversal in capital flows". On the

other, it downplays the dangers involved by arguing that the surge in

capital flows "speaks well for the resiliency of developing economies

and for the ability of international financial markets to manage risks."

An alternative view would be that many emerging market economies that

attract a disproportionate share of these capital flows, are fast approaching

a situation where they are vulnerable to financial crises, with the current

scenario incorporating features that could make these crises more intense.

What is more, it appears that prudential norms, risk management techniques

and disclosure requirements put in place as part of the so-called "new

international financial architecture" seem inadequate to foreclose

a build up of this kind. This is not surprising, since garnering large

and quick profits rather than minimising risks seems to be the dominant

requirement of financial institutions from the developed countries.

The current situation is the inevitable result of expanding the space

for financial capital through dilution or elimination of regulation. Financial

liberalisation has ensured that since the late 1970s, the newly discovered

"emerging markets" among developing countries have been the

new frontier for profiteering by global financial institutions. Awash

with the liquidity derived from the surpluses earned by oil exporters

and the savings accumulated by the generation of baby-boomers in the West,

banks, investment funds and pension funds were looking to new avenues

for lucrative investments. The role of financial intermediaries was one

of dressing up developing countries that were hitherto "untouchables"

as lucrative destinations for financial capital. And financial innovation

consisted in not just identifying instruments that could carry such investments,

but derivatives that could help hedge against the risk associated with

rushing into uncharted territory.

The process began when developing countries were still reeling under the

effects of declining non-fuel commodity prices and rising oil prices,

which had left gaping holes in the current account of their balance of

payments. The new found interest of global finance offered developing

country governments an opportunity to finance that gap, even if it meant

offering high returns to foreign financial investors. It was this conflation

of interests of developing country governments and financial institutions

from the developed countries that led up to the debt crisis of the 1980s

and the financial crises of the 1990s, including those that began with

the East Asian crises in 1997.

One consequence of the 1997 crisis was a sharp decline in lending to developing

countries. But this did not mean a decline in capital flows. Rather, encouraged

by the post-crisis deflation in asset prices in emerging markets and the

sharp devaluation of their currencies, foreign direct investment kept

flowing into developing countries to acquire assets at rock bottom prices

when measured in hard currencies. While net debt flows to developing countries

declined from $53.1 billion in 1998 to just $1.2 billion in 2000, net

FDI flows remained more or less stable at around $170 billion a year.

Since 2002, when growth accelerated or remained high in China and India

and commodity prices rose sharply in the case of oil and metals and moderately

in the case of agriculture, this lull in capital flows has given way to

a surge. Besides the features noted above, three kinds of developments

have accompanied this surge. First, the growing importance of unregulated

hedge funds looking for abnormal returns in portfolio equity markets,

which renders activity in those markets highly speculative and opaque.

Second, the rapid increase in investments by "private equity"

firms – investing largely in unlisted equity - in corporations in developing

countries. The size of each of these investments is such that they are

identified as foreign "direct" investments, even though their

objective is speculative. The evidence on the controversial role played

by these firms in the developed countries indicates that their activity

too is extremely opaque. Third, the revival once again of the global market

for developing country debt, driven this time by private corporate borrowing

in the syndicated loan market. Since this new surge in credit rides on

a wave of securitisation that transfers the risk associated with such

lending to pension and mutual funds among others, accumulating risk does

not serve as a deterrent on banks creating such credit.

There are a number of implications of these tendencies. To start with,

the risk associated with the current surge in capital flows can be and

is much greater than was true during previous episodes involving a similar

surge. Moreover, the surge is accompanied by the growing acquisition of

assets in developing countries outside the stock market with objectives

that are largely speculative, so that a sell-off, if it occurs, would

be far more widespread. And the persistence of the herd instinct has meant

that the surge in fixed and portfolio investment flows has resulted in

a revival of credit flows that is unbridled since it is accompanied by

risk-mitigation techniques that transfer risk to those who are least equipped

to assess them. Unfortunately, all of this occurs in an environment in

which the target of both investment and debt flows is the private sector,

which makes it difficult for governments that have liberalised financial

regulation to control such flows. In sum, the risks associated with the

current surge in capital flows are far greater than emerges from the World

Bank’s rather sanguine assessment of the possible fall-out of the ongoing

transformation of global financial flows. A turn in the investment cycle,

with far-reaching implications, is real and imminent.