The ongoing attempts at legislating

financial reform in the U.S. Congress are of great interest to the rest

of the world. This is not only because everything the U.S. does is bound

to have ripple effects, but because the proposed regulations may have

an impact in controlling at least some of the rampant excesses and extreme

volatility that we have been experiencing in financial markets.

One of the most important aspects of the legislation that has been passed

by the U.S. Senate (which still has to be reconciled with the version

passed by the U.S. House of Representatives) has to do with derivatives

markets and their effects on commodity trading. It is now widely accepted

that increasing financial involvement in primary commodity markets (including

oil, minerals and agricultural products) played a significant role in

generating or amplifying price volatility in these markets.

While financial involvement in commodity markets has been growing since

the early 2000s, the impact of these players has been particularly evident

since early 2007, causing dramatic and rapid changes in world prices of

these goods in both futures and spot markets. There were huge increases

of most commodity prices between January 2007 and June 2008, followed

by collapses in price until early 2009, followed by significant increases

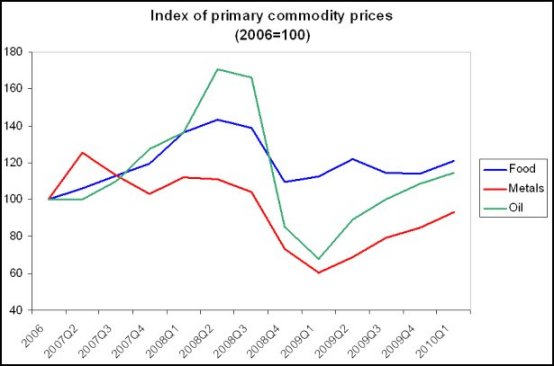

once again until early 2010. The chart indicates the extent to which the

spot prices of some of the important categories of primary commodities

fluctuated in the period since the start of 2007.

These price changes had hugely adverse effects in the developing world.

They sent out confusing, misleading and often completely wrong price signals

to farmers that caused over-sowing in some phases and under cultivation

in others. They created havoc among mineral exporters who were not sure

of the prices at which they should sign export contracts. Consumers were

especially badly affected: while the increase in global prices tended

to be transmitted (even if not fully) to consumers in developing countries,

when global prices fell there was no such immediate tendency. The continued

rise in food prices in many developing countries has impacted on the incidence

of poverty and hunger, and become a political issue of some importance.

So both the direct producers and consumers lost out because of this price

instability. The only gainers were the financial and marketing intermediaries,

typically large corporations, who were able to profit from rapidly changing

prices.

Global commodity prices have always been volatile to

some degree and prone to boom-bust cycles. In the 1950s and 1960s, commodity

boards and international commodity agreements were seen as one means of

stabilising global prices. Since their decline from the mid-1970s, and

especially as financial deregulation and innovation became more pronounced

from the early 1980s, the emergence of commodity futures markets was touted

as providing the advantages of such agreements in a more market-friendly

framework. There were several features of such futures markets that were

perceived to be of value: they allowed for better risk management through

hedging by different layers of producers, consumers and intermediaries;

they enabled open-market price discovery of commodities through buying

and selling on the exchanges; they were therefore perceived to lower transaction

costs.

Financial deregulation in the early part of the current decade gave a

major boost to the entry of new financial players into the commodity exchanges.

In the U.S., which has the greatest volume and turnover of both spot and

future commodity trading, the significant regulatory transformation occurred

in 2000. While commodity futures contracts existed before, they were traded

only on regulated exchanges under the control of the Commodity Futures

Trading Commission (CFTC), which required traders to disclose their holdings

of each commodity and stick to specified position limits, so as to prevent

market manipulation. Therefore they were dominated by commercial players

who were using it for the reasons mentioned above, rather than for mainly

speculative purposes.

In 2000, the Commodity Futures Modernization Act effectively deregulated

commodity trading in the United States, by exempting over-the-counter

(OTC) commodity trading (outside of regulated exchanges) from CFTC oversight.

Soon after this, several unregulated commodity exchanges opened. These

allowed any and all investors, including hedge funds, pension funds and

investment banks, to trade commodity futures contracts without any position

limits, disclosure requirements, or regulatory oversight. The value of

such unregulated trading zoomed to reach around $9 trillion at the end

of 2007, which was estimated to be more than twice the value of the commodity

contracts on the regulated exchanges. According to the Bank for International

Settlements, the value of outstanding amounts of OTC commodity-linked

derivatives for commodities other than gold and precious metals increased

from $5.85 trillion in June 2006 to $7.05 trillion in June 2007 to as

much as $12.39 trillion in June 2008.

Unlike producers and consumers who use such markets for hedging purposes,

financial firms and other speculators increasingly entered the market

in order to profit from short-term changes in price. They were aided by

the 'swap-dealer loophole' in the 2000 legislation, which allowed traders

to use swap agreements to take long-term positions in commodity indexes.

There was a consequent emergence of commodity index funds that were essentially

'index traders' who focus on returns from changes in the index of a commodity,

by periodically rolling over commodity futures contracts prior to their

maturity date and reinvesting the proceeds in new contracts. A study by

Christopher Gilbert ("Speculative influences on commodity futures

2006-08", UNCTAD Discussion Paper No. 197, Geneva) has found that

index traders amplified price volatility to the extent of 30 per cent

in oil and metals prices, and around 15 per cent in food grains prices.

Such commodity funds dealt only in forward positions with no physical

ownership of the commodities involved. This further aggravated the treatment

of these markets as vehicles for a diversified portfolio of commodities

(including not only food but also raw materials and energy) as an asset

class, rather than as mechanisms for managing the risk of actual producers

and consumers. The CFTC estimated that of the $161 billion of commodity

index business in the United States markets at the end of 30 June 2008,

approximately 24 per cent was held by index funds, 42 per cent by institutional

investors, 9 per cent by sovereign wealth funds and the remaining 25 per

cent by other traders. An official probe by the U.S. Senate found "substantial

and persuasive evidence" that non-commercial traders pushed up futures

prices, disrupted convergence between futures and cash prices and increased

costs for farmers, the grain industry and consumers.

Now, one important proposal in the financial reform legislation passed

by the U.S. Senate seeks to plug, at least partially, the loopholes that

allowed such frenzied activity in commodity futures markets. It requires

that previously unregu¬lated over-the-counter (OTC) trades be traded

on public exchanges. This would reverse the effect of the 2000 Act, and

enable the CFTC to analyse daily trade data and determine when traders

have exceeded the CFTC's commodity-specific position limits (which provide

a percentage ceiling for all commodity contracts open for trade during

a specific trading period). It has been estimated that around ninety per

cent of this market in the U.S. would move from over-the-counter swaps

trading to the more transparent and capitalized exchange trading environment

for futures contracts.

In addition, another important amendment brought by Senator Blanche Lincoln

of Arkansas would force the banks to spin off their highly profitable

derivative trading into entities that would be separate from their commercial

banking. Section 716 ("Prohibition against Federal Government Bailouts

of Swaps Entities") would sharply reduce the possibility of taxpayer-financed

bailouts for speculative activity that does not serve the real economy.

This would mean that purely commercial banks with guaranteed deposits

would have much lower dependence on the unregulated and risky over-the-counter

swaps market.

It would also, of course, reduce the profitability of the big banks that

have been able to hunt with the hounds and run with the hares through

such OTC transactions. As expected, this particular provision is under

sharp attack from the U.S. finance industry, with major banks such as

Morgan Stanley and Goldman Sachs lobbying fiercely to remove it. Both

the Chairperson of the Federal Deposit Insurance Corporation Sheila Bair,

and the head of the Federal Reserve Ben Bernanke, have spoken out against

it, saying it could destabilise the financial system. The danger is that

during the "reconciliation" process of the Senate and House

bills, which is typically conducted within closed doors, the financial

lobbyists will win and the motion may get killed.

That is only one of the dangers. Another is that providing muscle to regulators

need not ensure that the regulators do their job appropriately. So, even

if the CFTC acquires the ability to control and regulate trading activity

in commodity futures, its actions may not be that effective. For example,

in late January this year the CFTC announced that it would place position

limits on oil, natural gas, heating oil and gasoline futures. However,

the limits announced were so high that, even by the CFTC's own calculations,

they were unlikely to affect much of the trade.

There have also been arguments that such activity will simply move to

other players, such as hedge funds, which are expected to be major beneficiaries

of the move. Or that OTC contracts in commodity futures will increasingly

take place in other financial centres, in London, Tokyo or even Singapore.

But such arguments underestimate the tremendous influence of the U.S.

in shaping financial systems globally. Thus far, it could be argued that

this influence has essentially been a negative force, but if even these

relatively limited new regulations actually come into play, they could

force some positive changes elsewhere as well.

So, just as the deregulation of U.S. mar¬kets contributed to excessive

speculation and global price volatility, the regulatory reform measures

- if they are properly defined and implemented in the right spirit - could

operate to prevent future episodes of the very extreme volatility that

is so damaging to developing countries.

Of course, this does not in any way mean that the world food crisis is

over, or that commodity prices will not continue to behave in a volatile

fashion without other measures adopted by governments. But it may mean

that developing countries will get some breathing space from excessive

price volatility that should help them to get the policies in place to

tackle the real problems in the food economy and elsewhere.