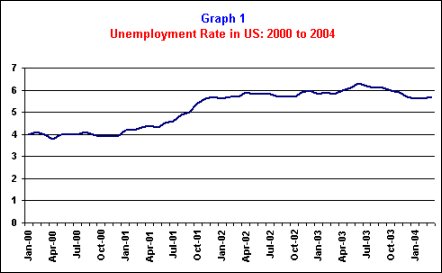

The present recession in the US economy has been notably different from previous episodes of economic slump in atleast two ways. Firstly, the growth in employment which started falling since early 2001 continued to fall even during the first quarter of January, 2004. In the year 2001 alone, there were1.5 million net jobs lost according to official estimates on payroll employment. The following year added less than 0.4 million jobs. Employment growth during 2003 has been inadequate to make up for the massive job-losses of the previous two years. The situation in the opening months of 2004 has see-sawed so far (see Table 1). The slowest to respond has been the manufacturing sector, which actually triggered the recession when the boom in the IT sector burst at the end of the 1990s. In all the 21 industries that constitute manufacturing sector, employment declined, and 17 of the 21 saw losses exceeding 10%. Congressional budget office estimates the manufacturing sector net jobloss to be 3 million between July 2000 and January 2004 [1]. This has brought down the employment in manufacturing down to 14.3 million, lowest since July 1950. Unemployment rates that had dipped below 4% during the late 1990s shot up to above 6% (see Graph 1). Analysts say that even this high rate might be a conservative estimate since there are scores of people who faced with long periods of unemployment have stopped reporting themselves as part of the labour force [2]. Thus the employment situation is adverse not only because of the severe intensity of the jobloss but also due to the extended period during which the employment situation has worsened. The present cycle is one of the longest lasting declines in employment since 1933.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

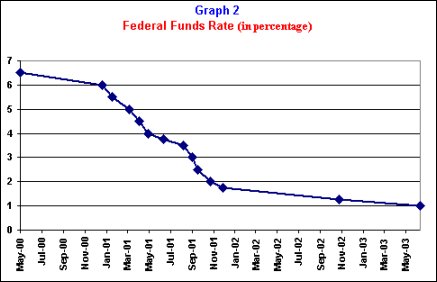

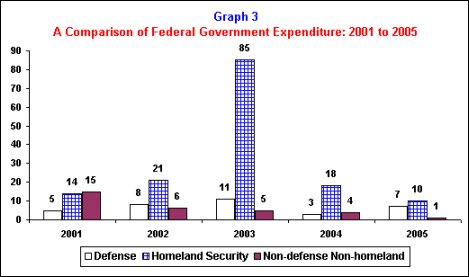

The second tendency, which makes the present US recession distinct from earlier periods of recession, is the enormous fiscal and monetary stimulus being provided by the Federal government. Direct demand injection in the form of substantial increases in defense and defense-related expenditure, orchestrated through the war against terrorism, has supplemented traditional supply side measures. The latter include substantial reduction in interest rates (see Graph 2) and major tax cuts. Probably for the first time ever, massive increases in war expenditure by the US government were accompanied by heavy tax relief [3].

|

|

|

|

The following paragraphs explore the unemployment issue in some detail. Why despite a turnaround in output growth evident since 2002/3, did the employment growth continue to drag behind? [4] Our method would be to analyse the patterns of expenditure in the two major sectors – government and private business and relate it to the puzzle of slow employment growth.

|

|

|

|

Government

Spending

Military-fuelled growth, or military Keynesianism,

was first theorised by Kalecki in 1943. Kalecki argued

that capitalists and their political champions tended

to bridle against classic Keynesianism; achieving full

employment through public spending made them nervous

because it risked over-empowering the working class

and the unions. The military was a much more desirable

investment from their point of view, although

justifying such a diversion of public funds required a

certain degree of political repression, best achieved

through appeals to patriotism and fear-mongering about

an enemy threat - and, inexorably, an actual war

[5].

The neo-liberal right wing in the US has adopted the

strategy of military Keynesianism with much

enthusiasm. Between 2002 and 2004, total budgetary

outlay grew at an annual rate of 7-8%, up from an

average of 3.46% during 1991-9. National defense

expenditure which had been declining in absolute terms

every year since the end of Cold War, registered an

annual growth of 12-17% between 2002 and 2004.

Including the costs of two major military operations

in Afghanistan and Iraq, the US defense budget

increased from $300 billion in the year 2000 to $460

billion in 2004, i.e., by 52.9%.

Department of homeland security is another area

where resources have flown generously. On March 1,

2003, approximately 1.8 lakh personnel from 22

different organizations around the government became

part of the Department of Homeland Security, whose

mission was to make America more secure. 17 of the 19

budget functions contain at least some funding for

homeland security activities. The President’s budget

for 2005, includes $47.4 billion as resources for

homeland security activities, a 15% increase over 2004

level and a 130% increase over 2002. If we compare

these figures with other budgetary allocations, say

the estimated outlays on Education, Training,

Employment, & Social Services (Function 500) or

Community and regional development (Function 450),

over 2004 and 2005, outlay on Function 500 is

estimated to increase by $1.8 billion (2%) to reach a

level of $89 billion, whereas outlay on Function 450

would actually fall in absolute terms by $1.7 billion

to reach a level of $17 billion. Obviously, the

disproportionately large spending on defense and

related activities to combat the supposed threat of

terrorism is being made up through cuts in spending on

social sector, infrastructure, development and other

heads. (see Graph 3)

|

|

|

|

What as been

the underlying pattern of employment generation of

this nature of public spending?

The rising level of sophistication of defense

equipment and overall defense systems has meant rising

capital intensity of production and consequently

falling job-creation capacity of defense spending. A

report in the Washington post in 1986 wrote that 1 out

of every 20 jobs in the US were directly or indirectly

related to military spending [6].

More recent estimates say that this percentage has

dropped to 3.2% [7].

Military expenditure, which has always been extremely

capital intensive has become even more so. Reports

widely speak of absence of new recruits of military

personnel even during the war on Afghanistan and Iraq.

In the absence of direct recruitment of military

personnel by the Pentagon, the route by which defense

expenditure can generate employment is through defense

contractors. The heavy government outlays on security,

military operations, and other types of defense

expenditure have financed multi-billion dollar

contracts to politically-connected giant corporations.

The largest of these contracts would be more than $20

billion, and the average one would be atleast a few

billions. In fact, each of these contracts has the

capacity to regenerate the economy of an entire

region. For instance, the $4 billion contract awarded

to the California company Northrop Grumman to work on

the Star Wars missile defense program, has a

possibility to regenerate several of the computer

firms, as much of the modern security paraphernalia

depends on Silicon Valley computer technology.

To what extent the contracts translate into real

production and employment boosters would of course

depend on the extent of excess capacity and inventory

holdings of these firms. Most of the orders for

supplies of tanks, ordnance, missiles, shipbuilding,

aircraft, engines, computer technology would be

enforced over a longish period of time and therefore

involve considerable production lags. Research on

defense systems, including homeland security, a major

contributor to the increments in defense budget

similarly has a long gestation period. In the

short-run, there is less chance of many of these

spending heads stimulating production and employment

significantly.

War profiteering has raised the profit margins of

defense contractors enormously [8].

Yet the transmission from very high profits to higher

employment is not at all obvious. A case in point is

General Dynamics, one of the top 5 military

contractors. Between 1991 and 1993, stock price of the

company rose 553%, but General Dynamics downsized its

workforce in the early 1990s by 80% from 1,02,000 to

21,000

[9].

Overseas defense spending on war and occupation of

Afghanistan automatically represents leakage from US

public spending and would therefore lower the

multiplier effect of public spending. For instance,

the present state of affairs in Iraq has forced the

giant corporations engaged in reconstruction work to

employ security persons to the tune of 200,000 for its

staff, which would mean an additional cost of $1

billion! However, there are two factors that have

prevented the overseas factor from becoming too strong

a force in pulling down domestic employment. One, the

actual war or the reconstruction budget was only a

relatively small part of the overall rise in defense

spending. Second, barring physical constraints that

would encourage the US firms in Iraq and Afghanistan

to spend locally, US contractors have been found to

place a lot of the reconstruction orders with their

offices in the US. Bechtel, the engineering giant was

awarded a $680 million contract to evaluate and repair

Iraq's power, water and sewage systems. The work has

mainly been assigned to its offices in the US.

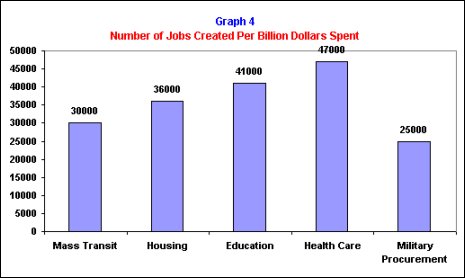

Finally, in comparison to military expenditure the

job creation capacity of various other sectors that

are part of federal government’s budgetary functions

is much higher (see Graph 4). Thus as far as jobs are

concerned, military spending is a much worse

investment than other federally funded programme. The

new orientation of the US budget with cuts for

non-homeland non-defense functions, would have caused

some erosion of employment growth.

|

|

|

|

Private

Business Spending

The private business sector is in the peculiar

position of being responsible for the massive

job-loss, and yet structural constraints have

prevented generation of any fresh stimulus from within

the industrial sector, especially manufacturing. Table

2 compares the contribution to real GDP growth by

various national income categories for the three years

2001 to 2003. It can be clearly observed that for two

consecutive years, 2001 and 2002, contribution to real

GDP growth of gross non-residential private domestic

investment was negative. But for the steady expansion

of personal consumption spending and public spending,

the repercussions for real output growth would have

been much more severe during the recession years.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

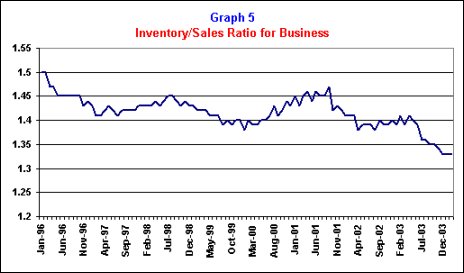

Private business spending has been slow to respond to monetary stimulus by the Fed. Since May 2000, the Federal funds rate was eased 13 times and by some 550 basis points (refer to Graph 2). The reason why the comfortable liquidity position failed to revive investment in capacity has to do with the level of capacity utilization of US industries. Average capacity utilization rate during 1993-2000 was 82.4% for all industries, which fell steadily since May/June 2000 to reach a trough of 74.4% by Dec.2001 and has remained between 74-76 % eversince. Even after the demand for industrial goods started picking up, firm managers have preferred to run-down inventory stocks rather than increasing capacity utilization. This is reflected in the declining inventory/sales ratio which has continued to fall in the first quarter of 2004 to reach the lowest level in the past 8 years (see Graph 5). In such a scenario, employment growth in industry would automatically be sluggish.

|

|

|

|

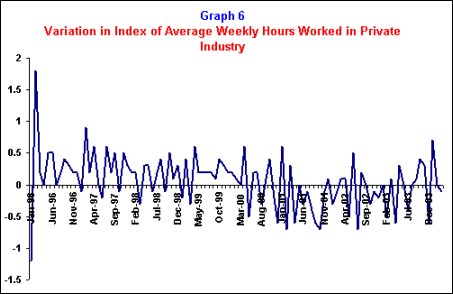

To avoid hiring workers, US firm managers have also encouraged existing workers to work extra hours. Just like the slack in capacity, there appears to be a slack in labour use. The average working hours of workers in private industry that had dropped during the course of the recession is now beginning to climb up (see the slightly upward trend in Graph 6 in the recent months). Adjustment by employers of laying-off the less productive workers during the downturn, has supposedly, resulted in increased productivity such that the same output now requires less labour hours [10].

|

|

|

|

|

|

During the 1990s the

development of the manufacturing sector in the

United States was led particularly by the growth in

computers and electronic products. In 1990, the

computer and electronic products industry accounted

for 5 percent of real total manufacturing output. By

2001, its real share had grown to 28 percent – a

more than fivefold increase. To a great extent, the

tremendous growth in the computer and electronic

products industry through 2001 masked declines in

other manufacturing industries. With growth,

however, came greater vulnerability to changes in

the fortunes of this particular industry. When the

bubble burst in the demand for semiconductors,

computers and telecommunications equipment in late

2000 and early 2001, workers throughout the United

States were laid off, generating ripple effects that

extended throughout manufacturing and the broader

economy. Approximately 19 percent of the 2.4 million

jobs lost in manufacturing sector since March 2001

were shed in the computer and electronic products

industry [11]. Another

11 percent of these 2.4 million jobs were lost in

the machinery industry – a sector which includes

semiconductor processing equipment. Hence, while

manufacturing employment was buoyed by increased

demand for high-technology products in the nineties,

it now suffers the flipside of this relationship—

the downturn in the global demand for computers and

electronic products has contributed in large part to

the overall slow pace of recovery.

Another structural shift in US manufacturing

industries has been the rising competition from

cheap imports especially from China. Imports as a

share of total demand for manufactured goods in the

U.S. has increased steadily over the past few

decades, and this trend continues. Between 1997 and

2003 this share increased from 17 percent to 26

percent [12]. China has

been competing in industries such as textiles,

stuffed toys, metal-furnitures etc, industries that

are labour-intensive. Though analysts assure that

U.S. manufactures are concentrated in capital goods

industry, and trade-related lay-offs have been

negligible during this recession

[13], the strong Chinese presence in the

labour-intensive sectors does add to the downslide

of manufacturing employment.

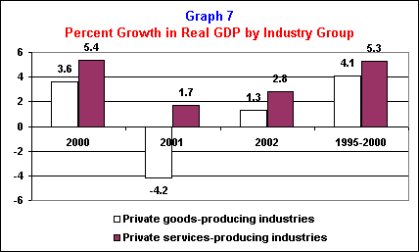

Manufacturing sector jobs in USA account for only

12% of employed workforce. An overwhelming

proportion of the jobs are now in the service

sector: service jobs account for more than 80% of

the total employment and 78% of GDP. The services

witnessed low but non-negative growth in real GDP

during the first two years of recession.(see Graph

7) Net jobs lost in the private service sector

between 2001 and 2003 was 0.3 million (based on BLS

data), which is 1/8th of the job-loss in the

manufacturing sector over a similar period. Recent

reports speak of a continuing streak of robust

growth of the service sector over the past 13

month-period[14].

|

|

|

|

Just as manufacturing jobs

have been threatened by import competition from

China, an imminent threat to service-sector jobs in

the US arises from business process outsourcing to

countries such as India. The present recession has

been an opportune moment for many large service

industries to move their operations offshore in

search of cheap labour resources. In a static sense

this has implied fewer jobs for US citizens. But the

corporates assure that the long-run effects of lower

labour costs and therefore higher profit margin

would show up in higher profitability and lower

average prices for the Americans. Forrester

Research, a consultancy, guesses that 3.3m American

service-industry jobs will have gone overseas by

2015.

Obviously there is clash of interest here: the US

multinational lobby is pushing aggressively for more

overseas-based operations so that labour costs are

minimized, while the domestic worker unions are

fighting to retain these jobs within USA in an

already job-scarce economy. The developing country

governments like India look upon the outsourced jobs

as reciprocal gains for opening their economies to

both free trade and investment flows from developed

countries. The recent legislations against

outsourcing imposed by several state governments in

the US have invited sharp criticism. Raising

protectionist barriers would reduce the employment

opportunities for workers in the developing

countries.

It must be mentioned here that social safety net, an

essential buffer against economic cycles has been

steadily withering away in the US. This has

considerably added to the woes of the workers and

their families. Unemployment insurance which is the

only state programme worth its name has benefited

less than 40% of the jobless workers during 2000/1

[15]. Many states have raised the minimum

qualification for unemployment insurance to

ridiculously high levels. The root of the problem,

the state governments complain, lies in the

inadequate financial resources that have kept the

present unemployment benefits way below the 1991

level, not to speak of the levels during the

recessions of mid 1970s or the early 1980s.

US government largesse on military is not only

devastating poor developing nations, but also

destroying the lives of ordinary Americans.