The story of the expansion of China's

exports is a remarkable one by any standards. In 1978, China's exports

were valued at around $20 billion, and its rank among world exporters

was 32nd. Since then, exports have grown at an average annual rate of

30 per cent, such that in 2004 China overtook Japan to become the world's

third largest exporter, with exports of nearly $600 billion.

In 2005, export growth has continued unabated, with even more breathtaking

increases recorded in the first quarter of this year. Exports grew by

more than 35 per cent compared to the same period last year, while import

growth slowed down to 15 per cent. As a result, the Chinese economy posted

a trade surplus of $16.6 billion, compared to an overall trade deficit

of $8.4 billion in the first quarter of 2004.

This extraordinary growth has already given rise to backlash, especially

in the United States, where protectionist pressures and anti-Chinese sentiments

are on the rise. There have been calls for China to revalue upwards its

currency the yuan (or RenMinBi), which is currently pegged at 8.28 per

US dollar, not only from the US administration, but from the OECD, the

G-7, and the IMF.

What is the story behind this apparently unstoppable export growth? Many

observers have attributed this to the benefits of international economic

integration, which is why the Chinese economy is typically cited as the

great success story of globalisation. There is no doubt that such integration

has played an important role, but the point to remember when analysing

the Chinese experience is that this integration has not been purely market-led,

but has been closely monitored, regulated and indeed controlled by the

state.

This is clearly evident from a look at the external trade policy regimes

in China, which have gone through several major phases. For two decades

after Government Administration Council adopted the Interim Regulations

on Foreign Trade Management in 1950, China's trade was based on complete

state monopoly and dominated by trade with the former Soviet Union and

other Eastern European countries. From 1979, along with various internal

reforms especially related to the peasant contract system in agriculture,

there was some opening up of trade.

From 1979 to 1987, there was a process of delegating authority with respect

to foreign trade to lower levels and decentralising the highly concentrated

planning management system. National purchase and allocation plans were

replaced instructive plans with market regulation and implementing import

and export licenses and a quota system. The pattern of trade was also

diversified to include compensation trade, processing with supplied materials,

trade on commission basis, border trade, local trade, small-deal trade,

processing and assembling with imported materials, processing for export,

chartering and leasing trade.

Between 1988 and 1990, foreign trade subsidies were frozen and a contract

responsibility system in foreign trade was implemented. From 1991 to 1993,

the foreign exchange mechanism was readjusted and a double-track exchange

rate was adopted. Foreign trade enterprises (still dominantly State Owned

Enterprises) were allowed to retain part of their foreign exchange earnings,

but all financial subsidies to them were stopped and they were made to

take on the responsibility for their own profits and losses.

In 1994, the unification of the dual rates in foreign exchange and adopting

a unified floating exchange rate for Renminbi on the basis of market need

and supply effectively meant a substantial devaluation of the RenMinBi.

At the same time, the practice of allowing foreign trade enterprises to

retain part of their foreign exchange earnings was abolished. The tax

refund system for exports was implemented, and the range of import and

export quotas and licenses was substantially cut.

On July 1, 1994, the "Foreign Trade Law" was officially put

into effect, which stated that China practices a unified foreign trade

system and, while giving appropriate protection to domestic enterprises,

adopts such internationally conventional anti-dumping, anti-subsidy and

guarantee practices. Controls were lifted over more than 90 per cent of

export commodities, where market prices were to be dominant, and a bidding

system was introduced for some important export commodities.

The WTO Accession Agreement of 2002 marked a new phase of intensified

liberalisation of trade, with China making sweeping commitments to reduce

quota controls, tariffs and so on especially with respect to agricultural

products. Nevertheless, despite the apparent drastic trade reforms, the

Chinese government retains substantial control over trade through two

important levers.

First, nearly half of all exports are still accounted for by State Owned

Enterprises, although the share of foreign owned enterprises has been

increasing recently. Second, control over the banking system and the ability

to direct and regulate the allocation of credit has been the most important

instrument both of macroeconomic control and of direction of investment

and production, which has had direct effects on both exports and imports.

The recent deceleration in import growth, for example, is a clear result

of the controls on credit implemented by the Chinese authorities on fears

of overheating in the economy.

These various phases have also been associated with different degrees

of integration into the world economy, based on indicators like trade

dependence in GDP. The share of total trade (imports and exports) in GDP

rose in a stable fashion from 9 per cent in 1978 to 25 per cent in 1989.

In the 1990s, influenced by the dual impact of the RMB's devaluation and

the accelerated growth of GDP value counted in terms of RMB, China's foreign

trade dependence ratio experienced great fluctuations. From 2000, the

rise in trade shares of GDP has been very rapid, going up from 43.8 per

cent in 2000 to 60 per cent in 2003 to 70 per cent in 2004.

Despite the past experience of major exporters of the 20th century like

Japan and South Korea, this experience is historically unique in its rapidity

and extent, since no other country has been through such a massive increase

in trade shares in such a short time. This can be attributed to a number

of special features of China's current trade, which is particularly based

on the globally integrated production which is a relatively new feature

of the world economy.

The proportion of processing trade is rather high in the makeup of China's

foreign trade, which accounts for high imports being associated with high

exports. Further, the Chinese expansion is still dominantly driven by

manufacturing, and the tertiary sector still accounts for only one-third

of GDP.

It is also true that China's GDP has probably to some extent been devalued

because of statistics reasons. The overall GDP value of the country is

lower than the summation of the production values of all regions, which

suggests that the aggregate GDP data could be underestimates. The sums

of the regional GDP values were 8.7, 9.7, 11.7 and 15.6 per cent higher

respectively than the overall GDP values in the years from 2000 to 2003.

This would make the trade share of GDP appear to be higher than it actually

is.

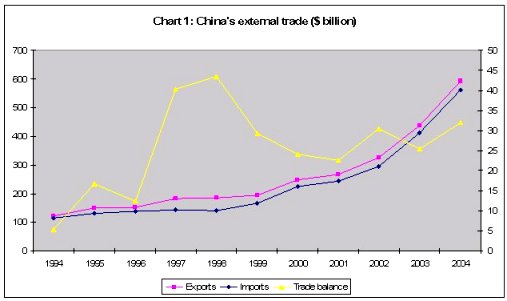

This is the context in which the recent trends in China's trade have to

be viewed. Chart 1 shows the pattern of overall trade since 1994. It is

evident that both exports and imports have been rising rapidly, but the

trade surplus (on the right axis) has been relatively moderate and indeed

has declined from its peak of 1997. The perception of overvaluation of

the yuan is not justified from the point of the of the overall trade balance,

which is currently showing a surplus of only around $32 billion, or only

2.3 per cent of GDP, which is hardly large by international standards.

|

What is of greater interest is the pattern of recent trade. The conventional

view is that it has been driven by export of textiles and clothing, after

the withdrawal of MFA quotas and the entry of China in the WTO. But Table

1, which indicates the top ten categories of export, suggests that apparel

or garments has been only one of the factors behind the big export push.

Toys, which was the other great export success of the 1990s, is also relatively

less important in recent exports, which have been dominantly driven by

capital goods.

Table 1: Top ten exports of China

Commodity Description |

2003 ($ mn) |

2004 ($ mn) |

Per cent change |

Electrical machinery & equipment |

88,977.6 |

129,663.7 |

45.8 |

Power generation equipment |

83,468.9 |

118,149.3 |

41.7 |

Apparel |

45,759.2 |

54,783.6 |

19.7 |

Iron & steel |

12,864.8 |

25,216.4 |

96.0 |

Furniture & bedding |

12,895.5 |

17,318.6 |

29.1 |

Optics & medical equipment |

10,564.3 |

16,221.0 |

53.6 |

Footwear & parts thereof |

12,955.0 |

15,203.2 |

17.4 |

Toys & games |

13,279.9 |

15,089.2 |

13.6 |

Mineral fuel & oil |

11,110.2 |

14,475.7 |

30.2 |

Inorganic & organic chemicals |

10,734.8 |

13,937.6 |

29.8 |

This indicates some shifts in trade pattern. Toys, clothing, furniture

and television sets have dominated Chinese exports for years, but now

newer products like portable electric lamps and even radio navigation

equipment are now being shipped in growing quantities to countries ranging

from Britain and Spain to Brazil and Indonesia. At the same time, China

is becoming a large exporter of industrial commodities like steel and

chemicals, importing fewer cars and less heavy machinery as Chinese companies

and multinationals manufacture more of these in China.

These changes are reflected in imports, which are again dominated by capital

goods rather than raw materials. Even though China became the most significant

marginal consumer in the world oil market in 2004, oil imports are only

the third largest element in the total import bill, as Table 2 indicates.

Table 2: Top ten imports into China

Commodity Description |

2003 |

2004 |

Percentage Change |

Electrical machinery & equipment |

103,925.9 |

142,073.6 |

36.7 |

Power generation equipment |

71,500.2 |

91,631.6 |

28.2 |

Mineral fuel & oil |

29,272.5 |

48,036.6 |

64.2 |

Optical & medical equipment |

25,137.5 |

40,154.9 |

59.8 |

Iron & steel |

25,596.9 |

40,154.9 |

10.9 |

Plastics & articles thereof |

21,032.6 |

28,060.1 |

33.4 |

Inorganic & organic chemicals |

18,736.9 |

27,809.0 |

48.4 |

Ore, slag, & ash |

7,171.9 |

17,292.7 |

141.0 |

Vehicle & parts other than rail |

11,814.8 |

13,102.7 |

11.2 |

Copper & articles thereof |

7,165.4 |

10,484.3 |

46.3 |

The changes in the steel industry are perhaps the most illustrative of

what is going on. China has become the world's largest steel consumer,

because of its massive construction boom and investment in road infrastructure.

But Chinese steel production has risen even faster, as practically every

province has erected steel mills. So many of these mills produce steel

reinforcing bars, known in the industry as rebars and used in concrete

construction, that China has gone from a shortage of rebars to a glut,

and Chinese rebars are now being exported all over the world.

China became the largest foreign supplier last year of steel tubing and

casing for oil wells in the United States, another technologically simple

steel product that Chinese mills have mastered. Over all, China remains

a net importer of steel, but by a shrinking margin. In 2004, steel imports

fell 11.3 per cent, to $3.82 billion, while exports rose 389 per cent,

to $2.62 billion.

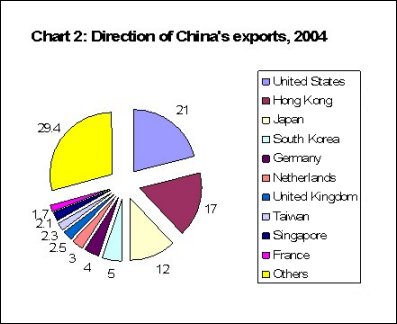

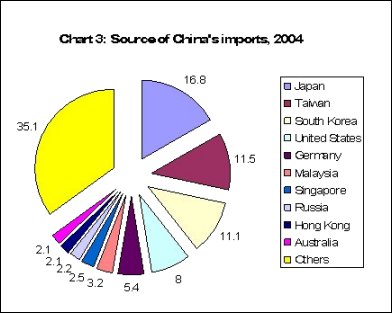

These changes are also mirrored in the direction of trade, which has shown

less dependence upon the United States in very recent times, and more

concentration of Asia. This is reflected in Charts 3 and 4, showing the

destination of exports and the source of imports respectively in 2004.

|

|

This is part of a conscious policy of the Chinese government, to diversify

trade patterns and increase interaction not only within Asia (as exemplified

by the China-ASEAN deal of late last year) but also attempts to reach

out to Latin American and African countries.

All this indicates the hard-headed and practical nature of the Chinese

economic leadership, which has so far resisted the increasingly oppressive

calls for currency revaluation and tried alternative methods like an export

tax, which it has already imposed on garments exports. Clearly, the Chinese

trade strategy is one which involves far greater and more consistent state

intervention than almost any other country, and its current expansion

must be seen in that light.