An unusual and striking

feature of the current global balance of payments situation is the huge

deficit on the current account of the world’s dominant country, the United

States, which is partly being financed with surpluses in the current and

capital account of developing countries, especially those in developing

Asia. At the end of the second quarter of 2004, the annual current account

deficit in the US balance of payments stood at $572 billion and was forecast

to touch 5.5 per cent of GDP in 2004. At around the same time, 9 developing

economies in Asia and Latin America (Brazil, China, Hong Kong, India,

Indonesia, Malaysia, Singapore, South Korea, Taiwan province of China,

and Venezuela) were recording an annual surplus of around $190 billion

on their current account.

To boot, many of these developing countries were recipients of large capital

inflows—in the form of foreign direct investment, portfolio capital and

debt—resulting in surpluses on the capital account. Together these current

and capital account surpluses were adding to their reserves, which in

turn were being invested in dollar denominated financial assets, thereby

financing in part the US deficit.

Weekly data from the Federal Reserve relating to November 3, 2004 showed

the Fed's holdings of assets for official institutions – which is a proxy

for foreign central bank holdings - rose over the previous year by $253.6

billion to $1,053 billion. This compares with a rise of $217 billion during

the whole of 2003. Needless to say, not all of these investments are from

developing countries, since Japan is a major investor. The Japanese government

spent a record $180 billion in 2003 on intervention in foreign exchange

markets and much of that money found its way into the US Treasury market.

During that period, Japan's foreign exchange reserves rose by $203.8 billion

to $673.5 billion. In the first two months of this year, those reserves

rose a further 15 per cent to $776.9 billion. While developing countries

may not be playing a similar role, their contribution is still important.

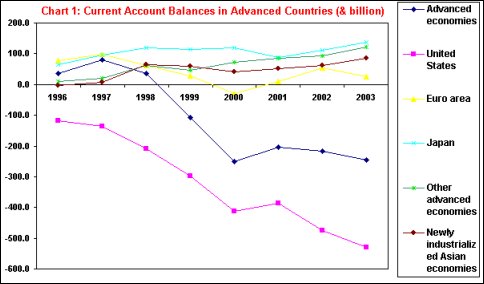

As Chart 1 shows, the current account deficit in the US has widened continuously

since the mid-1990s, resulting in an overall deficit for all advanced

economies, despite the fact that every one of them has shown surpluses

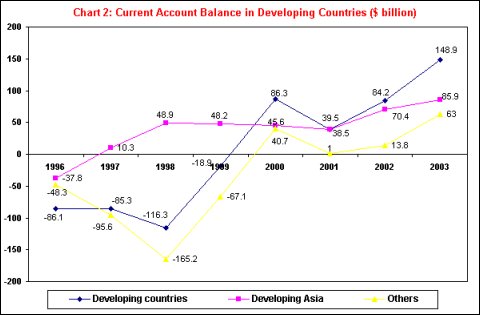

in almost all those years. On the other hand, during this period developing

countries as a group have seen a transformation of their current account

deficits into surpluses (Chart 2). While this was true initially of a

set of countries in Asia, they have since been joined by countries in

West Asia, the Commonwealth of Independent States (included by the IMF

in the developing countries and emerging markets group) and Latin America,

though not Africa and Central and Eastern Europe. However, developing

and emerging market countries outside Developing Asia have also been recording

a surplus as a group.

| |

| |

This implies that three decades of globalisation have fundamentally

transformed the international balance of payments situation. Prior to

the oil shocks, which were important triggers for the major changes in

the quantum and nature of international capital flows, the international

payments scenario reflected differences in the global economic strength

of individual nations. The scenario was one where the developed countries

recorded large surpluses, the oil-exporting developing countries much

smaller surpluses and the oil-importing developing countries were burdened

with significant deficits. The process of restoring global balance involved

adjusting growth in the oil-importing developing countries so as to tailor

their deficits to correspond to the extent to which surpluses from the

developed countries could be recycled to finance those deficits. Though

for a short period after the oil shocks of the 1970s this situation changed

with surpluses in developed countries falling, those earned by the oil

exporters rising sharply and deficits in the oil-importing developing

countries exploding, the picture returned to its pre-oil shock form by

the 1980s. Even when oil exporters were earning large surpluses, the fact

that these surpluses were being deposited within the banking system in

the developed world made the process of recycling surpluses one of transfers

from the developed to the oil-importing developing countries. The real

change was that private rather than official flows through the bilateral

and multilateral development network came to dominate capital flows.

Associated with this shift was a transformation of capitalism in the developed

countries which witnessed the rise to dominance of finance capital. To

start with, oil surpluses deposited with the international banking system

resulted in a massive increase in credit provision, both within the developed

countries and in the so-called emerging markets. Second, the breakdown

of the system of fixed exchange rates triggered by the US decision to

delink the dollar from gold, resulted in a sharp increase in foreign exchange

trading. Third, growing exposure of financial agents in domestic and international

debt markets and in foreign exchange markets resulted in the burgeoning

of derivatives that allowed financial institutions to hedge their bets

by transferring credit risk. And, finally, the liberalisation of financial

markets in developing countries aimed at exploiting the benefits of a

global financial system awash with liquidity provided an opportunity for

banks, pension funds and other financial firms to increase their investments

in developing countries in search of lucrative returns.

The long term effects of these developments are there to see. Available

figures point to galloping growth in the global operations of financial

firms. In the early 1980s, the volume of transactions of bonds and securities

between domestic and foreign residents accounted for about 10 per cent

of GDP in the US, Germany and Japan. By 1993, the figure had risen to

135 per cent for the US, 170 per cent for Germany and 80 per cent for

Japan. Much of these transactions were of bonds of relatively short maturities.

Since then, not only have these transactions increased in volume, but

a range of less traditional transactions have come to play an even more

important role. Traditional bank claims, though important, are by no means

dominant. Banks reporting to the Bank of International Settlements (BIS)

recorded foreign claims on residents of all countries at $15.7 trillion

at the end of 2003. This compares with the annual global GDP of $36400

trillion in that year.

Non-bank transactions have been far more important. In 1992, the daily

volume of foreign exchange transactions in international financial markets

stood at $820 billion, compared to the annual world merchandise exports

of $3.8 trillion or a daily value of world merchandise trade of $10.3

billion. According to the recently released Triennial Central Bank Survey

of Foreign Exchange and Derivatives Market Activity, in April 2004, the

average daily turnover (adjusted for double-counting) in foreign exchange

markets stood at $1.9 trillion. With the average GDP generated globally

in a day standing at close to $100 trillion in 2003, this appears to be

a small 2 per cent relative to real economic activity across the globe.

But the sum involved is huge relative the daily value of world trade.

In 2003, the value of world merchandise exports touched $7.3 trillion,

while that of commercial services trade rose to $1.8 trillion. Thus, the

daily volume of transactions in foreign exchange markets exceeded the

annual value of trade in commercial services and was in excess of one

quarter of the annual merchandise trade.

The trade in derivatives is also large and significant. The Triennial

Survey indicates that the average daily volume of exchange traded derivatives

amounted to $4.5 trillion in 2004. In the OTC derivatives market, average

daily turnover amounted to $1.2 trillion at current exchange rates. The

OTC market section consists of “non-traditional” foreign exchange derivatives

– such as cross-currency swaps and options – and all interest rate derivatives

contracts. Thus total derivatives trading stood at $5.7 trillion a day,

which together with the $1.9 million daily turnover in foreign exchange

markets adds up to $7.6 trillion. This exceeds the annual value of global

merchandise exports in 2003.

One consequence of these developments was that the flow of capital to

developing countries, particularly the “emerging markets” among them had

nothing to do with their financing requirements. Capital in the form of

debt and equity investments began to flow into these countries, especially

those that were quick to liberalize rules relating to cross-border capital

flows and regulations governing the conversion of domestic into foreign

currency. The point to note is that these inflows did not spur substantial

productive investment in these countries. Even foreign direct investment,

defined as investment in firms where the foreign investor holds 10 per

cent or more of equity, had “portfolio” characteristics, and often took

the form of acquisitions rather than greenfield investment.

What is important from the point of view of global balances is that the

inflow of such capital imposes a deflationary environment on developing

countries, because one requirement for keeping financial investors happy

is to substantially reduce the deficit of the government or its expenditures

financed with borrowing. Financial interests are against deficit-financed

spending by the State for a number of reasons. To start with, deficit

financing is seen to increase the liquidity overhang in the system, and

therefore as being potentially inflationary. Inflation is anathema to

finance since it erodes the real value of financial assets. Second, since

government spending is “autonomous” in character, the use of debt to finance

such autonomous spending is seen as introducing into financial markets

an arbitrary player not driven by the profit motive, whose activities

can render interest rate differentials that determine financial profits

more unpredictable. Finally, if deficit spending leads to a substantial

build-up of the state’s debt and interest burden, it may intervene in

financial markets to lower interest rates with implications for financial

returns. Financial interests wanting to guard against that possibility

tend to oppose deficit spending. Given the consequent dislike of expansionary

fiscal policy on the part of financial investors, countries seeking to

attract financial flows or satisfy existing financial investors are forced

to adopt a deflationary fiscal stance, which limits their policy option.

Part of the reason why developing countries record a surplus on their

current account is the deflationary fiscal stance adopted by their governments.

Growth is curtailed through deflation so that, even with a higher import-to-GDP

ratio resulting from trade liberalisation, imports are kept at levels

that imply a trade surplus. Consider the flows that deliver current account

surpluses for developing countries? As Table 1 shows, two factors account

for these surpluses: first, the transformation of the trade deficit (goods

and services) in these countries into surpluses, and a substantial inflow

of current transfers, mainly in the form of remittances. So, unless exports

of goods and services and/or remittances are large and growing, deflation

must be the factor influencing the current account.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

In sum, while the inflow of remittances is reflective of one aspect

of the process of globalisation that has benefited developing countries,

the rise of trade surpluses reflect the deflation imposed by financial

flows and the financial crises they engineer in some countries. As a result,

developing countries as a group did not require capital inflows to finance

their balance of payments. But such inflows did occur, particularly in

the form of private foreign investment. Such capital inflows then either

went out as other net investment or were accumulated as reserves that

were invested in large measure in US Treasury bills. That is, private

capital flowed into developing countries to earn lucrative returns, and

this capital then flowed out as investment in low interest Treasury bills

in order to finance the US balance of trade deficit.

What is more, if a country is successful in attracting financial flows,

the consequent tendency for its currency to appreciate forces the central

bank to intervene in currency markets to purchase foreign currency and

prevent excessive appreciation. The consequent build-up of foreign currency

assets, while initially sterilized through sale of domestic assets, especially

government securities, soon reduces the monetary policy flexibility of

the central bank. Governments in Asia, especially India, faced with these

conditions are increasingly resorting to trade and capital account liberalization

to expend foreign currency and reduce the compulsion on the central bank

to keep building foreign reserves. That is, if financial liberalisation

is successful, in the first instance, in attracting capital flows, it

inevitably triggers further liberalization, including of capital outflows,

leading to an increase in financial fragility.

Thus, financial liberalisation that successfully attracts capital flows

increases vulnerability and limits the policy space of the government.

Unfortunately, the dominance of finance globally has meant that such debilitating

flows occur even when individual developing countries or developing countries

as a group have no need for such flows to finance their balance of payments

or augment their savings. The real benefit of such flows is derived by

the US government, which, being the home of the reserve currency can resort

to large scale deficit financing which it opposes in developing countries.

The resulting balance of trade and current account deficits are not a

problem because they are financed with capital flows from the rest of

the world including “emerging market” developing countries. The problem

now is that the willingness of private investors and governments to hold

more dollar denominated assets is waning. If that continues a crisis at

the metropolitan centre of global capitalism is a possibility.