In mid-July,

Alan Greenspan, chairman of the US Federal Reserve, while deposing before

a congressional committee, warned the Chinese authorities that they could

not continue to peg the renminbi to the US dollar, without adversely affecting

the functioning of their monetary system. This touching concern for and

gratuitous advice to the Chinese had, however, some background. Greenspan

was merely echoing the sentiment expressed by a wide circle of conservative

economists that the Chinese must float their currency, allow it to appreciate

and, hopefully, help remove what is being seen as the principal bottleneck

to the smooth adjustment of the unsustainable US balance of payments deficit.

China was, of course, only the front for a wide range of countries in

Asia, who were all seen as using a managed and “undervalued” currencies

to boost their exports. Around the same time that Greenspan was making

his case before the congressional committee, The Economist published an

article on the global economic strains being created by Asian governments

clinging to the dollar either by pegging their currencies or intervening

in markets to shore them up. That article reported the following: “UBS

reckons that all Asian currencies, except Indonesia’s are undervalued

against the dollar … The most undervalued are the yuan, yen, the Indian

rupee and the Taiwan Province of China and Singapore dollars; the least

undervalued are the ringgit, the Hong Kong dollar and the South Korean

won.”

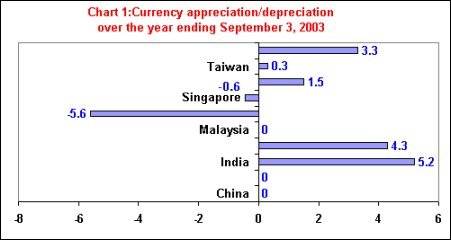

The evidence to support this is of course limited. It lies in the fact

that while over the year ending September 3rd the euro has appreciated

against the dollar by about 9 per cent, many Asian currencies have either

been pegged to the dollar, appreciated by a much smaller percentage relative

to the dollar or even depreciated vis-à-vis the dollar.

|

To anyone who has been following the debate

on exchange rate regimes and exchange rate levels in developing countries,

this perception would appear to be a dramatic reversal of the mainstream,

conservative argument that had dominated the development dialogue for

the last three to four decades. Till recently, many of these countries

were being accused of pursuing inward looking policies, of being too interventionist

in their trade, exchange rate and financial sector policies, and, therefore,

of being characterized by “overvalued” exchange rates that concealed their

balance of payments weaknesses. An “overvalued” rate, by setting the domestic

currency equivalent of, say, a dollar at less than what would have been

the case in an equilibrium with free trade, is seen as making imports

cheaper and exports more expensive. This can be sustained in the short

run because trade restrictions do not result in a widening trade and current

account deficit. But in the medium term it seen as encouraging investments

in areas that do not exploit the comparative advantages of the country

concerned, leading to an inefficient and internationally uncompetitive

economic structure.

What was required, it was argued, was substantial liberalization of trade,

a shift to a more liberalized exchange rate regime, less intervention

all-round, and a greater degree of financial sector openness. Partly under

pressure from developed county governments and the international institutions

representing their interests, many of these countries have since put in

place such a regime.

Seen in this light, consistency and correctness are not requirements it

appears when defending the world’s only superpower. Nothing illustrates

this more than the effort on the part of leading economists, the IMF,

developed country governments and the international financial media to

hold the exchange rate policy in Asian countries, responsible for stalling

the “smooth adjustment” of external imbalances in the world system. The

biggest names have joined the fray to make the case: Alan Greenspan, chairman

of the US Federal Reserve, John Snow, US treasury secretary, and Kenneth

Rogoff, IMF chief economist.

The adoption of a liberalized economic regime in which output growth had

to be adjusted downwards to prevent current account difficulties and attract

foreign capital had its implications. It required governments to borrow

less to finance deficit spending, which often led to lower growth, lower

inflation and lower import demand. Combined with or independent of higher

export growth, these effects showed up in the form of reduced deficits

or surpluses on their external trade and current accounts. Since in many

cases the ‘chronic’ deflation that the regime change implied was accompanied

by large capital inflows after liberalization, there was a surplus of

foreign exchange in the system, which the central bank had to buy up in

order to prevent an appreciation in the value the nation’s currency. Currency

appreciation, by making exports more expensive and imports cheaper, could

have devastating effects on exports in the short run and generate new

balance of payments difficulties in the medium term. In fact, among the

reasons underlying the East Asian crises of the late 1990s was a process

of currency appreciation driven by export success on the one hand and

liberalized capital inflows on the other.

Faced with this prospect countries like China and India chose to adopt

a more cautious approach to economic liberalization and, especially with

regard to the exchange rate regime and to the liberalization of rules

governing capital flows into and out of the country. However, even limited

liberalization entailed providing relatively free access to foreign exchange

for permitted trade and current account transactions and the creation

of a market for foreign exchange in which the supply and demand for foreign

currencies did influence the value of the local currency relative to the

currencies of major trading partners. This made the task of managing the

exchange rate difficult. The larger the flow of foreign exchange because

of improved current account receipts (including remittances) and enhanced

inflows of capital (consequent to limited capital account liberalization),

the greater had to be the demand for foreign exchange if the local currency

was to remain stable. But given the context of extremely large flows (China)

and/or relatively low demand during the late 1990s due to deflation (India),

there was a tendency for supply to exceed demand, even if this did not

always reflect a strong trading position. As a result, to stabilize the

value of the currency the central banks in these countries were forced

to step in, purchase foreign currencies to stabilize the value of the

local currency, and build up additional foreign exchange reserves as a

consequence.

Different countries adopted different objectives with regard to the exchange

rate. China, for example, chose to make a stable exchange rate a prime

objective of policy and has frozen its exchange rate vis-à-vis

the dollar at renminbi 8.28 to the dollar since 1995. To its credit, it

stuck by this policy even during the Asian currency crisis, when the value

of currencies of its competitors like Thailand and Korea depreciated sharply.

This helped the effort to stabilize the currency collapse in those countries,

even if in the immediate short run it affected China’s trade adversely.

India too had adopted a relatively stable exchange rate regime right through

this period, allowing the rupee to move within a relatively narrow band

relative to a basket of currencies, and not just the dollar.

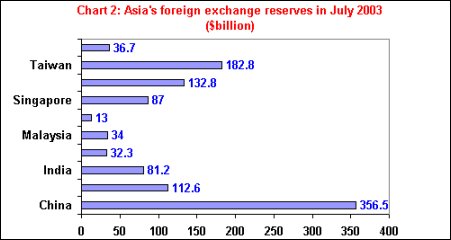

The net result is that most Asian countries – some that fell victim to

the late 1990s financial crises, like Korea, and those that did not, like

China and India – have accumulated large foreign exchange reserves (Chart

2). According to one estimate, Asia as a whole is sitting on a reserve

pile of more than $1600 billion. This was the inevitable consequence of

wanting to prevent autonomous capital flows that came in after liberalization

of foreign direct and portfolio investment rules from increasing exchange

rate volatility and threatening currency disruption due to a loss of investor

confidence. These reserves are indeed a drain on these systems, since

they involve substantial costs in the form of interest, dividend and repatriated

capital gains but had to be invested in secure and relatively liquid assets

which offered low returns. But that cost was the inevitable consequence

of opting for the deflation and the capital inflow that resulted from

the stabilization and adjustment strategy so assiduously promoted by the

US, the G-7, the IMF and the World Bank in developing countries the world

over. Unfortunately, the current account surpluses and the large reserves

that this sequence of events resulted in have now become the “tell-tale”

signs for arguing that the currencies in these countries are “under-“

not “overvalued” and therefore need to be revalued upwards.

|

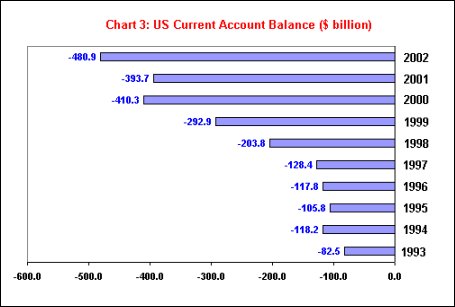

For long, this episode of rising reserves

in till-recently poor countries appeared almost conspiratorial, because

these reserves were being invested in dollar denominated assets including

government securities in the US and played an important role in financing

the burgeoning current account deficit in the US (Chart 3). The choice

of US assets was, of course, determined by the facts that the dollar still

is the world’s reserve currency and the US the world’s sole superpower,

both of which engender confidence in American, dollar-denominated assets.

The direct benefit for the US was obvious. With America experiencing growth

without the needed competitiveness, that growth was accompanied by a widening

of the trade and current account deficits on its balance of payments.

Capital inflows into the US helped finance those deficits, without much

difficulty. For example, UBS estimates that in the second quarter of 2003,

the central banks in Japan and China bought $39 billion and $27 billion

of dollars respectively. If these are invested in American assets they

would finance close to 45 per cent of the estimated $147 billion US current

account deficit in that quarter. They indeed were. Central banks, mostly

from Asia, are estimated to have financed more than half of the US current

account deficit in the second quarter.

|

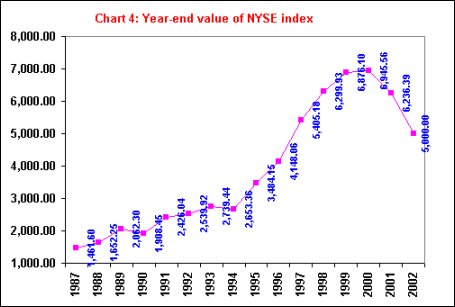

The indirect benefits of this arrangement

are even greater. For more than a decade now, the US has benefited from

a long period of buoyancy, so much so that it has accounted for 60 per

cent of cumulative world GDP growth since 1995. That buoyancy came not

because the US was the world’s most competitive nation in economic terms.

Rather, till the turn of the last decade growth was accounted for by a

private consumption and investment spending boom, spurred by the bubble

in US stock and bond markets (Chart 4) that substantially increased the

value of the savings accumulated by US households. The money market boom

was encouraged by the flight of capital from across the world to the safe

haven that dollar denominated assets were seen as providing. Investment

of reserves accumulated by the Asian countries was one important component

of that capital inflow. With the value of their savings invested in stocks

and securities inflated by the boom, consumers found confidence to spend.

|

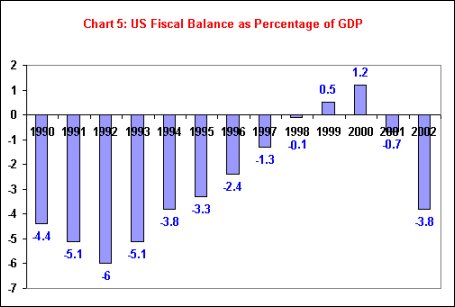

To be sure, when the speculative boom

came to end in 2000, triggered in part by revelations of corporate fraud,

accounting scandals and conflicts of interest, this spur to growth was

substantially moderated. But the low interest rate regime adopted by the

Fed still encouraged debt-financed consumer spending. Together with the

return to deficit-financed spending by the American state (Chart 5), justified

by its nebulously defined war on terror, America is once again witnessing

buoyant output growth even if this has not improved the employment situation

significantly. In fact, 2.6 million manufacturing jobs have been lost

in the US since Bush assumed office in 2001.

|

The only threat to US buoyancy throughout

this period was the possible unsustainability of the widening current

account deficit in its balance of payments. But the boom was not aborted,

because the rest of the world appeared only too willing to finance those

deficits, even if at falling interest rates in some periods.

Unfortunately, few other countries benefited directly from this chain

of events. They did not because they did not have the military power to

create the required confidence in their currencies, even if sheer competitiveness

warranted a decline in the dollar. Some countries benefited indirectly:

China, for example, because of the export boom to the US; the UK because,

among other things, of a boom in services, including financial services.

But overall, to use a phrase popularized by former US Treasury secretary

Lawrence Summers, the world economy was flying on one engine.

Within the imperial order always fearful of a “hard landing”, this has

created two imperatives. First, in the medium term, the world needs other

supportive engines, which must be from within the developed economies.

Second, till that time, and even thereafter, US growth must be sustained.

The new discovery that Asian currencies, particularly the Chinese renminbi,

is under- and not overvalued, stems from the second of these two concerns.

With the US current account deficit expected to exceed 5 per cent this

year, there are few who are convinced that it would find investors who

would be confident enough to continue financing that deficit. This is

becoming clear from the fact that the share of the deficit financed by

central bank investments is rising, as private investors grow more cautious.

Thus, if the dollar is not to collapse, the US current account deficit

must be curtailed and reversed.

However, this cannot be ensured by curtailing US growth and therefore

the growth of US imports. It is necessary to boost exports, so that growth

can coexist with a reducing trade and current account surplus. This is

where China and the fact that it notched up a record $103 billion trade

surplus with the US last year comes in. Ignoring the fact that simultaneously

China had recorded a trade deficit of $75 billion with the rest of the

world, the surplus with the US is seen as a direct consequence of China’s

undervalued exchange rate, which has been pegged to the dollar since 1995

despite rising capital flows and reserves. Thus, the story goes, if China

revalues its currency vis-à-vis the dollar by anywhere between

15 and 40 per cent, depending on the advocate, China would absorb more

imports from and be able to export less to the US, correcting the trade

imbalance between the two countries.

But that is not all. If China revalues its currency, it is argued, Europe

would improve its competitiveness lost as a result of the appreciation

of the euro vis-à-vis the dollar and therefore the renminbi, allowing

it to register higher export growth. Further, China’s revaluation would

reduce the need to pressurize Japan to revalue the yen, despite its own

surpluses with the US and the high level of its reserves. This deals with

the danger that yen revaluation might abort the feeble recovery that Japan

is experiencing after a decade of stagnation. These benefits could possibly

yield the supportive engines needed to keep the world economy in flight.

In this assault on the less-developed nations, involving a complete reversal

of the argument regarding the currency regime in developing countries,

the US and its allies are finding strange supporters. Trade unions and

manufacturing companies located in the US who have experienced job and

market losses have joined the chorus through organizations such as “The

Coalition for a Sound Dollar”. They are even threatening to take the Chinese

to the dispute settlement body of the WTO on the grounds that it is manipulating

the exchange rate to win unfair gains from trade. There effort is ostensibly

aimed at invoking a provision in the World Trade Organisation that bars

countries from influencing exchange rates to "frustrate the intent"

of WTO trade agreements. In practice, the clamour is all intended to get

the US government, in a pre-election year, to increasing pressure on China

to float its currency.

However, not all of American business supports this effort. Calman Cohen

of the Emergency Committee for American Trade, which represents many large

US companies doing business in China, is reported to have said that while

the renminbi may well be undervalued, it was not the main cause of the

industrial problems facing the US. His principal and well-founded fear

is that action against China would adversely affect US companies that

as part of their competitive strategy are sourcing their products from

countries like China.

Not surprisingly, Rob Westerhof, chief executive of Philips Electronics

North America and former chief executive of Philips Electronics East Asia,

argues: “A free float or sudden revaluation would be bad for China and

bad for business. Instead, Beijing should maintain the peg for now and

aim for a gradual revaluation of about 15 per cent over the next five

years. Free- floating the renminbi can be considered only when China has

a well established financial system. That will take at least another 10

years.” He made it clear that “business prefers a stable renminbi-dollar

exchange rate. A sudden revaluation of the renminbi would disrupt results

for the many multinational companies (Philips included) that supply American

and European retail chains with goods made in China. Currently, hedging

against exchange rate fluctuations of a free-floating, unpredictable renminbi

would be very costly for those companies.”

Unfortunately, some Asian countries, particularly those that have been

experiencing an appreciation of their currencies from the lows they reached

after the 1997 financial crisis are supporting the demand with the hope

that they would benefit from the loss of Chinese export competitiveness

that a revaluation of the renminbi would involve. Interestingly, Japan

too is part of this group, even though it is itself intervening in currency

markets to prevent the yen from appreciating too much against the dollar.

Thus at the end of September, the dollar recovered sharply against the

yen as a result of Bank of Japan intervention, conducted through the New

York Federal Reserve. This help reverse a prior downward lurch of the

dollar vis-à-vis the yen. According to information released recently

by the Japanese Finance Ministry, the government and central bank have

spent a total of $ 40 billion between August 28 and September 26, taking

the total amount spent on supporting the yen in the first nine months

of 2003 to well above $100 billion. This willingness to intervene openly

is partly explained by the fact that the G-7 has accepted that any excessive

appreciation of the yen could abort a recovery which has come after a

long while and which is seen as crucial for overall global growth. This

support for action against yen appreciation goes against the G-7’s own

recent statement that cam out in favour of exchange rate flexibility in

the world, which it is now clear was aimed at developing Asia in general

and China in particular.

Despite its own actions, the Japanese government has been willing to go

along with the demand that the Chinese and other developing Asian countries

should revalue their currency by opting for a float. Once again the fact

that the developed countries believe that developing countries should

do as the G-7 says and not as it does has been brought home.

The flaws in these arguments are obvious. A revaluation of the renminbi

may reduce China’s trade surplus with the US, but it is unlikely to trigger

either export or output growth in the US. Rather, the space vacated by

the Chinese in US markets would be occupied by some other trading country

such as Vietnam, Korea or the Philippines. Further, those Asian countries

that expect to gain from the renminbi’s revaluation would soon find that

their current account surpluses and reserves are seen as grounds for identifying

their currencies as undervalued and provide the basis for a revaluation

demand. India, with less than $90 billion of foreign exchange reserves

is already being targeted. Whatever gains would occur from China’s revaluation

would be shortlived.

Further, if China and other countries, like India, with rising reserves

are deprived of those reserves on these grounds, the capital required

to finance the current account and budget deficits accompanying US growth

would soon dry up. This would drive up interest rates in the US, cut consumption

and investment spending, make the current account deficit unsustainable,

and ensure the collapse of US growth and the dollar that the revaluation

is expected to stall.

In sum, the whole episode indicates that the desperation to protect the

current imperial order is yielding a number of scatter-brained proposals.

Economics has been reduced to deformed ideology, devoid of consistency

and rationality. Fortunately, the Chinese have thus far stood their ground

and refused to yield. Hopefully, other developing countries would also

see where their best interests lie.