John Stuart Mill was among the foremost liberal thinkers of modern times who wrote extensively…

Economic Contraction and the Fiscal Stance of the Indian Government C. P. Chandrasekhar and Jayati Ghosh

It is generally recognised that the Indian economy was already in a steep slowdown well before the Covid-19 pandemic and badly planned lockdown further destroyed economic activity. But what is possibly not so well understood that that a major reason for the recent slowdown was not just government inaction (or acts of omission) but specific policy actions (or acts of commission) that actually worsened the problem.

Essentially, the Indian government contributed to the economic slowdown by significantly reducing its public expenditure at a time when spending by other segments of the economy (households and enterprises) was already slowing or declining. This had the inevitable effect of further reducing aggregate demand in the economy, at a time when a major demand injection is really what the economy required most. Instead of providing such an injection through more public spending, the Modi government made matters significantly worse.

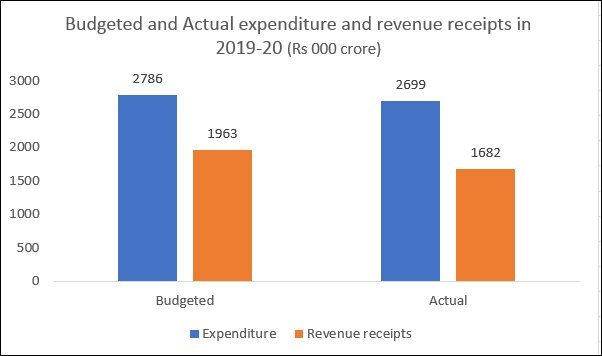

This is evident from Figure 1, which uses the latest available data for the last fiscal year to show that actual spending by the central government was lower than was budgeted for, and therefore would have generated lower direct and indirect demand through multiplier effects.

Figure 1: The government spent much less than was budgeted for in the last fiscal year.

Source: www.cga.nic.in

Why did the government choose to spend less? The reason is its obsession with the fiscal deficit, which has meant that it is caught in a negative spiral from which it cannot extricate itself. The process is as follows: a slowing economy generates lower-than-expected tax revenues for obvious reasons. In 2019-20, lower indirect tax collections were accompanied by a significant mid-year tax giveaway for corporations, which also reduced direct tax revenues. (This incidentally did nothing to revive private investment, as companies simply pocketed the profits and chose to wait it out until market conditions improved through higher demand!) As a result, as tax revenues throughout the year continued to be well below the expected (budgeted) figures, the projected fiscal deficit grew. To reduce this, the central government tightened its purse strings. It reduced required transfers to states, and cut several spending on several other important heads, such as for agriculture, MSMEs, women and child development.

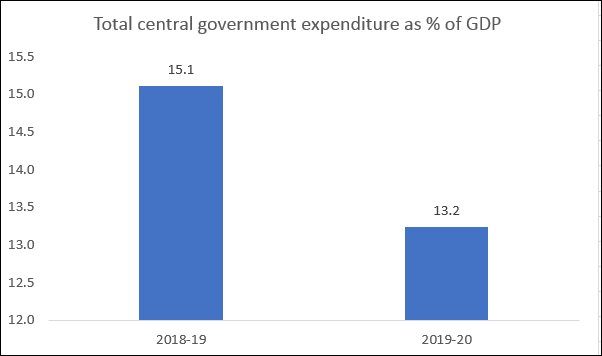

This resulted, in the end, in a significant decline in total central government expenditure to GDP—which is the best indicator of the fiscal stance (Figure 2). This decreased by nearly 2 percentage points of GDP compared to the previous year, a truly significant negative demand stimulus to an already decelerating economy.

Figure 2: Central government expenditure declined sharply as share of GDP

The predictable irony is that this did nothing to keep the fiscal deficit under control—in fact, it expanded significantly anyway, from the projected 3.4 per cent of GDP to 4.6 per cent of GDP (which is also widely believed to be an underestimate because of definitional sleights-of-hand). Why should this happen? The answer is simple, to be found in the idea of the “paradox of thrift” that has been known to economists for nearly a century. Essentially, when someone tries to save more and spend less in a context of economic decline, that further reduces demand and therefore economic activity falls further.

This process is even more lethal and counterproductive when governments engage in this foolish behaviour, since their spending is not and need not be constrained by current revenues. But if a government chooses to reduce its spending in response to reduced tax collections over the course of the year, it delivers a double whammy. First, it adds to the recessionary or contractionary tendencies in the economy, and therefore makes it more likely that the economy will grow less than expected. Second, precisely because of this, it also ends up with even lower tax collections. As a result, its own actions affect both the numerator (the fiscal deficit) and the denominator (the GDP) and thereby worsen the fiscal deficit-to-GDP ratio, the very indicator it was trying so hard to control!

This is obvious macroeconomic folly, and it could have been thought that its own recent experience would make the Modi government realise how misguided this strategy is. Unfortunately, all the indicators are that it is still doing the same thing now, when the economic situation is much worse. The unplanned and brutal lockdown brought most of the economy to a halt from the last week of March 2020. The likelihood is that for the month of April, around 40-50 per cent of economic activity simply would not have taken place. That is a dramatic decline, and countering that to prevent complete collapse would require very significant increases in public spending.

Ideally, much of this should have been to compensate those most affected by the lockdown: informal workers, whose plight is now well-known. Substantial income transfers for around three months (say Rs 7000 per household per month) and universal access to free food grain for six months could have been immediate responses. Unfortunately, the government did almost nothing, providing such limited amounts of both food and cash transfers that they barely scratched the surface of the requirement.

Table 1: Even in April 2020, government spending was very inadequate

|

Apr-19 |

Apr-20 |

Absolute change |

% change |

% change in constant prices |

|

|

Total expenditure |

2,54,679 |

3,07,060 |

52,381 |

20.6 |

17.4 |

|

Interest payments |

19,557 |

26,696 |

7,139 |

36.5 |

33.4 |

|

Other revenue exp |

2,04,534 |

2,52,058 |

47,524 |

23.2 |

20.1 |

|

Capital expenditure |

30,588 |

28,306 |

-2,282 |

-7.5 |

-10.6 |

The macroeconomic implications of controlling public spending now are also dire. Table 1 shows the central government spending for the month of April 2020 relative to one year earlier. The increase in real terms was only 17.4 per cent, nowhere near enough to counter the massive contraction of economic activity in other sectors. It is also worth noting that despite the Finance Minister announcing an immediate “relief” package of Rs 1.7 lakh crore, in April 2020 the absolute increase in expenditure compared to a year earlier was only Rs 52,000 crore, less than one-third the announced amount.

In such situations of economic contraction, both scale and speed matter: the longer a fiscal stimulus is delayed, the worse the economic contraction, and the greater the problem that fiscal policy will have to resolve later. But the indications are that the government will cut back on other spending to make up for even this minor increase. If the government does not learn from its own bitter experience, there is little to alter the depressing trajectory of continuous decline.

(This article was originally published in the Business Line on June 16, 2020)