Sri Lanka defaulted on its external debt for the first time in its postcolonial history…

Developing Asia’s External Debt Concerns C. P. Chandrasekhar and Jayati Ghosh

There has been much discussion about how external debt concerns are likely to weigh heavily on developing countries in their attempts at economic recovery in the wake of the Covid-19 pandemic. Most of this discussion has centred on emerging markets in Latin America and developing countries in Africa, some of which are already experiencing severe problems of debt servicing. Argentina and Ecuador are both currently trying to restructure some of their external debt; other countries (particularly in Africa) are also seeking debt relief and some have benefited from moratoria on interest payments.

There appears to be less concern about external debt problems in developing Asia. This may be because of the perception that—while debt to GDP ratios in the region are high and have grown rapidly in the past few years, most of this debt is to internal creditors and in the domestic currency. Also, in the past few years, while cross-border net debt flows decelerated across the developing world, developing Asia experienced the sharpest slowdown. However, the latest Consolidated Banking Statistics from the BIS suggest that the region is much more vulnerable to external debt shocks that may be in the offing.

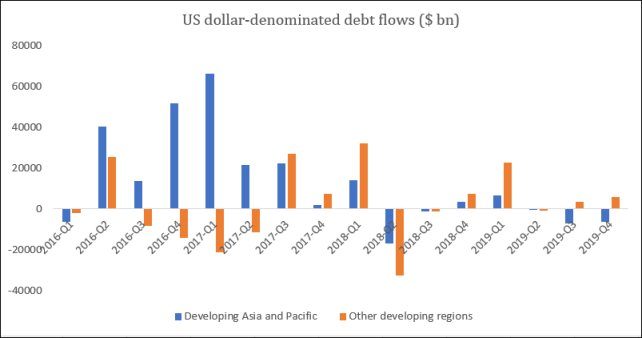

Figure 1: Net cross -border debt flows to developing Asia declined in 2019

Source for all data: www.bis.org

Most of developing Asia’s external borrowing is denominated in US dollars. Figure 1 that considers only dollar-denominated debt, suggests that while net debt flows into developing Asia and the Pacific increased between 2016 and early 2018, when the flows were negative to other developing regions, since then the pattern has reversed. Indeed, for 2019 as a whole, net flows into emerging Asia-pacific were negative, and net claims on the region overall declined by 2 per cent, even as they increased slightly for developing countries as a group.

However, the recent accretion of external debt is only one indicator of potential vulnerability. The Global Financial Crisis has already indicated some indicators to watch out for that can quickly generate stress and domestic problems. Two such indicators are the extent to which non-resident creditors (as opposed to domestic creditors) dominate in claims on debt denominated in a foreign currency, and the maturity structure of debt. Obviously, claims held internationally can be more volatile, especially as they in turn tend to be backed by short-term wholesale funding, which can disappear during a crisis. Similarly, if more claims are short-term in nature, they can simply not be rolled over in periods of stress and heightened risk-aversion. By contrast, even when aggregate debt levels are large, if they are held by local residents in longer term assets that are denominated in the local currency, they are more likely to be stable even through periods of disruption in global markets.

By those criteria, Asia is actually worse off than other developing regions. Within total debt claims denominated in foreign currency, international claims accounted for nearly two-thirds, at 64 per cent, compared to 57 per cent in Latin America. Also, several important economies in the region show a higher share of short-term maturities than elsewhere.

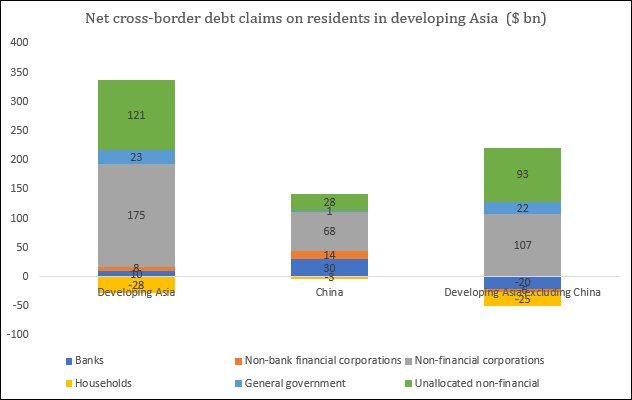

The composition of these claims is also of significance. Figure 2 shows that non-financial corporations have been the biggest recipients of bank credit, such that by the close of 2019, they accounted for 57 per cent of net cross-border claims, while “unaccounted” non-financial recipients were nearly 40 per cent. By contrast, households are net holders of claims, or creditors abroad, to the tune of $28 billion dollars. This reflects the growing integration of Asian financial markets with global markets, as more and more domestic savings of households gets routed abroad through the activities of pensions funds and other mutual funds.

When China is excluded, the situation in the rest of developing Asia looks even more serious. Claims on non-financial corporations are as much as 63 per cent of the total net debt, and those on unaccounted non-financial residents are 54 per cent. Meanwhile, banks, non-bank financial institutions and households are all net creditors abroad. This high degree of financial integration can be a major source of fragility for emerging markets, which are not only buffeted by tendencies in global markets that may have nothing to do with internal economic trends, but also are more likely to show very rapid movements in response to shocks and any adverse domestic developments.

Figure 2: Most debt claims are on non-financial agents

The relatively rapid expansion of bond markets in the developing Asia-Pacific region was until quite recently a cause of congratulation, until it became evident that these bond markets can become an even greater source of external vulnerability. Even for local currency denominated bonds, it has been observed that when they are held by non-residents, there can be significant sales in times of stress that cause their yields to rise, and these sales can also impact the foreign exchange market if the sellers choose to exit.

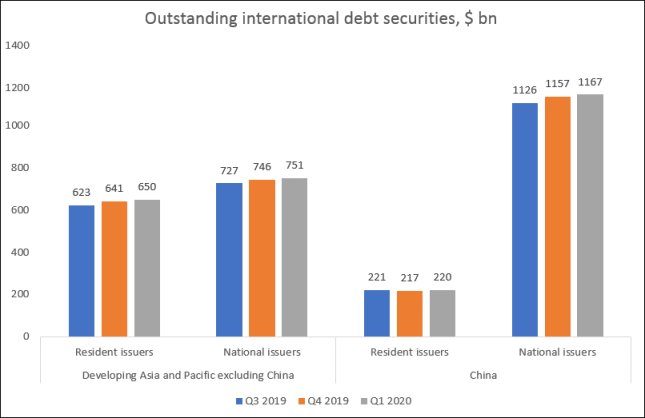

A growing proportion of Asia’s debt is in the form of bonds, and non-financial corporations in particular have displayed significant appetite for issuing such bonds. Given the active secondary market in these debt securities, it is obvious that there can be rapid movements in these markets in the wake of any bad news, and therefore this is a potent source of financial fragility. Figure 3 shows the total outstanding international debt securities (IDS) over the last three quarters for which data are available, for China and for the rest of developing Asia-Pacific. These have continued to increase even into the first quarter of 2020.

What is particularly striking is the difference between resident and national issuers of debt. According to the BIS, “nationality refers to the ultimate obligor, as opposed to the immediate borrower on a residence basis, and is linked to the consolidation of assets and liabilities for related entities.” This allows us to better understand the links between borrowers in different countries and sectors, and to determine the holders of the ultimate liability. For example, the debts of an offshore subsidiary of a Chinese bank may be guaranteed by the Chinese bank. It is worth noting that this is a common practice especially with respect to tax havens: thus we find that outstanding IDS for the Cayman Islands, Ireland, the Netherlands and the United Kingdom are substantially lower on a nationality basis than on a residence basis. However, outstanding IDS for China and India (and incidentally also Brazil and Russia) are more than twice as high on a nationality basis.

Figure 3: International debt securities issued in the region have continued to grow

It is evident that the external debt problems of developing Asia are both more complex and more subterranean than is immediately evident. How that will play out during this pandemic and global depression is therefore still open to question.

(This article was originally published in the Business Line on July 14, 2020)