John Stuart Mill was among the foremost liberal thinkers of modern times who wrote extensively…

Roots of the Sri Lankan Debt Trap C. P. Chandrasekhar and Jayati Ghosh

The contours of the economic, political and humanitarian crises that Sri Lanka currently faces are now well known. With limited economic diversification, it has for long been an open economy that has found it difficult to earn the foreign exchange needed to finance its imports of goods and services. Structurally the Sri Lankan economy has remained highly export dependent even since gaining political independence in 1948, with the ratio of goods and services export to GDP touching almost 40 per cent in 2000 and standing at 30 per cent prior to the global financial crisis of 2008 and the Great Recession into which the world subsequently descended. This dependence has resulted in chronic trade and current account deficits.

After experimenting with import controls to address this vulnerability during the 1960s and 1970s, governments since the late 1970s have relied on foreign capital inflows, especially borrowing from official and private creditors, to finance trade and current account deficits. That added rising debt servicing costs to its foreign exchange outflows, worsening the balance of payments situation. Unable to sustain this arrangement following recent short term shocks in the form of the COVID-19 pandemic and the Ukraine invasion, Sri Lanka’s foreign exchange reserves collapsed. In the event, it has had to default on its external debt.

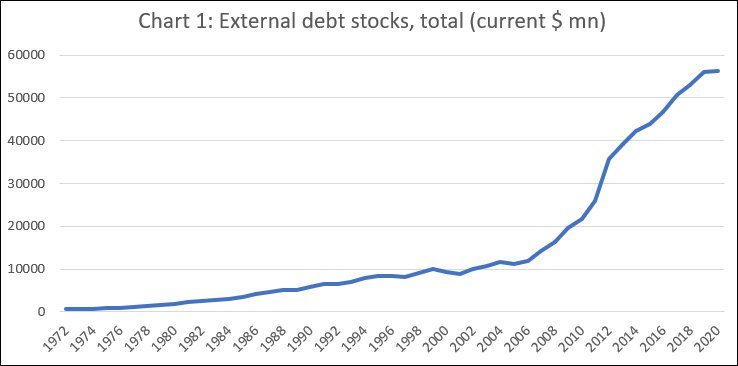

Scrutiny of this trajectory raises the question as to how Sri Lanka, with its tenuous balance of payments situation, was able to access large volumes of foreign debt, with outstanding debt totalling $56 billion in 2020. With hindsight it appears that this ‘favourable’ treatment the island economy received from foreign lenders was dependent on its willingness to embrace a market-friendly, open economy policy regime recommended by the Bretton Woods institutions since its early post-independence years.

Immediately after 1948 and till 1956, the Sri Lankan government chose to continue with the export dependent economic structure inherited from the pre-independence era in which production and trade were linked to the colonial agenda and were dominated by three primary products—tea, rubber and coconut. That policy stance was endorsed by the World Bank which, in 1953 urged the government to adopt an open economy framework, combined with fiscal and monetary prudence and deft use of exchange rate adjustment to manage the balance of payments. It also promised ‘support’ to facilitate such a strategy. During those years, that policy stance seemed to work for Sri Lanka as improved export receipts delivered by the primary commodity boom associated with the Korean War enhanced government revenues and growth without balance of payments difficulties.

But with the end of the Korean War boom exports turned sluggish, rising just 14 per cent between 1957 and 1965, while imports (which included those of essentials) remained high. Not surprisingly, over the period from 1959 to 1976, to varying degrees, governments put in place import controls involving quantitative restrictions and higher tariffs, to reduce imports and alter the structure of the economy to reduce import dependence. However, given the obstacles created by global inequality and by domestic political and economic circumstances, the medium- and long-term objectives of restructuring the economy to reduce import dependence and enhance export revenues were only partially realised. Current account deficits widened, leading to a foreign exchange crisis in the mid-1960s. This intensified elite pressure to revert to a less restrictive and open economic regime.

It was at this point in time that the IMF, which had always stayed in the shadows, decided to respond positively and “generously” to requests of assistance, in return for assurances that the interventionist economic regime would be dismantled. IMF support also called forth support initially from the donor community (the Aid Ceylon Group) and later from international private finance. That triggered a transition to a liberal economic order when the United National Party was voted to power in 1977 and a new Constitution with a Presidential form of government was adopted. An open, market-friendly economic policy regime in some form has been in place since.

A consequence has been the persistence of balance of payments difficulties, worsened by the difficulties created by long years of civil strife. However, Sri Lanka managed to finance its chronic trade and current account deficits with foreign borrowing, which boosted the limited capital inflows coming from foreign direct investment. As Chart 1 shows, the stock of external debt initially rose from just above $1 billion in 1977 to more than $5 billion in 1988, $9 billion in 1998 and $16 billion in 2008. But, following the global financial crisis, easy access to foreign liquidity encouraged governments to prime the economy with support from foreign capital, resulting in the stock of external debt rising to exceed $56 billion in 2020.

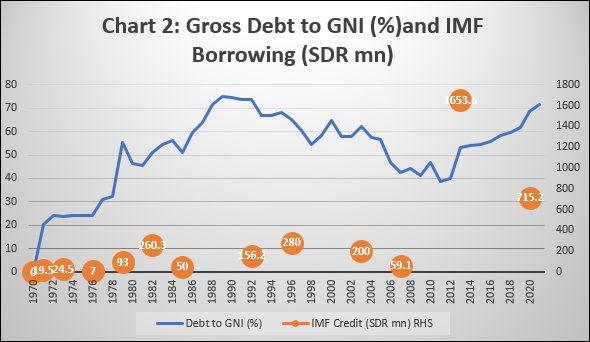

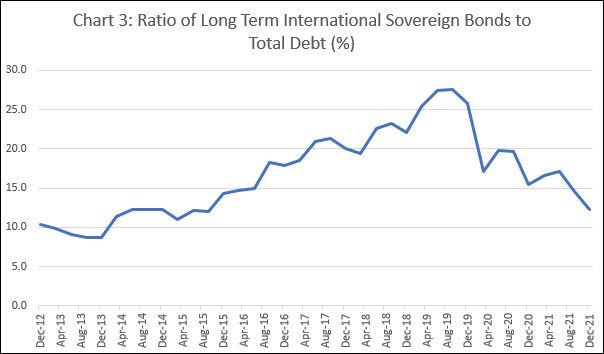

Foreign borrowing of this magnitude could be sustained partly because of the credibility that consecutive Extended Fund Facility and Standby IMF lending arrangements gave the government. There have been 16 of them since independence and the 17th is under negotiation. Chart 2 tracks the relationship between overall borrowing and IMF arrangements. The ratio of Sri Lanka’s gross external debt stock to gross national income, which rose from 25 per cent in 1976 to 75 per cent in 1990, fell to 40 per cent in 2011 and then rose again to 69 per cent in 2020. The first spike in external borrowing coincided with several agreements with the IMF between 1971 and 1981, totalling more than SDR450 million. The second spike, which saw the Sri Lankan government relying on the issue of international sovereign bonds (ISBs) to attract debt capital, was also accompanied by two major IMF agreements for a total of SDR 2.4 billion in 2012 and 2019. During this period the ratio of long term ISBs to total debt rose from 10 per cent to 27.5 per cent (Chart 3). It was when it became obvious that IMF assistance was unlikely to help Sri Lanka escape the debt trap that borrowing through ISBs fell as a ratio of external borrowing, though short term borrowing from multiple other sources continued.

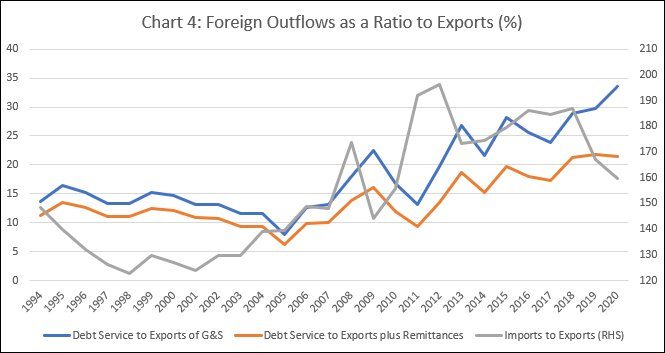

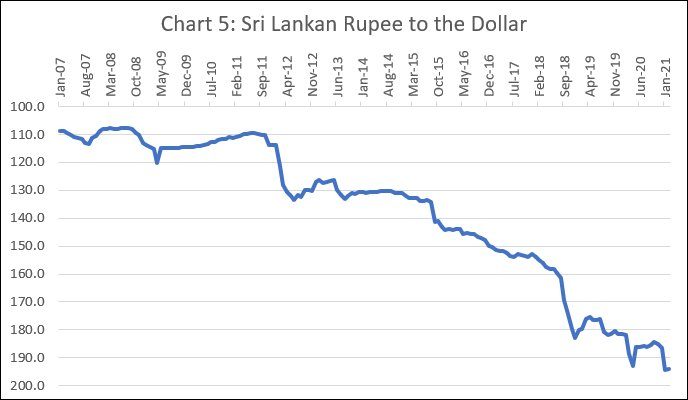

The adverse consequences of this for the balance of payments are visible in Chart 4 which records the sharp rise in the ratios of debt service to exports and debt service to exports and remittance receipts. Meanwhile, rising imports and indifferent export performance were resulting in a sharp rise in the ratio of import payments to export receipts. This proved completely unsustainable after the COVID-19 pandemic damaged tourism earnings and export revenues, triggering measures to curb imports that led to the production declines in agriculture and industry, shortages of essential commodities and power shut downs. A depreciation of the Sri Lanka rupee that was relied on in the long-term as part panacea for the balance of payments crunch (Chart 5), now became a symptom of the crisis with the rupee’s value collapsing in unofficial markets, forcing the government to devalue the official exchange rate as well, fuelling the inflation that was raging because of high energy prices and domestic shortages.

In a typical twist, the international media has been attributing Sri Lanka’s problems to excess borrowing from China, which accounts for only around 10 per cent of total debt. The real culprits in terms of lending without due diligence are the IMF and, prodded on by it, private international finance. That was the poison pill that Sri Lanka was fed to play the role of neoliberal poster boy in South Asia.

(This article was originally published in the Business Line on May 2, 2022)