Asia’s Covid-19 Response and the Road to a Green Recovery C. P. Chandrasekhar

Across the world, one consequence of the coronacrisis has been a shift away from fiscal conservatism, with diminishing concern for austerity or even fiscal prudence. Victor Gaspar and Gita Gopinath of the IMF estimate that the total value of the global fiscal policy response to the pandemic and its fallout stood at close to USD 11 trillion by early July 2020. As a consequence, public debt to GDP ratios have crossed 100% in 25 advanced economies (only surpassed during World War II) and risen to a historic high of more than 60% in 27 emerging market economies. The pressure on governments to proactively allocate resources to address the pandemic, to halt the downturn it precipitates, and to ramp up spending to restore growth, has also created an opportunity to change priorities and focus on expenditures that render the recovery climate positive and socially and environmentally just.

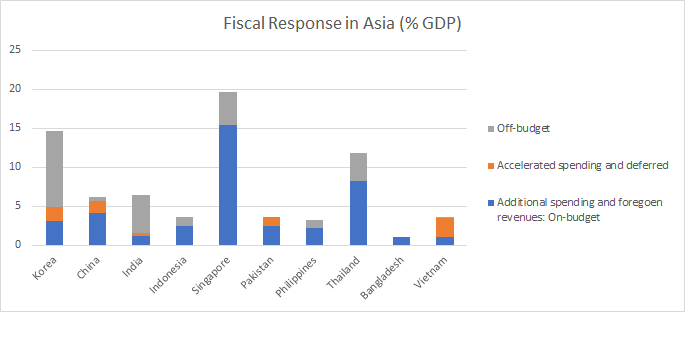

Proactive fiscal policies are apparent in Asia as well, though there are significant differences in the response (see chart). South Korea, China, Singapore and Thailand have been far more proactive, whereas India, Indonesia, Pakistan, Philippines, Bangladesh and Vietnam have outlaid smaller sums. But performance does not depend on outlays alone, as Vietnam’s success in quelling the pandemic illustrates.

This spending is only the beginning, since it just covers (not even adequately in most countries) the immediate effort to mitigate the effects of the coronacrisis. Regional or national lockdowns were not a cure, but a means of slowing the pace of infections to ensure health systems were not overwhelmed. This bought time to ramp up testing, tracing and isolation to contain the infection; substantially enhance and improve hospital facilities; and protect health workers and doctors. Here too efforts varied, with countries like Korea and Singapore undertaking mass testing and tracing and hiking medical spending significantly, whereas others limited their testing and were tardy even in providing protective equipment, besides investing in hospital facilities, as the case count rose.

The role of governments in the recovery

Social distancing requirements and lockdowns brought a sudden stop to economic activity, resulting in large-scale unemployment and pushing informal sector businesses and small and medium firms to bankruptcy. To counter the social effects, governments provided transfers in kind and cash to support the many who had lost their livelihoods, programmes to generate employment, measures to sustain agriculture and farm incomes, and support for the informal sector and small, medium and even large businesses. While monetary policy measures like liquidity infusion, credit provision and lowered interest rates could help, a proactive fiscal policy was a must. Globally, governments have adopted a combination of monetary and fiscal policy measures, with “relief and recovery” outlays taking public spending to record levels.

When a crisis demands a sudden surge in spending, targeted to achieve identified social goals, the planned allocation of funds cannot be based on considerations of pecuniary return. Governments play an important role, since the private sector will underspend given low or absent returns; spending priorities should be defined, well-timed and coordinated. Matters cannot be left to the market. Government agencies must oversee Covid-19 related spending by both the public and private sectors, and undertake a large part of that spending.

These imperatives have influenced policy in Asia. Most Asian central banks have reduced benchmark interest rates, by 75 basis points in Korea and India for example, infused liquidity including through temporary purchases of private sector bonds, and changed norms to allow banks to lend more. While fiscal activism has been visible, all countries must do more.

From “relief and recovery” to lasting “stimulus”

As new rounds of fiscal spending are announced, there is a shift from “relief and recovery” to providing a “stimulus” to return to sustained growth economies that have contracted because of demand compression. The sudden halt of economic activity, the unemployment it precipitated, and the loss of earnings across businesses resulted in sharp drops in consumption and investment. The world economy is projected to contract by 5% or more. Japan, which grew by just 0.7% in 2019, is projected to contract by close to 6% in 2020. The corresponding figures for emerging and developing Asia are 5.5% and -0.8%. There are no indications that a V-shaped recovery is likely in the foreseeable future unless effective measures are taken to trigger a recovery. This situation calls for a countercyclical, expansionary response from the state, which in the face of demand inadequacies does not, like the private sector, hold back on spending, but expands both consumption and investment spending to revive demand, reduce unutilized capacity and kickstart private investment.

Thus, further increases in fiscal spending are likely, even beyond what might be necessitated by second or subsequent waves of infections. Herein lies an opportunity. Initially, even this second, parallel track of “stimulus spending” was directed to the much-needed “relief effort”. In some countries, temporary employment in government projects was offered to address the unemployment resulting from the pandemic. India, for example, substantially hiked allocations for its flagship rural employment programme, which promises 100 days of work to each rural household, and raised the wage it pays. Some spending aimed to ring-fence essential economic activities and impose operating practices to guard against infection in functioning workplaces, so as to restart production and relax supply shortages.

A sustainable recovery

But the fiscal push must persist much longer than the pure relief effort, which will diminish as lockdowns are lifted and economic activities resume, and will not be the dominant concern if and when a Covid-19 vaccine is developed. Over time, therefore, the stimulus effort would revive sustainable demand by generating decent employment, paying reasonable wages and ensuring wage-led growth, while minimising negative environmental impacts and addressing the gaps and inadequacies that make handling shocks like the pandemic difficult.

There is no gainsaying the fact that the post-Covid-19 world is bound to be different. The intensity and prolonged nature of the coronacrisis have revealed the dangers inherent in underfunded health systems, extreme inequality and poor living conditions, and a deteriorating and unhealthy environment. This provides an opportunity for advocates of a changed development path to leverage the lessons learnt from the Covid-19 catastrophe.

Even before that catastrophe, the failure to ensure a robust recovery a decade after the Great Recession triggered by the 2008 global financial crisis had set off a progressive demand for a Green New Deal. Though initiated in the United Kingdom and Europe, and unsuccessfully introduced through legislation in the United States, the idea has resonated in Asia as well, with environmental activists and the progressive intelligentsia advocating a similar agenda. The basic idea is to combine the investment required to meet carbon emission reduction and climate change adaptation commitments and targets (in clean, renewable, and zero-emission energy sources and energy efficient smart grids, for example) with programmes that accelerate employment growth, improve income distribution and advance human development.

Towards a post-pandemic Green future

Since increased spending planned and/or coordinated by government is likely to become the new norm after Covid-19, collateral benefits can be derived by gearing spending to changing the development path. Public investment could be directed to address crucial infrastructural bottlenecks in areas like provision of clean water and sanitation, and in power generation or transportation with low carbon-emitting technologies. It could be diverted to support disaster management efforts and to mitigate adverse trends resulting from extreme climate events. It could be deployed to advance the sustainable development goals, accelerate poverty reduction, and ensure that no one is left behind. It could also be directed towards mitigation and adaptation efforts to address damaging climate change resulting from carbon emissions.

The case for this policy transition after years of unequalising, environmentally damaging and climate disruptive growth has been strongly and repeatedly made. But that transition has not occurred, for a number of reasons. First is the shift to business-friendly economic policies that have privileged tax concessions and tax forbearance as means of incentivizing private investors, despite significant increases in inequality in income and wealth. That has limited resource mobilization by government for a green agenda. Second is the growing role in economic decision-making of the private sector, which by focusing on private profit and ignoring social returns bypasses projects that are socially and environmentally beneficial. Third is the embrace of fiscal conservatism by governments, which shrinks debt-financed spending that could help accelerate green growth.

The transition is, however, crucial. For example, much needs to be done in Asia to wean countries away from cheap energy derived from fossil fuels that contributes significantly to global GHG emissions, and to reduce deforestation. Charlene Watson and Liane Schalatek report in a recent Climate Finance Fundamentals briefing paper from the Heinrich Boell Stiftung that 18 multilateral climate funds and initiatives approved 530 projects worth USD 4.9 billion in 18 countries in Asia from 2003 to 2019. While these flows need to be considerably enhanced, resources for green programmes must come from domestic sources as well. Richer countries in Asia must outlay a fair share of domestic resources, so that international flows from bilateral climate finance and multilateral climate funds can flow to poorer economies and the least developed countries in the region that are most vulnerable to extreme weather events. This has not been the case so far, with funds being directed disproportionately to mitigation projects in India, Indonesia and China, for example.

Failure to mobilize domestic resources will force reliance on debt and at some point trigger opposition, given the stranglehold of neoliberal ideas privileging fiscal “consolidation” above all else. As of now there is greater openness to debt-financed spending. Even senior IMF officials, who lean to conservatism on fiscal matters, have noted that there is room for more fiscal support in countries like India. But this rhetoric has had uneven influence on policy across countries. If the required medium and long-term fiscal push that can advance climate and sustainable development goals is to be realised, governments must increase progressive taxation of the rich as warranted by levels of inequality, and impose taxes on wealth that has been significantly undertaxed in most countries in the region.