El lugar de México en América Latina Saúl Escobar Toledo

El peso de la deuda Saúl Escobar Toledo

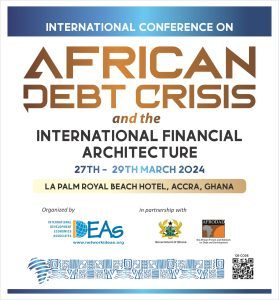

When multiple crises confront global leaders, some receive less attention than they should. One such is an(other) external debt crisis in developing countries, which is likely to be prolonged with long-term spill overs. However, while most observers admit that a debt crisis is unfolding, a commitment to find a lasting solution is absent. The elements of such a package are known. It must include official debt write-offs, large private creditor haircuts and the channelling of cheap liquidity to less developed countries through mechanisms like enhanced SDR issues. While failure to deliver on these fronts is preventing resolution, the resort to austerity in the midst of a crisis is imposing huge burdens on the majority in debt stressed countries.

The posts in this section monitor and analyse the evolving crisis, and offer viable and progressive alternatives.

As the Covid-19 pandemic spread across countries, governments across the world have imposed lockdowns and taken other drastic measures to control the contagion. This has led to unprecedent shocks to the global economy, as economic activity has come close to collapse in many regions of the world, affecting both demand and supply.

The articles in this section analyse the economic processes in this still-unfolding story, analysing the effects on the economy and different segments, the policy responses and other proposals for coming out of this crisis.

Covid-19 in India – profits before people Jayati Ghosh

Vaccine Apartheid Jayati Ghosh

The announcement of a BRICS development bank in the context of the ongoing global economic turmoil assumes a special significance. Some perceive it as an alternative to the already discredited World Bank with its North Centric leadership resulting in a dogmatic imposition of neo-liberal conditionalities on the indebted South; many assume this as a watershed, signaling the shift in global economic governance from the traditional powerhouses of the North to the newly emerging powerhouses of the South; while others perceive it as a tool to be used by the member countries to increase their influence in their respective Southern pockets.

This section includes articles analysing the emergence of BRICS Development Bank and its possible implications for global economic governance, regional impact of the BRICS nations, and other repercussions.

Following the financial crisis, much has been done for preventing systemic failure in the financial sector, stalling economic downturn and ensuring a recovery. However, the adequacy and appropriateness of the measures adopted remain questionable. As far as reforming the financial sector is concerned, despite a spate of proposals, agreement on the appropriate mix of policies and the progress with implementation have been limited. This section presents papers and articles that analyse the adequacy of various proposals and measures, the challenges that could arise at the time of implementation and advocate additional or alternative measures. Some of these papers also take a renewed look at the veracity of the arguments given for explaining the genesis of the crisis.

Austerity, Dispossession and Injustice: Facets of the Debt Crisis in Sri Lanka Ahilan Kadirgamar

Sri Lanka defaulted on its external debt for the first time in its postcolonial history in April 2022. The International…

Fetishising the Growth Rate of GDP Prabhat Patnaik

John Stuart Mill was among the foremost liberal thinkers of modern times who wrote extensively on economics and philosophy. Though under the influence of his wife Harriet Taylor Mill, he…

The Debt Trap and the Global South Ahilan Kadirgamar

A ‘debt trap’ is ensnaring the Global South, a crisis forcing governments into difficult choices. How do these debts lead to indirect taxation, subsidy cuts, and the resulting hardships for…